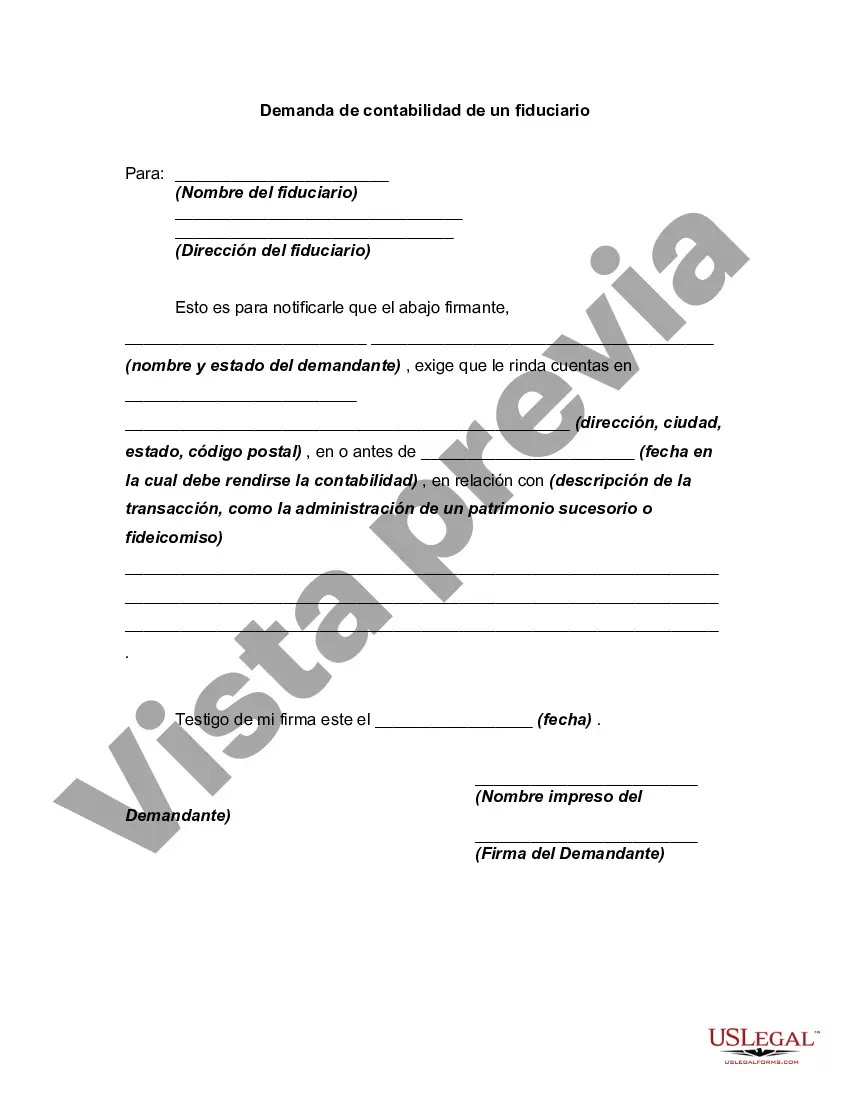

Sometimes, a prior demand by a potential plaintiff for an accounting, and a refusal by the fiduciary to account, are conditions precedent to the bringing of an action for an accounting. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Title: Understanding the Growing Demand for Accounting from a Fiduciary in Franklin Ohio Introduction: As businesses and individuals in Franklin, Ohio, strive to effectively manage their finances and comply with legal obligations, the demand for accounting services from fiduciaries has witnessed significant growth. In this article, we will explore the reasons behind this increasing demand and discuss various types of accounting services sought by individuals and organizations in Franklin, Ohio. 1. Wealth Management Accounting Services: With Franklin, Ohio residents seeking professional assistance in managing their wealth, fiduciaries specializing in wealth management accounting services have emerged as a crucial resource. These fiduciaries assist individuals with comprehensive financial planning, investment management, tax planning, and estate administration, ensuring their clients' assets are optimized and protected. 2. Business Accounting Services: Small and large businesses in Franklin, Ohio, recognize the importance of maintaining accurate financial records and adhering to accounting standards. Fiduciaries specializing in business accounting help these organizations streamline their financial operations, handle payroll, track expenses, prepare financial statements, and ensure compliance with tax regulations and reporting requirements. 3. Forensic Accounting Services: In cases where fraud or financial irregularities are suspected, the demand for forensic accounting from fiduciaries has risen. Fiduciaries offering forensic accounting services in Franklin, Ohio, utilize specialized investigative techniques to uncover financial misconduct, provide litigation support, and assist in resolving legal disputes related to financial matters. 4. Nonprofit Organization Accounting: Nonprofit organizations in Franklin, Ohio, often require specialized accounting services to navigate the unique financial challenges they face. Fiduciaries possessing expertise in nonprofit accounting assist these organizations in managing grants, maintaining transparency and accountability, complying with tax regulations, and preparing financial statements tailored to nonprofit reporting requirements. 5. Trust Accounting Services: As individuals in Franklin, Ohio, create trusts for estate planning purposes or charitable causes, fiduciaries specializing in trust accounting play a crucial role. These professionals ensure proper administration of trusts, maintain accurate records of trust assets, prepare periodic financial reports, and provide assistance in tax planning and compliance. 6. Estate Accounting Services: To address the complexities associated with estate settlements, fiduciaries offering estate accounting services in Franklin, Ohio, are in high demand. These professionals meticulously manage and report on the financial activities of estates, prepare estate inventories, keep track of financial transactions, ensure timely distribution of assets, and assist with tax filings related to estates. Conclusion: The demand for accounting services from fiduciaries in Franklin, Ohio, has grown significantly due to the need for expert financial management, compliance with regulations, and safeguarding of assets. Whether it is wealth management, business accounting, forensic accounting, nonprofit accounting, trust accounting, or estate accounting services, fiduciaries play a vital role in assisting individuals and organizations in Franklin, Ohio, with their diverse financial needs.Title: Understanding the Growing Demand for Accounting from a Fiduciary in Franklin Ohio Introduction: As businesses and individuals in Franklin, Ohio, strive to effectively manage their finances and comply with legal obligations, the demand for accounting services from fiduciaries has witnessed significant growth. In this article, we will explore the reasons behind this increasing demand and discuss various types of accounting services sought by individuals and organizations in Franklin, Ohio. 1. Wealth Management Accounting Services: With Franklin, Ohio residents seeking professional assistance in managing their wealth, fiduciaries specializing in wealth management accounting services have emerged as a crucial resource. These fiduciaries assist individuals with comprehensive financial planning, investment management, tax planning, and estate administration, ensuring their clients' assets are optimized and protected. 2. Business Accounting Services: Small and large businesses in Franklin, Ohio, recognize the importance of maintaining accurate financial records and adhering to accounting standards. Fiduciaries specializing in business accounting help these organizations streamline their financial operations, handle payroll, track expenses, prepare financial statements, and ensure compliance with tax regulations and reporting requirements. 3. Forensic Accounting Services: In cases where fraud or financial irregularities are suspected, the demand for forensic accounting from fiduciaries has risen. Fiduciaries offering forensic accounting services in Franklin, Ohio, utilize specialized investigative techniques to uncover financial misconduct, provide litigation support, and assist in resolving legal disputes related to financial matters. 4. Nonprofit Organization Accounting: Nonprofit organizations in Franklin, Ohio, often require specialized accounting services to navigate the unique financial challenges they face. Fiduciaries possessing expertise in nonprofit accounting assist these organizations in managing grants, maintaining transparency and accountability, complying with tax regulations, and preparing financial statements tailored to nonprofit reporting requirements. 5. Trust Accounting Services: As individuals in Franklin, Ohio, create trusts for estate planning purposes or charitable causes, fiduciaries specializing in trust accounting play a crucial role. These professionals ensure proper administration of trusts, maintain accurate records of trust assets, prepare periodic financial reports, and provide assistance in tax planning and compliance. 6. Estate Accounting Services: To address the complexities associated with estate settlements, fiduciaries offering estate accounting services in Franklin, Ohio, are in high demand. These professionals meticulously manage and report on the financial activities of estates, prepare estate inventories, keep track of financial transactions, ensure timely distribution of assets, and assist with tax filings related to estates. Conclusion: The demand for accounting services from fiduciaries in Franklin, Ohio, has grown significantly due to the need for expert financial management, compliance with regulations, and safeguarding of assets. Whether it is wealth management, business accounting, forensic accounting, nonprofit accounting, trust accounting, or estate accounting services, fiduciaries play a vital role in assisting individuals and organizations in Franklin, Ohio, with their diverse financial needs.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.