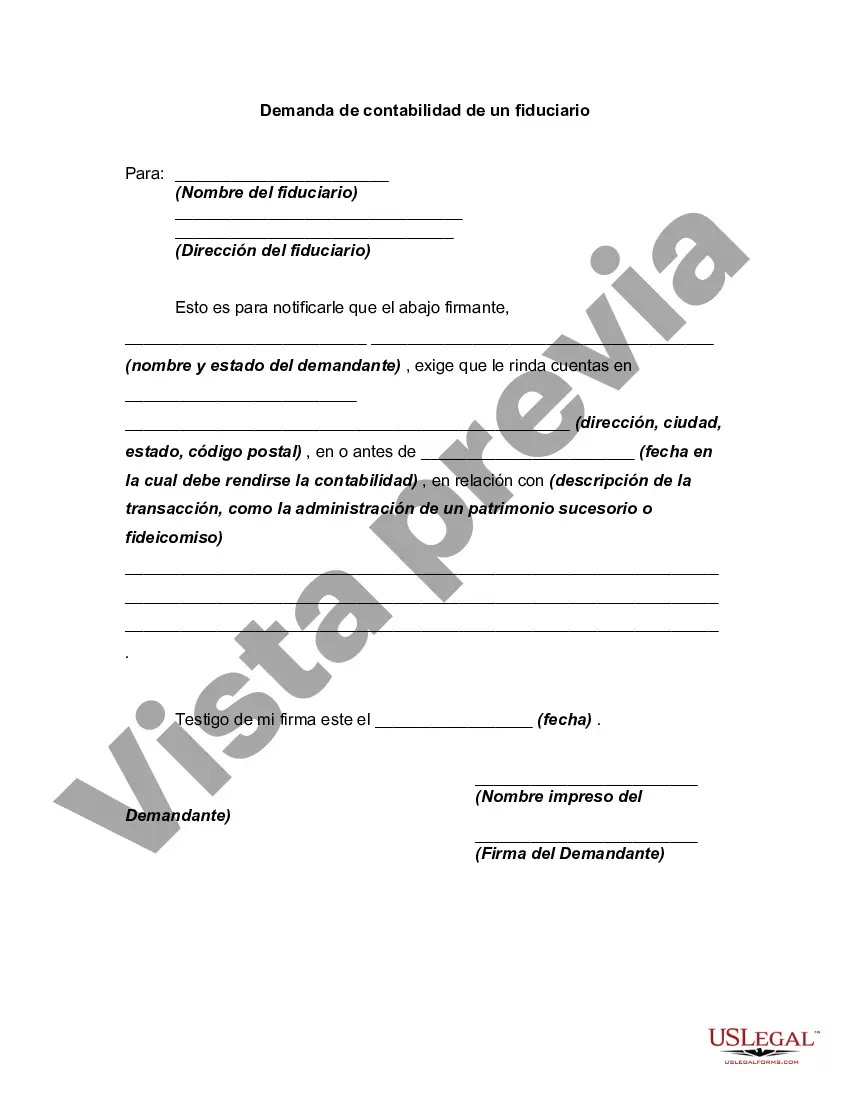

Sometimes, a prior demand by a potential plaintiff for an accounting, and a refusal by the fiduciary to account, are conditions precedent to the bringing of an action for an accounting. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Los Angeles, California Demand for Accounting from a Fiduciary: All You Need to Know Keywords: Los Angeles, California, demand, accounting, fiduciary, types Los Angeles, the sprawling city located in Southern California, is renowned for its diverse economic landscape and is home to a multitude of businesses, organizations, and individuals. With its bustling economy, the demand for accounting services from fiduciaries has become increasingly essential. This article aims to provide a detailed description of what Los Angeles, California demand for accounting from a fiduciary entails, addressing its various types. 1. Definition of a Fiduciary: In the context of accounting, a fiduciary refers to an individual or a company entrusted with managing the financial affairs and assets of another party. A fiduciary is legally bound to act in the best interests of their clients, making accuracy, transparency, and accountability paramount. 2. Importance of Accounting from a Fiduciary: Accounting performed by fiduciaries ensures the proper management and tracking of financial records and transactions. It provides clients with a clear understanding of their financial situation, helping them make informed decisions. Furthermore, accounting services from a fiduciary help ensure compliance with applicable laws, regulations, and standards. 3. Types of Los Angeles Demand for Accounting from a Fiduciary: a. Personal Fiduciary Accounting: This type of accounting typically relates to individuals who require assistance managing their personal assets, including real estate, investments, and personal finances. Personal fiduciaries ensure accurate record-keeping, budgeting, and financial planning for their clients. b. Business Fiduciary Accounting: With Los Angeles being a hub for business activities, there is a significant demand for accounting from fiduciaries within the corporate sector. Business fiduciaries oversee financial matters, such as bookkeeping, financial reporting, tax preparation, and auditing, for companies, ensuring compliance with legal and regulatory requirements. c. Estate and Trust Fiduciary Accounting: Estate and trust fiduciaries are responsible for managing the financial affairs of deceased individuals or entities. These fiduciaries handle crucial tasks like inventorying assets, paying creditors, distributing inheritances, and filing estate tax returns. The demand for estate and trust fiduciary accountants is particularly high in Los Angeles due to its thriving real estate market and high-net-worth residents. 4. Qualifications and Skills: Given the complexity of fiduciary accounting, individuals providing these services in Los Angeles must possess a deep understanding of accounting principles, tax laws, and financial management. Certified Public Accountants (CPA's) and Certified Financial Planners (Caps) are often preferred for their expertise, knowledge, and ethical standards. In conclusion, the demand for accounting from fiduciaries in Los Angeles, California is multifaceted, encompassing personal, business, and estate/trust accounting. These accounting professionals play a vital role in ensuring accurate financial management, compliance, and transparency. Whether it's providing personal financial guidance or managing complex business transactions, fiduciary accounting services are essential in helping individuals and organizations navigate the intricate financial landscape of Los Angeles.Los Angeles, California Demand for Accounting from a Fiduciary: All You Need to Know Keywords: Los Angeles, California, demand, accounting, fiduciary, types Los Angeles, the sprawling city located in Southern California, is renowned for its diverse economic landscape and is home to a multitude of businesses, organizations, and individuals. With its bustling economy, the demand for accounting services from fiduciaries has become increasingly essential. This article aims to provide a detailed description of what Los Angeles, California demand for accounting from a fiduciary entails, addressing its various types. 1. Definition of a Fiduciary: In the context of accounting, a fiduciary refers to an individual or a company entrusted with managing the financial affairs and assets of another party. A fiduciary is legally bound to act in the best interests of their clients, making accuracy, transparency, and accountability paramount. 2. Importance of Accounting from a Fiduciary: Accounting performed by fiduciaries ensures the proper management and tracking of financial records and transactions. It provides clients with a clear understanding of their financial situation, helping them make informed decisions. Furthermore, accounting services from a fiduciary help ensure compliance with applicable laws, regulations, and standards. 3. Types of Los Angeles Demand for Accounting from a Fiduciary: a. Personal Fiduciary Accounting: This type of accounting typically relates to individuals who require assistance managing their personal assets, including real estate, investments, and personal finances. Personal fiduciaries ensure accurate record-keeping, budgeting, and financial planning for their clients. b. Business Fiduciary Accounting: With Los Angeles being a hub for business activities, there is a significant demand for accounting from fiduciaries within the corporate sector. Business fiduciaries oversee financial matters, such as bookkeeping, financial reporting, tax preparation, and auditing, for companies, ensuring compliance with legal and regulatory requirements. c. Estate and Trust Fiduciary Accounting: Estate and trust fiduciaries are responsible for managing the financial affairs of deceased individuals or entities. These fiduciaries handle crucial tasks like inventorying assets, paying creditors, distributing inheritances, and filing estate tax returns. The demand for estate and trust fiduciary accountants is particularly high in Los Angeles due to its thriving real estate market and high-net-worth residents. 4. Qualifications and Skills: Given the complexity of fiduciary accounting, individuals providing these services in Los Angeles must possess a deep understanding of accounting principles, tax laws, and financial management. Certified Public Accountants (CPA's) and Certified Financial Planners (Caps) are often preferred for their expertise, knowledge, and ethical standards. In conclusion, the demand for accounting from fiduciaries in Los Angeles, California is multifaceted, encompassing personal, business, and estate/trust accounting. These accounting professionals play a vital role in ensuring accurate financial management, compliance, and transparency. Whether it's providing personal financial guidance or managing complex business transactions, fiduciary accounting services are essential in helping individuals and organizations navigate the intricate financial landscape of Los Angeles.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.