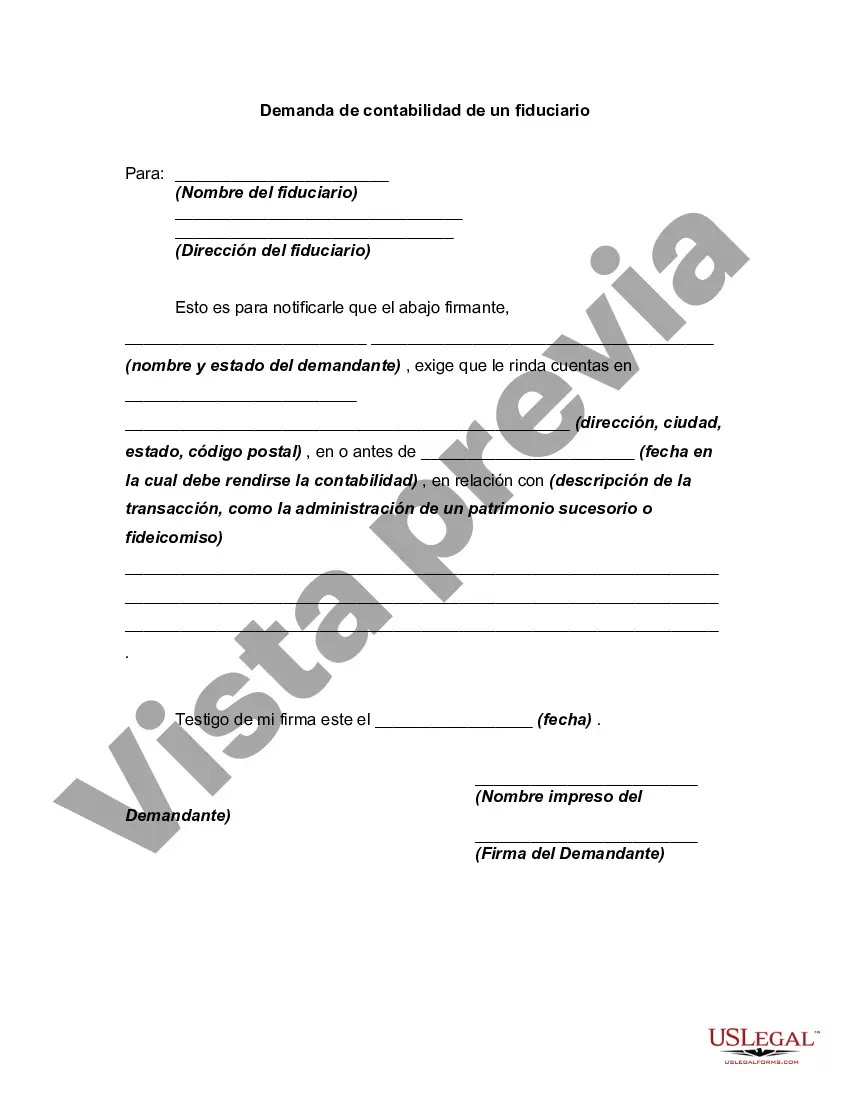

Sometimes, a prior demand by a potential plaintiff for an accounting, and a refusal by the fiduciary to account, are conditions precedent to the bringing of an action for an accounting. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Lima Arizona Demand for Accounting from a Fiduciary: Exploring Types and Its Importance Keywords: Lima Arizona, demand for accounting, fiduciary, types, importance DESCRIPTION: Lima, a scenic city located in the southeastern part of Arizona, is known for its rich history and vibrant community. As the economic landscape of Lima continues to evolve, there is an increasing demand for accounting services from fiduciaries within the region. Accounting plays a crucial role in ensuring transparency, accountability, and financial integrity, especially when it comes to managing and safeguarding entrusted assets, making it imperative for fiduciaries to seek professional assistance. Demand for Accounting from a Fiduciary in Lima Arizona: 1. Estate Executors and Administrators: Executors and administrators handle the financial affairs of estates, ensuring the proper distribution of assets according to the will or legal requirements. Demand for accounting services is high among these fiduciaries, as they must maintain accurate records, prepare financial statements, and provide an account of their activities. 2. Trustees: Trustees are responsible for managing and distributing assets held in trust for the benefit of beneficiaries. They require accounting assistance to track income, expenses, investment performance, and any distributions, ensuring compliance with legal obligations and fulfilling fiduciary duties. 3. Guardians: Guardians are entrusted with managing the financial affairs of minors or incapacitated adults. They need accounting services to maintain clear records of income, expenses, and assets held on behalf of those under their care. This helps to ensure that the assets are managed appropriately and that the best interests of the wards are protected. Importance of Demand for Accounting from a Fiduciary: 1. Financial Transparency and Accountability: Accounting provides fiduciaries with the tools and knowledge to maintain transparent financial records. This encourages accountability, reduces the risk of mismanagement or fraud, and promotes trust among interested parties. 2. Compliance with Legal and Regulatory Requirements: Fiduciaries must adhere to various legal and regulatory obligations. Proper accounting practices help them meet reporting requirements, file accurate tax returns, and ensure compliance with applicable laws, mitigating potential legal or financial risks. 3. Protection of Beneficiaries' Interests: Accounting services play a crucial role in safeguarding beneficiaries' interests. By providing a clear financial picture, fiduciaries can demonstrate proper management of assets, prevent unauthorized transfers, and mitigate the risk of misappropriation. 4. Enhanced Decision Making: Accurate accounting data empowers fiduciaries to make informed decisions regarding investments, asset allocation, and distributions. With insights gained through accounting reports, fiduciaries can optimize financial strategies to maximize value and meet beneficiaries' needs effectively. In conclusion, the demand for accounting from fiduciaries in Lima, Arizona, is crucial for maintaining financial integrity, ensuring compliance, and safeguarding the interests of beneficiaries. Estate executors, administrators, trustees, and guardians are among the key individuals who require accounting services to fulfill their fiduciary duties effectively. By harnessing the power of accounting, fiduciaries can navigate the complex responsibilities entrusted to them, ultimately benefiting both themselves and the beneficiaries they serve.Lima Arizona Demand for Accounting from a Fiduciary: Exploring Types and Its Importance Keywords: Lima Arizona, demand for accounting, fiduciary, types, importance DESCRIPTION: Lima, a scenic city located in the southeastern part of Arizona, is known for its rich history and vibrant community. As the economic landscape of Lima continues to evolve, there is an increasing demand for accounting services from fiduciaries within the region. Accounting plays a crucial role in ensuring transparency, accountability, and financial integrity, especially when it comes to managing and safeguarding entrusted assets, making it imperative for fiduciaries to seek professional assistance. Demand for Accounting from a Fiduciary in Lima Arizona: 1. Estate Executors and Administrators: Executors and administrators handle the financial affairs of estates, ensuring the proper distribution of assets according to the will or legal requirements. Demand for accounting services is high among these fiduciaries, as they must maintain accurate records, prepare financial statements, and provide an account of their activities. 2. Trustees: Trustees are responsible for managing and distributing assets held in trust for the benefit of beneficiaries. They require accounting assistance to track income, expenses, investment performance, and any distributions, ensuring compliance with legal obligations and fulfilling fiduciary duties. 3. Guardians: Guardians are entrusted with managing the financial affairs of minors or incapacitated adults. They need accounting services to maintain clear records of income, expenses, and assets held on behalf of those under their care. This helps to ensure that the assets are managed appropriately and that the best interests of the wards are protected. Importance of Demand for Accounting from a Fiduciary: 1. Financial Transparency and Accountability: Accounting provides fiduciaries with the tools and knowledge to maintain transparent financial records. This encourages accountability, reduces the risk of mismanagement or fraud, and promotes trust among interested parties. 2. Compliance with Legal and Regulatory Requirements: Fiduciaries must adhere to various legal and regulatory obligations. Proper accounting practices help them meet reporting requirements, file accurate tax returns, and ensure compliance with applicable laws, mitigating potential legal or financial risks. 3. Protection of Beneficiaries' Interests: Accounting services play a crucial role in safeguarding beneficiaries' interests. By providing a clear financial picture, fiduciaries can demonstrate proper management of assets, prevent unauthorized transfers, and mitigate the risk of misappropriation. 4. Enhanced Decision Making: Accurate accounting data empowers fiduciaries to make informed decisions regarding investments, asset allocation, and distributions. With insights gained through accounting reports, fiduciaries can optimize financial strategies to maximize value and meet beneficiaries' needs effectively. In conclusion, the demand for accounting from fiduciaries in Lima, Arizona, is crucial for maintaining financial integrity, ensuring compliance, and safeguarding the interests of beneficiaries. Estate executors, administrators, trustees, and guardians are among the key individuals who require accounting services to fulfill their fiduciary duties effectively. By harnessing the power of accounting, fiduciaries can navigate the complex responsibilities entrusted to them, ultimately benefiting both themselves and the beneficiaries they serve.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.