Sometimes, a prior demand by a potential plaintiff for an accounting, and a refusal by the fiduciary to account, are conditions precedent to the bringing of an action for an accounting. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Phoenix, Arizona Demand for Accounting from a Fiduciary: Unveiling the Financial Expertise You Need In Phoenix, Arizona, the demand for accounting services from a fiduciary is at an all-time high. As businesses and individuals recognize the importance of efficient financial management, they turn to fiduciaries to safeguard their assets and make informed financial decisions. Let's explore in detail what constitutes this demand and the different types of accounting services sought in Phoenix. 1. Trust Accounting Services: Trust accounting involves managing the finances and assets held in trust by an appointed fiduciary. The demand for this particular service in Phoenix stems from the city's large population of retirees and high-net-worth individuals who distribute their wealth through trusts. Fiduciaries specializing in trust accounting comprehensively track and report financial activities, ensuring compliance with legal and regulatory requirements. 2. Estate Accounting Services: Phoenix's dynamic real estate market drives the demand for estate accounting services. When an individual passes away, their estate must be properly administered, and the fiduciary plays a crucial role in managing and accounting for the assets, debts, and expenses related to the estate. Estate accounting professionals in Phoenix are skilled at accurately valuing and accounting for real estate, investments, and personal property to ensure a smooth distribution of assets. 3. Business Accounting Services: Phoenix's thriving business landscape greatly contributes to the demand for fiduciary accounting services tailored specifically for businesses. From small startups to large corporations, companies require the expertise of fiduciaries to maintain accurate financial records, prepare tax filings, and provide strategic financial advice. Fiduciaries with a deep understanding of Phoenix's tax laws, regulations, and industry dynamics help businesses optimize their financial performance and navigate complex financial transactions. 4. Guardianship and Conservatorship Accounting Services: Protecting the financial interests of incapacitated individuals is another critical aspect of fiduciary accounting in Phoenix. Guardians and conservators are entrusted with managing the finances of minors, disabled persons, or individuals deemed unable to handle their own affairs. Demand for fiduciaries offering guardianship and conservatorship accounting services has grown as more families seek expert assistance in managing and safeguarding the assets of their vulnerable loved ones. In conclusion, Phoenix, Arizona exhibits a robust demand for accounting services from fiduciaries encompassing trust accounting, estate accounting, business accounting, and guardianship/conservatorship accounting. By working with a trusted fiduciary, individuals and businesses in Phoenix can ensure their financial affairs are meticulously managed and secure. Whether you need to navigate trust distributions, administer an estate, optimize business finances, or aid vulnerable individuals, fiduciaries in Phoenix stand ready to provide the expertise required for sound accounting practices.Phoenix, Arizona Demand for Accounting from a Fiduciary: Unveiling the Financial Expertise You Need In Phoenix, Arizona, the demand for accounting services from a fiduciary is at an all-time high. As businesses and individuals recognize the importance of efficient financial management, they turn to fiduciaries to safeguard their assets and make informed financial decisions. Let's explore in detail what constitutes this demand and the different types of accounting services sought in Phoenix. 1. Trust Accounting Services: Trust accounting involves managing the finances and assets held in trust by an appointed fiduciary. The demand for this particular service in Phoenix stems from the city's large population of retirees and high-net-worth individuals who distribute their wealth through trusts. Fiduciaries specializing in trust accounting comprehensively track and report financial activities, ensuring compliance with legal and regulatory requirements. 2. Estate Accounting Services: Phoenix's dynamic real estate market drives the demand for estate accounting services. When an individual passes away, their estate must be properly administered, and the fiduciary plays a crucial role in managing and accounting for the assets, debts, and expenses related to the estate. Estate accounting professionals in Phoenix are skilled at accurately valuing and accounting for real estate, investments, and personal property to ensure a smooth distribution of assets. 3. Business Accounting Services: Phoenix's thriving business landscape greatly contributes to the demand for fiduciary accounting services tailored specifically for businesses. From small startups to large corporations, companies require the expertise of fiduciaries to maintain accurate financial records, prepare tax filings, and provide strategic financial advice. Fiduciaries with a deep understanding of Phoenix's tax laws, regulations, and industry dynamics help businesses optimize their financial performance and navigate complex financial transactions. 4. Guardianship and Conservatorship Accounting Services: Protecting the financial interests of incapacitated individuals is another critical aspect of fiduciary accounting in Phoenix. Guardians and conservators are entrusted with managing the finances of minors, disabled persons, or individuals deemed unable to handle their own affairs. Demand for fiduciaries offering guardianship and conservatorship accounting services has grown as more families seek expert assistance in managing and safeguarding the assets of their vulnerable loved ones. In conclusion, Phoenix, Arizona exhibits a robust demand for accounting services from fiduciaries encompassing trust accounting, estate accounting, business accounting, and guardianship/conservatorship accounting. By working with a trusted fiduciary, individuals and businesses in Phoenix can ensure their financial affairs are meticulously managed and secure. Whether you need to navigate trust distributions, administer an estate, optimize business finances, or aid vulnerable individuals, fiduciaries in Phoenix stand ready to provide the expertise required for sound accounting practices.

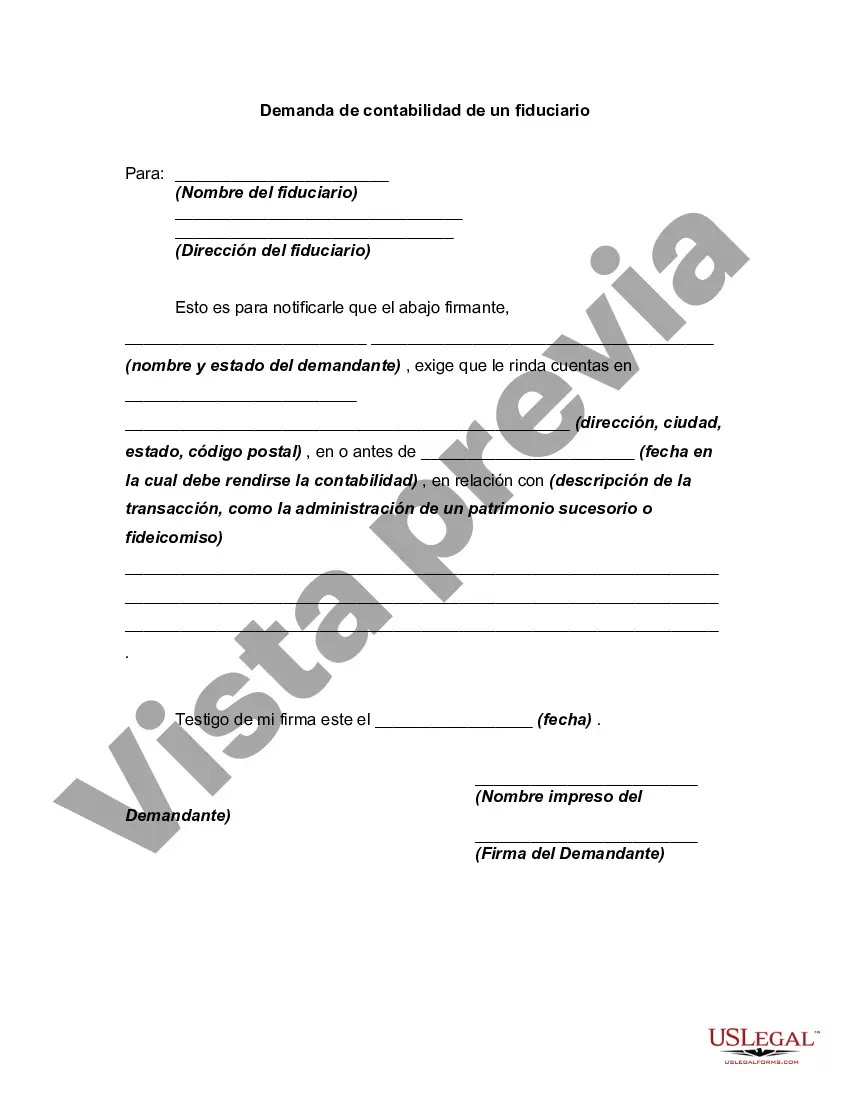

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.