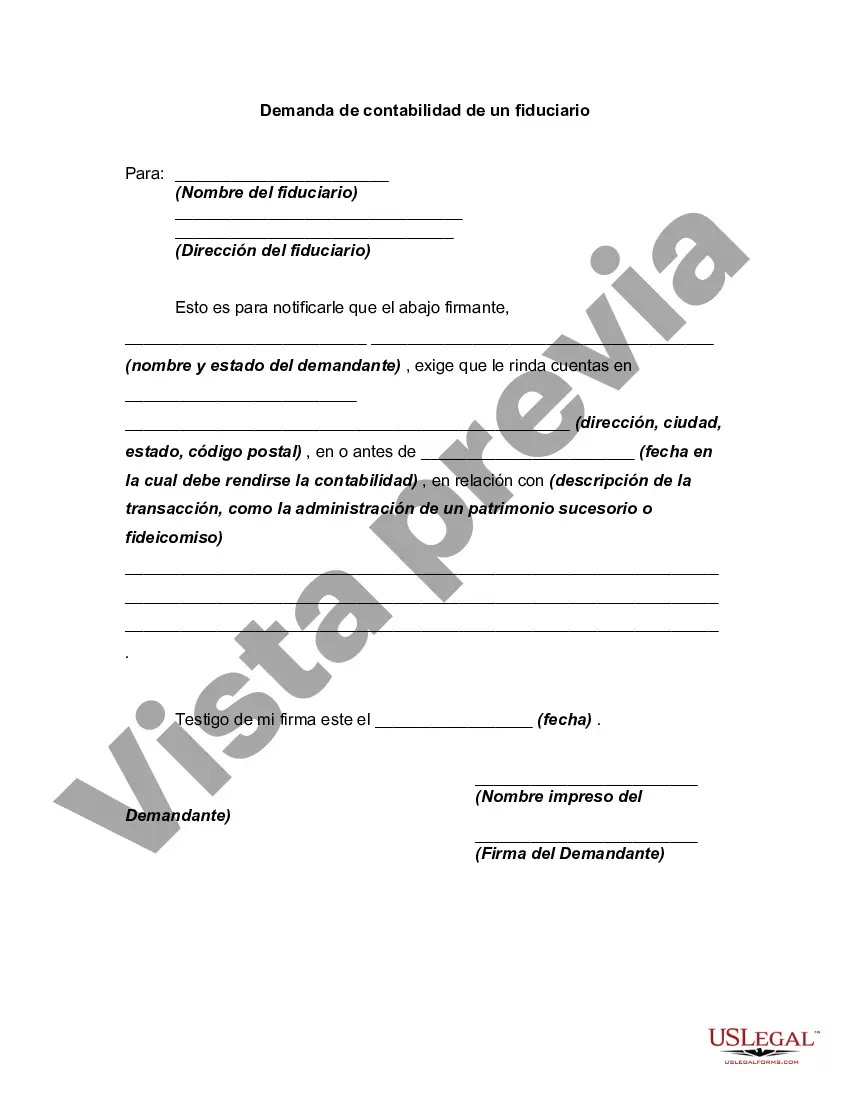

Sometimes, a prior demand by a potential plaintiff for an accounting, and a refusal by the fiduciary to account, are conditions precedent to the bringing of an action for an accounting. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Collin, Texas is a rapidly growing county located in the northern part of the state. With a booming economy and a thriving business community, the demand for accounting services from fiduciaries has seen a significant increase in recent years. Fiduciaries play a crucial role in managing and protecting the financial assets of individuals, businesses, and organizations, and their need for accurate and transparent accounting is paramount. The demand for accounting from fiduciaries in Collin, Texas is driven by several factors. First and foremost, the county's strong economy and business-friendly environment have attracted many entrepreneurs, investors, and high-net-worth individuals. As they seek to safeguard their financial interests and ensure compliance with complex financial regulations, the need for fiduciaries and their accounting expertise has soared. Furthermore, as Collin, Texas continues to experience rapid population growth, there is an increased demand for trust and estate planning, as well as eldercare services. These areas often rely on fiduciaries to manage assets, administer trusts, and handle financial matters on behalf of clients. The accounting services provided by fiduciaries help maintain transparency, track financial transactions, and ensure accurate reporting in compliance with legal and regulatory requirements. In Collin, Texas, the demand for accounting from fiduciaries can be classified into various types based on the specific areas of specialization. These include: 1. Investment Management Accounting: Fiduciaries entrusted with managing investment portfolios, such as financial advisors and wealth managers, require accounting services to track investment performance, prepare financial statements, and provide detailed reports to clients on their investment activities. 2. Estate and Trust Accounting: Estate planning fiduciaries, such as estate attorneys and trust officers, require accounting services to manage and distribute assets in accordance with the wishes of the deceased, handle tax planning, and ensure compliance with legal requirements. 3. Guardianship Accounting: Fiduciaries appointed by the court to manage the finances of minors or adults lacking capacity require accounting services to maintain accurate records, file necessary reports to the court, and ensure proper financial management. 4. Corporate or Institutional Fiduciary Accounting: Corporate trustees and institutional fiduciaries, such as banks and financial institutions, often require specialized accounting services to manage employee benefit plans, administer charitable trusts, and ensure compliance with complex regulatory frameworks. The demand for accounting from fiduciaries in Collin, Texas is expected to continue growing as the county's economy remains robust and the population continues to expand. Trust, transparency, and accurate financial reporting will remain paramount in this evolving landscape, making the expertise of fiduciary accountants indispensable. As individuals and businesses seek to protect and grow their financial interests, the role of fiduciaries and their demand for accounting services will remain vital in Collin, Texas.Collin, Texas is a rapidly growing county located in the northern part of the state. With a booming economy and a thriving business community, the demand for accounting services from fiduciaries has seen a significant increase in recent years. Fiduciaries play a crucial role in managing and protecting the financial assets of individuals, businesses, and organizations, and their need for accurate and transparent accounting is paramount. The demand for accounting from fiduciaries in Collin, Texas is driven by several factors. First and foremost, the county's strong economy and business-friendly environment have attracted many entrepreneurs, investors, and high-net-worth individuals. As they seek to safeguard their financial interests and ensure compliance with complex financial regulations, the need for fiduciaries and their accounting expertise has soared. Furthermore, as Collin, Texas continues to experience rapid population growth, there is an increased demand for trust and estate planning, as well as eldercare services. These areas often rely on fiduciaries to manage assets, administer trusts, and handle financial matters on behalf of clients. The accounting services provided by fiduciaries help maintain transparency, track financial transactions, and ensure accurate reporting in compliance with legal and regulatory requirements. In Collin, Texas, the demand for accounting from fiduciaries can be classified into various types based on the specific areas of specialization. These include: 1. Investment Management Accounting: Fiduciaries entrusted with managing investment portfolios, such as financial advisors and wealth managers, require accounting services to track investment performance, prepare financial statements, and provide detailed reports to clients on their investment activities. 2. Estate and Trust Accounting: Estate planning fiduciaries, such as estate attorneys and trust officers, require accounting services to manage and distribute assets in accordance with the wishes of the deceased, handle tax planning, and ensure compliance with legal requirements. 3. Guardianship Accounting: Fiduciaries appointed by the court to manage the finances of minors or adults lacking capacity require accounting services to maintain accurate records, file necessary reports to the court, and ensure proper financial management. 4. Corporate or Institutional Fiduciary Accounting: Corporate trustees and institutional fiduciaries, such as banks and financial institutions, often require specialized accounting services to manage employee benefit plans, administer charitable trusts, and ensure compliance with complex regulatory frameworks. The demand for accounting from fiduciaries in Collin, Texas is expected to continue growing as the county's economy remains robust and the population continues to expand. Trust, transparency, and accurate financial reporting will remain paramount in this evolving landscape, making the expertise of fiduciary accountants indispensable. As individuals and businesses seek to protect and grow their financial interests, the role of fiduciaries and their demand for accounting services will remain vital in Collin, Texas.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.