Sometimes, a prior demand by a potential plaintiff for an accounting, and a refusal by the fiduciary to account, are conditions precedent to the bringing of an action for an accounting. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Maricopa, Arizona Demand for Accounting from a Fiduciary: A Comprehensive Overview Keywords: Maricopa, Arizona, Demand for Accounting, Fiduciary, Types Introduction: In Maricopa, Arizona, individuals and businesses often rely on fiduciaries to manage their financial affairs and safeguard their assets. To ensure transparency and accountability, there may arise a need for demanding accounting records from fiduciaries. This article will explore the demand for accounting, its significance, and the different types prevalent in Maricopa, Arizona. 1. Understanding Demand for Accounting from a Fiduciary: In Maricopa, Arizona, the demand for accounting from a fiduciary refers to the legal action taken by beneficiaries or interested parties to obtain an accurate and complete record of financial transactions and activities conducted on their behalf by a fiduciary. This demand aims to ensure compliance with fiduciary obligations, prevent mismanagement, fraud, or neglect, and protect the interests of beneficiaries. 2. Significance of Demand for Accounting: Demanding accounting from a fiduciary plays a crucial role in maintaining trust, verifying financial records, and upholding fiduciary responsibilities. It allows beneficiaries to access relevant information, identify potential wrongdoing, and take appropriate legal action if necessary. Through this demand, accurate financial statements can be obtained, enabling transparency and helping determine if fiduciaries have acted in the best interest of the beneficiaries. 3. Types of Demand for Accounting from a Fiduciary: In Maricopa, Arizona, various scenarios might give rise to a demand for accounting from a fiduciary. Here are some common types: a) Estate Accounting Demand: Beneficiaries of an estate, particularly where a will or trust is involved, may demand accounting records from the executor or trustee. This type aims to ensure that assets are managed and distributed properly, minimizing the risk of misappropriation or undervaluation. b) Trust Accounting Demand: In situations where a trust is in place, beneficiaries may demand accounting records from the trustee. This demand ensures that the trustee is fulfilling their duties, adhering to the trust agreement, and managing trust assets appropriately. c) Guardianship/Conservatorship Accounting Demand: When a guardian or conservator is responsible for managing the financial affairs of a minor or incapacitated person, interested parties may demand accounting records. This type verifies that the guardian or conservator is acting in the best interest of the protected individual, avoiding any financial misconduct or exploitation. d) Business Fiduciary Accounting Demand: Demand for accounting may also arise in the context of business partnerships, where one partner acts as a fiduciary on behalf of others. Such demands can help monitor financial transactions, expenses, and profits, ensuring that fiduciaries are transparent and in compliance with their obligations. Conclusion: In Maricopa, Arizona, the demand for accounting from a fiduciary is a vital mechanism to ensure transparency, accountability, and protect the interests of beneficiaries. By requesting comprehensive accounting records, beneficiaries can access financial information, evaluate fiduciary performance, and take necessary legal action if fiduciaries fail to fulfill their duties effectively. These demands empower individuals to safeguard their assets, minimize the risk of fraud, and maintain trust in fiduciary relationships.Maricopa, Arizona Demand for Accounting from a Fiduciary: A Comprehensive Overview Keywords: Maricopa, Arizona, Demand for Accounting, Fiduciary, Types Introduction: In Maricopa, Arizona, individuals and businesses often rely on fiduciaries to manage their financial affairs and safeguard their assets. To ensure transparency and accountability, there may arise a need for demanding accounting records from fiduciaries. This article will explore the demand for accounting, its significance, and the different types prevalent in Maricopa, Arizona. 1. Understanding Demand for Accounting from a Fiduciary: In Maricopa, Arizona, the demand for accounting from a fiduciary refers to the legal action taken by beneficiaries or interested parties to obtain an accurate and complete record of financial transactions and activities conducted on their behalf by a fiduciary. This demand aims to ensure compliance with fiduciary obligations, prevent mismanagement, fraud, or neglect, and protect the interests of beneficiaries. 2. Significance of Demand for Accounting: Demanding accounting from a fiduciary plays a crucial role in maintaining trust, verifying financial records, and upholding fiduciary responsibilities. It allows beneficiaries to access relevant information, identify potential wrongdoing, and take appropriate legal action if necessary. Through this demand, accurate financial statements can be obtained, enabling transparency and helping determine if fiduciaries have acted in the best interest of the beneficiaries. 3. Types of Demand for Accounting from a Fiduciary: In Maricopa, Arizona, various scenarios might give rise to a demand for accounting from a fiduciary. Here are some common types: a) Estate Accounting Demand: Beneficiaries of an estate, particularly where a will or trust is involved, may demand accounting records from the executor or trustee. This type aims to ensure that assets are managed and distributed properly, minimizing the risk of misappropriation or undervaluation. b) Trust Accounting Demand: In situations where a trust is in place, beneficiaries may demand accounting records from the trustee. This demand ensures that the trustee is fulfilling their duties, adhering to the trust agreement, and managing trust assets appropriately. c) Guardianship/Conservatorship Accounting Demand: When a guardian or conservator is responsible for managing the financial affairs of a minor or incapacitated person, interested parties may demand accounting records. This type verifies that the guardian or conservator is acting in the best interest of the protected individual, avoiding any financial misconduct or exploitation. d) Business Fiduciary Accounting Demand: Demand for accounting may also arise in the context of business partnerships, where one partner acts as a fiduciary on behalf of others. Such demands can help monitor financial transactions, expenses, and profits, ensuring that fiduciaries are transparent and in compliance with their obligations. Conclusion: In Maricopa, Arizona, the demand for accounting from a fiduciary is a vital mechanism to ensure transparency, accountability, and protect the interests of beneficiaries. By requesting comprehensive accounting records, beneficiaries can access financial information, evaluate fiduciary performance, and take necessary legal action if fiduciaries fail to fulfill their duties effectively. These demands empower individuals to safeguard their assets, minimize the risk of fraud, and maintain trust in fiduciary relationships.

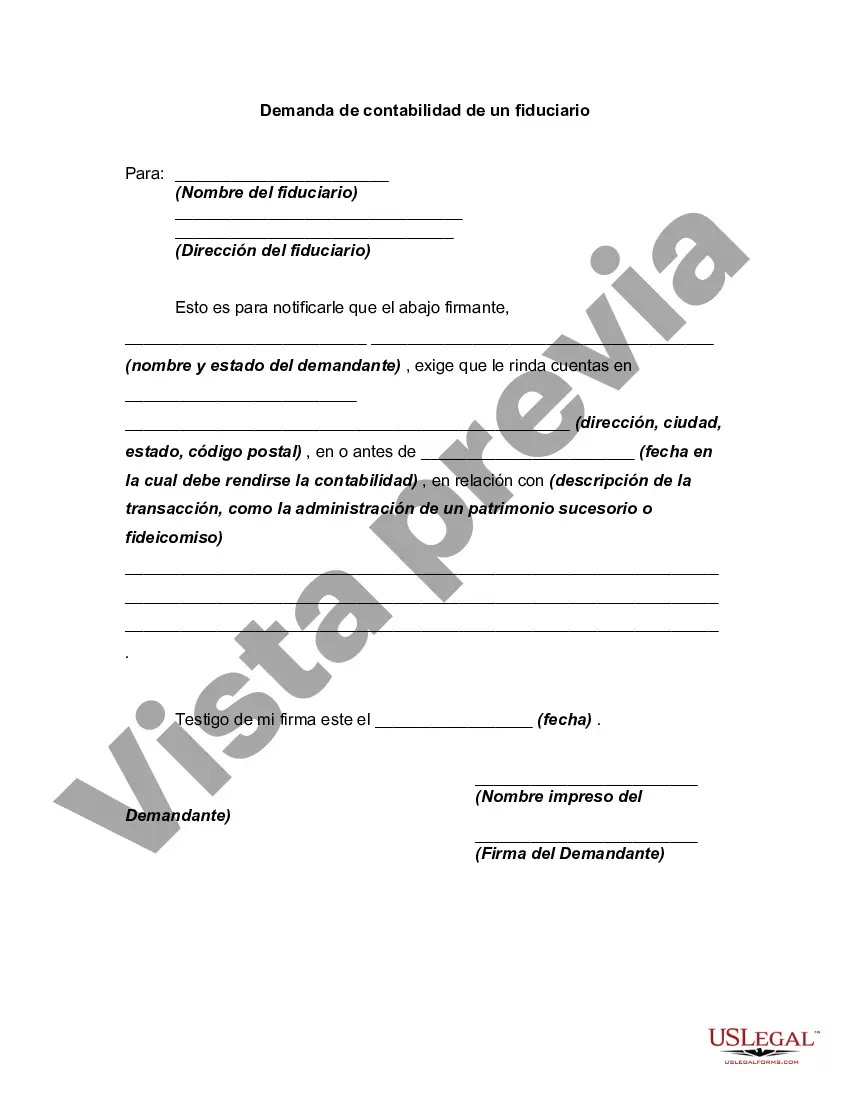

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.