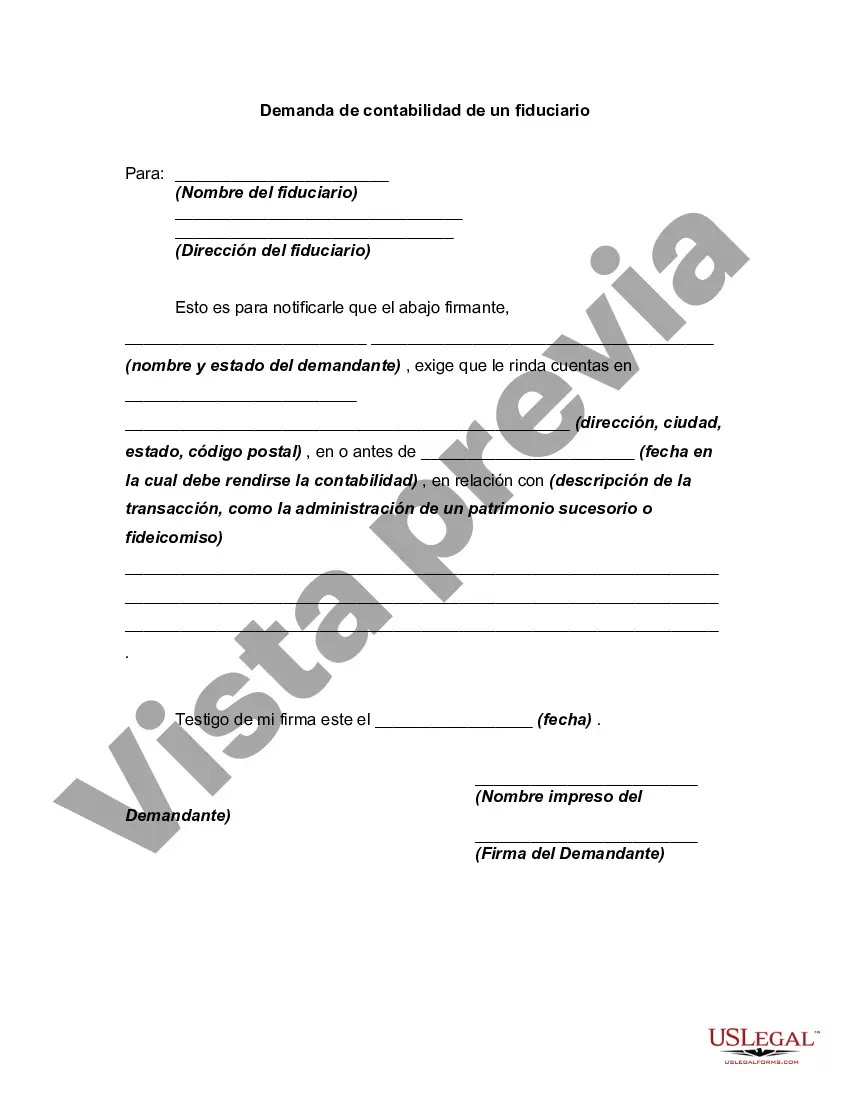

Sometimes, a prior demand by a potential plaintiff for an accounting, and a refusal by the fiduciary to account, are conditions precedent to the bringing of an action for an accounting. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

San Antonio, Texas Demand for Accounting from a Fiduciary: A Detailed Description In San Antonio, Texas, the demand for accounting services from a fiduciary is continuously growing as individuals and businesses seek professional assistance in managing their financial affairs. From personal trust management to corporate financial oversight, fiduciaries play a crucial role in ensuring the accuracy, transparency, and compliance of financial transactions. This article will delve into the different types of demand for accounting from a fiduciary in San Antonio and explain the importance of their services. 1. Personal Trust Accounting: San Antonio residents often engage fiduciaries to handle personal trust accounting. Fiduciaries meticulously maintain financial records, prepare accounting, and ensure that trust assets are appropriately managed and distributed in accordance with applicable laws and the granter's instructions. They play a crucial role in safeguarding the financial interests of beneficiaries, managing income and expenses, and providing periodic reports to all relevant parties. 2. Estate Accounting: Estate accounting is another area where there is a significant demand for fiduciary accounting services. When an individual passes away, fiduciaries, often appointed as executors or administrators, are responsible for inventorying and valuing assets, settling debts, preparing estate tax returns, and distributing assets as per the decedent's wishes or legal requirements. Accurate and transparent accounting is essential to mitigate potential conflicts among heirs and ensure a fair distribution of the estate. 3. Guardianship Accounting: Fiduciaries also play a vital role when it comes to accounting for guardianship. In cases where individuals are unable to manage their own affairs due to age, disability, or other incapacitating conditions, fiduciaries are appointed by the court to handle financial matters. They must maintain detailed accounting records of income, expenses, and asset management for the benefit of the ward to ensure that their financial well-being is protected. The demand for accounting from fiduciaries in San Antonio is fueled by several factors: a. Complexity of Financial Laws: The intricate financial regulations and tax codes necessitate professional expertise to navigate transactions lawfully. Fiduciaries possess the necessary knowledge and experience to manage financial matters compliantly, limiting potential legal risks for clients. b. Peace of Mind: Engaging a fiduciary for accounting services provides clients with peace of mind, knowing that their financial affairs are handled by professionals capable of maintaining accurate records, adhering to legal obligations, and acting in their best interests. c. Focus on Core Competencies: Outsourcing accounting to a fiduciary allows individuals and businesses to focus on their core competencies, freeing up time, resources, and energy that can be better allocated to strategic planning, business growth, or personal pursuits. Overall, the demand for accounting from fiduciaries in San Antonio, Texas, spans personal trust management, estate accounting, and guardianship accounting. Their expertise in financial record-keeping, compliance, and asset management ensures that individuals and businesses can confidently navigate complex financial landscapes while protecting their interests and meeting legal obligations.San Antonio, Texas Demand for Accounting from a Fiduciary: A Detailed Description In San Antonio, Texas, the demand for accounting services from a fiduciary is continuously growing as individuals and businesses seek professional assistance in managing their financial affairs. From personal trust management to corporate financial oversight, fiduciaries play a crucial role in ensuring the accuracy, transparency, and compliance of financial transactions. This article will delve into the different types of demand for accounting from a fiduciary in San Antonio and explain the importance of their services. 1. Personal Trust Accounting: San Antonio residents often engage fiduciaries to handle personal trust accounting. Fiduciaries meticulously maintain financial records, prepare accounting, and ensure that trust assets are appropriately managed and distributed in accordance with applicable laws and the granter's instructions. They play a crucial role in safeguarding the financial interests of beneficiaries, managing income and expenses, and providing periodic reports to all relevant parties. 2. Estate Accounting: Estate accounting is another area where there is a significant demand for fiduciary accounting services. When an individual passes away, fiduciaries, often appointed as executors or administrators, are responsible for inventorying and valuing assets, settling debts, preparing estate tax returns, and distributing assets as per the decedent's wishes or legal requirements. Accurate and transparent accounting is essential to mitigate potential conflicts among heirs and ensure a fair distribution of the estate. 3. Guardianship Accounting: Fiduciaries also play a vital role when it comes to accounting for guardianship. In cases where individuals are unable to manage their own affairs due to age, disability, or other incapacitating conditions, fiduciaries are appointed by the court to handle financial matters. They must maintain detailed accounting records of income, expenses, and asset management for the benefit of the ward to ensure that their financial well-being is protected. The demand for accounting from fiduciaries in San Antonio is fueled by several factors: a. Complexity of Financial Laws: The intricate financial regulations and tax codes necessitate professional expertise to navigate transactions lawfully. Fiduciaries possess the necessary knowledge and experience to manage financial matters compliantly, limiting potential legal risks for clients. b. Peace of Mind: Engaging a fiduciary for accounting services provides clients with peace of mind, knowing that their financial affairs are handled by professionals capable of maintaining accurate records, adhering to legal obligations, and acting in their best interests. c. Focus on Core Competencies: Outsourcing accounting to a fiduciary allows individuals and businesses to focus on their core competencies, freeing up time, resources, and energy that can be better allocated to strategic planning, business growth, or personal pursuits. Overall, the demand for accounting from fiduciaries in San Antonio, Texas, spans personal trust management, estate accounting, and guardianship accounting. Their expertise in financial record-keeping, compliance, and asset management ensures that individuals and businesses can confidently navigate complex financial landscapes while protecting their interests and meeting legal obligations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.