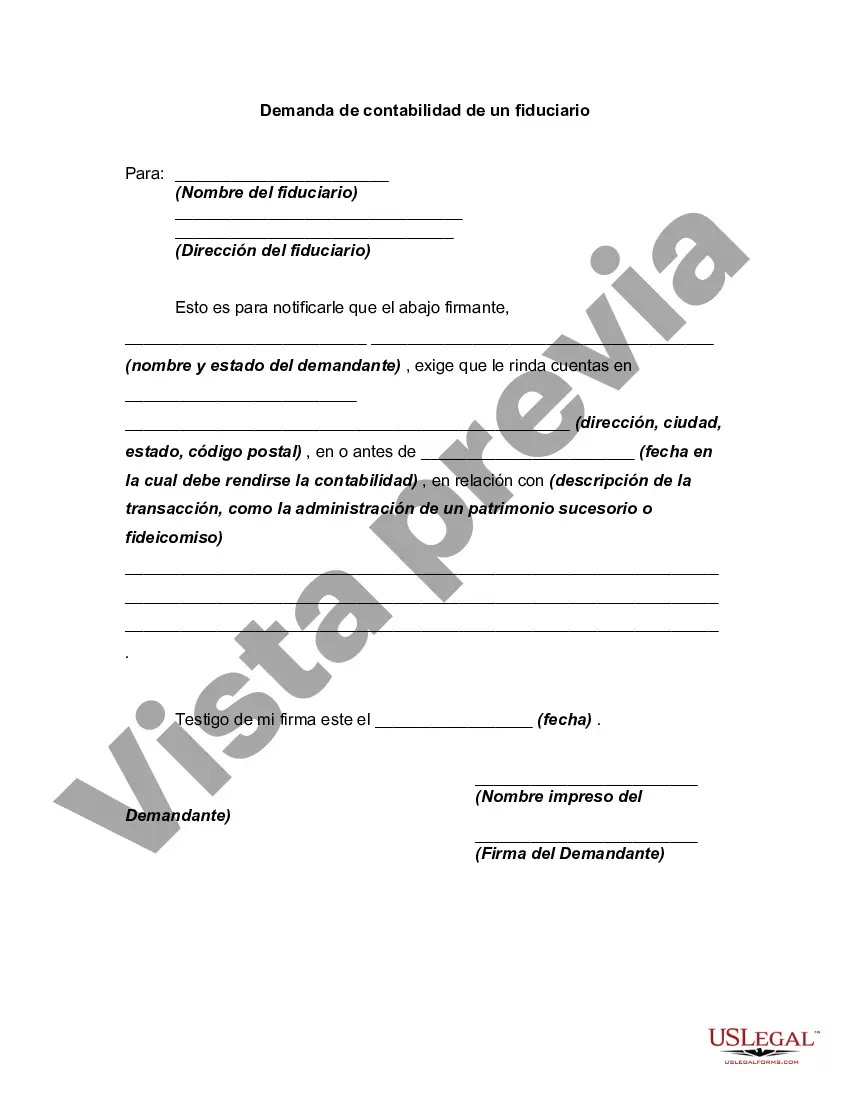

Sometimes, a prior demand by a potential plaintiff for an accounting, and a refusal by the fiduciary to account, are conditions precedent to the bringing of an action for an accounting. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Houston, Texas, is a bustling city known for its diverse economy, booming industries, and a strong demand for financial and accounting services. With a growing number of businesses and individuals seeking fiduciary services, the demand for accounting from a fiduciary in Houston is on the rise. A fiduciary, in the context of accounting, refers to a professional who acts in the best interest of their clients, providing trustworthy financial advice, managing assets, and ensuring compliance with regulatory standards. Houston offers various types of fiduciary accounting services, catering to different needs and requirements. 1. Personal Fiduciary Accounting: Houston residents often seek personal fiduciary accounting services to manage their individual finances, investments, and tax obligations. From tracking income and expenses to providing accurate tax planning and filing, personal fiduciary accountants offer comprehensive financial guidance tailored to individual goals. 2. Corporate Fiduciary Accounting: Houston's vibrant business community demands fiduciary accountants to handle complex financial transactions, manage company assets, and ensure financial compliance. Corporate fiduciary accountants help businesses with financial reporting, budgeting, auditing, and investment management to optimize financial performance and maintain transparency. 3. Trust and Estate Fiduciary Accounting: Individuals and families in Houston who have established trusts or estates often require fiduciary accountants to oversee their financial affairs. These professionals handle various tasks, such as managing trust assets, income distribution, tax planning, and estate administration, ensuring the wishes of the granter are properly executed. 4. Non-Profit Fiduciary Accounting: Houston's vibrant non-profit sector requires fiduciary accountants who possess expertise in the unique financial challenges faced by charitable organizations. Non-profit fiduciary accountants work closely with these organizations to manage grants and donations, prepare financial statements, and ensure compliance with legal and tax regulations. In response to the increasing demand for accounting from a fiduciary in Houston, numerous accounting firms and financial institutions have emerged to offer specialized services catering to the diverse needs of individuals, businesses, and non-profit organizations in the city. Whether individuals require personal financial management, corporations seek accurate financial reporting, or non-profit organizations aim to enhance their transparency and compliance, Houston thrives on the expertise of fiduciary accountants to meet these demanding requirements. So, if you are in Houston, Texas, and in need of accounting services from a fiduciary, consider exploring the types of fiduciary accounting mentioned above to find the most suitable professional for your specific needs.Houston, Texas, is a bustling city known for its diverse economy, booming industries, and a strong demand for financial and accounting services. With a growing number of businesses and individuals seeking fiduciary services, the demand for accounting from a fiduciary in Houston is on the rise. A fiduciary, in the context of accounting, refers to a professional who acts in the best interest of their clients, providing trustworthy financial advice, managing assets, and ensuring compliance with regulatory standards. Houston offers various types of fiduciary accounting services, catering to different needs and requirements. 1. Personal Fiduciary Accounting: Houston residents often seek personal fiduciary accounting services to manage their individual finances, investments, and tax obligations. From tracking income and expenses to providing accurate tax planning and filing, personal fiduciary accountants offer comprehensive financial guidance tailored to individual goals. 2. Corporate Fiduciary Accounting: Houston's vibrant business community demands fiduciary accountants to handle complex financial transactions, manage company assets, and ensure financial compliance. Corporate fiduciary accountants help businesses with financial reporting, budgeting, auditing, and investment management to optimize financial performance and maintain transparency. 3. Trust and Estate Fiduciary Accounting: Individuals and families in Houston who have established trusts or estates often require fiduciary accountants to oversee their financial affairs. These professionals handle various tasks, such as managing trust assets, income distribution, tax planning, and estate administration, ensuring the wishes of the granter are properly executed. 4. Non-Profit Fiduciary Accounting: Houston's vibrant non-profit sector requires fiduciary accountants who possess expertise in the unique financial challenges faced by charitable organizations. Non-profit fiduciary accountants work closely with these organizations to manage grants and donations, prepare financial statements, and ensure compliance with legal and tax regulations. In response to the increasing demand for accounting from a fiduciary in Houston, numerous accounting firms and financial institutions have emerged to offer specialized services catering to the diverse needs of individuals, businesses, and non-profit organizations in the city. Whether individuals require personal financial management, corporations seek accurate financial reporting, or non-profit organizations aim to enhance their transparency and compliance, Houston thrives on the expertise of fiduciary accountants to meet these demanding requirements. So, if you are in Houston, Texas, and in need of accounting services from a fiduciary, consider exploring the types of fiduciary accounting mentioned above to find the most suitable professional for your specific needs.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.