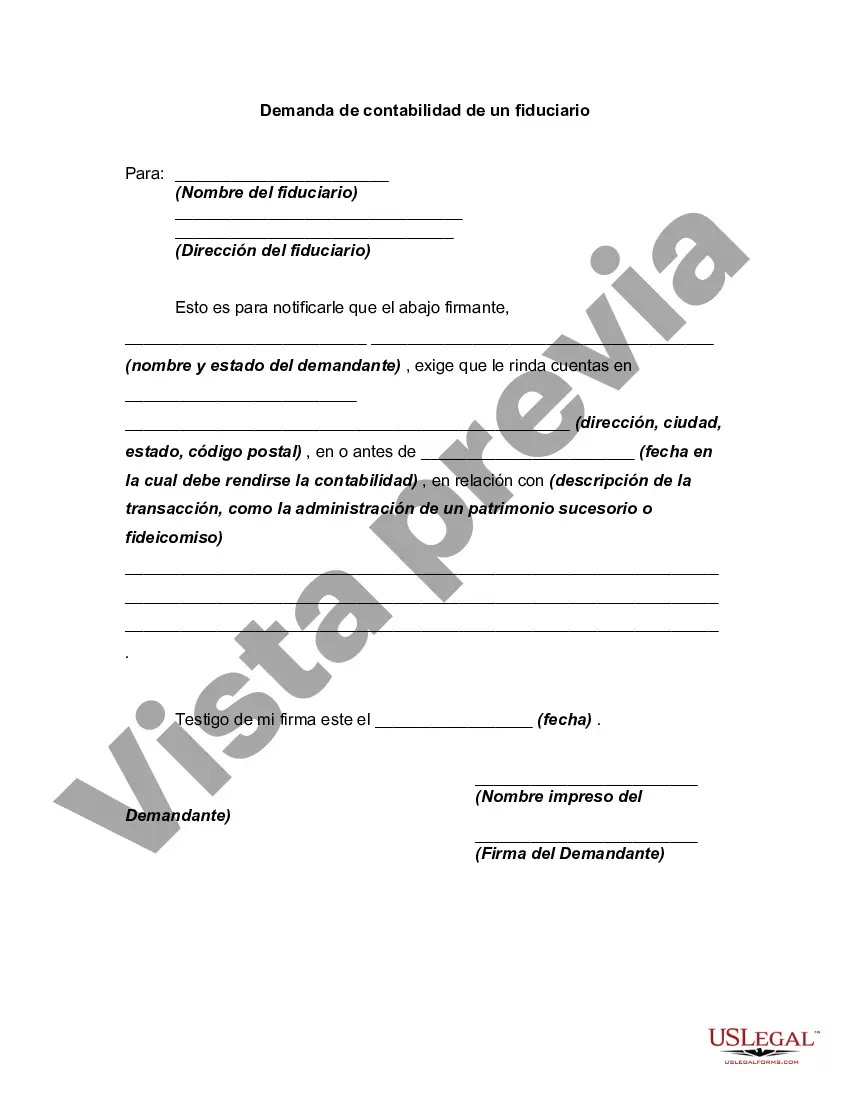

Sometimes, a prior demand by a potential plaintiff for an accounting, and a refusal by the fiduciary to account, are conditions precedent to the bringing of an action for an accounting. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Cuyahoga County, Ohio, is a thriving region located in the northeastern part of the state. Home to the city of Cleveland and surrounding municipalities, Cuyahoga County is known for its vibrant business environment and diverse communities. With a population of over 1.2 million people, there is a significant demand for accounting services, especially from fiduciaries who require specialized financial management expertise. A fiduciary, in this context, refers to an individual or an organization entrusted with the responsibility of managing financial affairs on behalf of others, such as estates, trusts, or corporate entities. Fiduciaries play a crucial role in ensuring the proper administration and protection of assets and are often required to maintain accurate and transparent accounting records. The demand for accounting services from fiduciaries in Cuyahoga County can be categorized into several types, including: 1. Estate Accounting: Estate fiduciaries, such as executors or administrators, are responsible for managing the financial affairs of deceased individuals during the probate process. They must track and report all assets, debts, income, and expenses related to the estate, ensuring compliance with legal and tax requirements. 2. Trust Accounting: Trustees hold and manage assets in accordance with the terms set forth in a trust agreement. They have a fiduciary duty to account for all trust transactions, including investments, income, distributions, and expenses. Accurate accounting is essential to safeguard the interests of beneficiaries and to fulfill their duties. 3. Guardianship Accounting: When individuals are unable to manage their financial affairs due to incapacity, guardians may be appointed to act on their behalf. Guardians are responsible for handling the protected person's assets, paying bills, and managing their financial affairs. Proper accounting is necessary to ensure transparency and accountability in these circumstances. 4. Corporate Fiduciary Accounting: Corporations or institutions serving as fiduciaries, such as banks or trust companies, often require specialized accounting services. These organizations manage various financial arrangements, including employee benefit plans, retirement accounts, and charitable foundations. Thorough and accurate accounting is crucial to comply with regulatory standards and meet the needs of their clients. In summary, Cuyahoga County, Ohio, experiences a high demand for accounting services from fiduciaries across different areas, such as estate, trust, guardianship, and corporate fiduciary accounting. These specialized accounting services ensure transparency, compliance, and effective financial management for individuals and organizations fulfilling fiduciary responsibilities.Cuyahoga County, Ohio, is a thriving region located in the northeastern part of the state. Home to the city of Cleveland and surrounding municipalities, Cuyahoga County is known for its vibrant business environment and diverse communities. With a population of over 1.2 million people, there is a significant demand for accounting services, especially from fiduciaries who require specialized financial management expertise. A fiduciary, in this context, refers to an individual or an organization entrusted with the responsibility of managing financial affairs on behalf of others, such as estates, trusts, or corporate entities. Fiduciaries play a crucial role in ensuring the proper administration and protection of assets and are often required to maintain accurate and transparent accounting records. The demand for accounting services from fiduciaries in Cuyahoga County can be categorized into several types, including: 1. Estate Accounting: Estate fiduciaries, such as executors or administrators, are responsible for managing the financial affairs of deceased individuals during the probate process. They must track and report all assets, debts, income, and expenses related to the estate, ensuring compliance with legal and tax requirements. 2. Trust Accounting: Trustees hold and manage assets in accordance with the terms set forth in a trust agreement. They have a fiduciary duty to account for all trust transactions, including investments, income, distributions, and expenses. Accurate accounting is essential to safeguard the interests of beneficiaries and to fulfill their duties. 3. Guardianship Accounting: When individuals are unable to manage their financial affairs due to incapacity, guardians may be appointed to act on their behalf. Guardians are responsible for handling the protected person's assets, paying bills, and managing their financial affairs. Proper accounting is necessary to ensure transparency and accountability in these circumstances. 4. Corporate Fiduciary Accounting: Corporations or institutions serving as fiduciaries, such as banks or trust companies, often require specialized accounting services. These organizations manage various financial arrangements, including employee benefit plans, retirement accounts, and charitable foundations. Thorough and accurate accounting is crucial to comply with regulatory standards and meet the needs of their clients. In summary, Cuyahoga County, Ohio, experiences a high demand for accounting services from fiduciaries across different areas, such as estate, trust, guardianship, and corporate fiduciary accounting. These specialized accounting services ensure transparency, compliance, and effective financial management for individuals and organizations fulfilling fiduciary responsibilities.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.