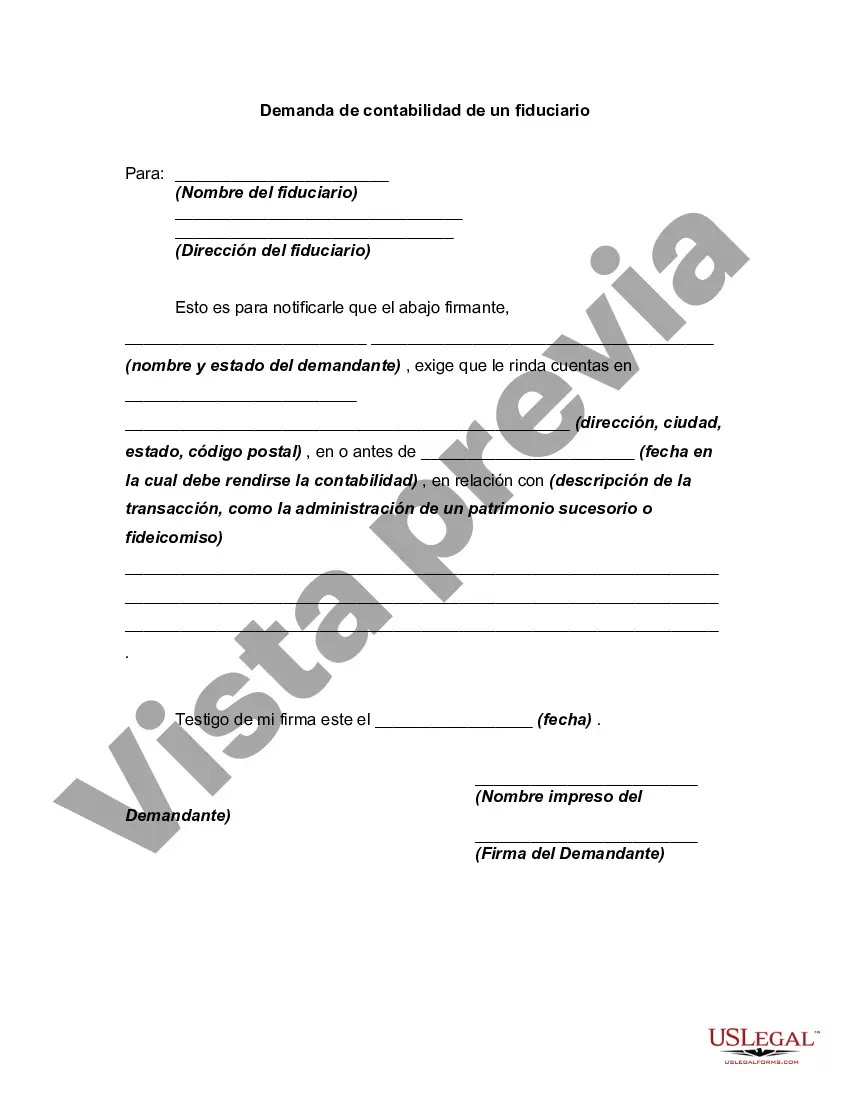

Sometimes, a prior demand by a potential plaintiff for an accounting, and a refusal by the fiduciary to account, are conditions precedent to the bringing of an action for an accounting. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

San Diego, California is a vibrant city located on the southern coast of the state. Known for its beautiful beaches, year-round mild climate, and diverse culture, San Diego attracts millions of tourists and residents alike. In recent years, there has been a growing demand for accounting services specifically from fiduciaries in the area. Fiduciaries are individuals or institutions entrusted with managing financial affairs for others, such as trustees, estate administrators, or guardians. The demand for accounting from a fiduciary in San Diego is driven by several factors. Firstly, the city has a significant aging population, leading to an increased need for estate planning and trust management. As individuals pass wealth down to younger generations, fiduciaries play a crucial role in ensuring that assets are protected and distributed according to the wishes of the deceased. Additionally, San Diego is home to various nonprofits and charitable organizations that rely on fiduciaries to manage their finances. These fiduciaries must adhere to strict accounting standards to maintain transparency and accountability, which further drives the demand for accounting services. Furthermore, San Diego's thriving business sector, including numerous startups and established companies, often seek fiduciary services for financial management, tax planning, and compliance purposes. Fiduciaries provide valuable expertise ensuring that businesses remain compliant with local, state, and federal regulations. While demand for accounting from a fiduciary in San Diego is generally driven by these factors, there are several types of fiduciary services available in the city: 1. Trust Accounting: Fiduciaries specializing in trust accounting manage and oversee the financial affairs and assets held in trusts. This includes accurate record-keeping, income distribution, investment management, and regular reporting to beneficiaries. 2. Estate Accounting: Estate accountants work closely with executors or personal representatives to handle the financial affairs of deceased individuals. They ensure assets are appropriately valued, debts and taxes are paid, and distributions to beneficiaries are made in accordance with the decedent's will or trust. 3. Guardianship Accounting: Fiduciaries appointed as guardians for minors or incapacitated individuals manage their financial affairs, including budgeting, bill payment, investment management, and regular reporting to the court. 4. Nonprofit Accounting: Fiduciaries serving nonprofit organizations in San Diego handle financial management, tax reporting, and compliance matters to ensure transparency and accountability to donors, board members, and regulatory agencies. In conclusion, San Diego's demand for accounting services from fiduciaries is fueled by its aging population, thriving business sector, and vibrant nonprofit community. Trust, estate, guardianship, and nonprofit accounting are some key types of fiduciary services required in the city. Fiduciaries play a critical role in managing financial affairs, providing expertise, and ensuring compliance, ultimately contributing to the financial well-being and stability of individuals, families, and organizations in San Diego.San Diego, California is a vibrant city located on the southern coast of the state. Known for its beautiful beaches, year-round mild climate, and diverse culture, San Diego attracts millions of tourists and residents alike. In recent years, there has been a growing demand for accounting services specifically from fiduciaries in the area. Fiduciaries are individuals or institutions entrusted with managing financial affairs for others, such as trustees, estate administrators, or guardians. The demand for accounting from a fiduciary in San Diego is driven by several factors. Firstly, the city has a significant aging population, leading to an increased need for estate planning and trust management. As individuals pass wealth down to younger generations, fiduciaries play a crucial role in ensuring that assets are protected and distributed according to the wishes of the deceased. Additionally, San Diego is home to various nonprofits and charitable organizations that rely on fiduciaries to manage their finances. These fiduciaries must adhere to strict accounting standards to maintain transparency and accountability, which further drives the demand for accounting services. Furthermore, San Diego's thriving business sector, including numerous startups and established companies, often seek fiduciary services for financial management, tax planning, and compliance purposes. Fiduciaries provide valuable expertise ensuring that businesses remain compliant with local, state, and federal regulations. While demand for accounting from a fiduciary in San Diego is generally driven by these factors, there are several types of fiduciary services available in the city: 1. Trust Accounting: Fiduciaries specializing in trust accounting manage and oversee the financial affairs and assets held in trusts. This includes accurate record-keeping, income distribution, investment management, and regular reporting to beneficiaries. 2. Estate Accounting: Estate accountants work closely with executors or personal representatives to handle the financial affairs of deceased individuals. They ensure assets are appropriately valued, debts and taxes are paid, and distributions to beneficiaries are made in accordance with the decedent's will or trust. 3. Guardianship Accounting: Fiduciaries appointed as guardians for minors or incapacitated individuals manage their financial affairs, including budgeting, bill payment, investment management, and regular reporting to the court. 4. Nonprofit Accounting: Fiduciaries serving nonprofit organizations in San Diego handle financial management, tax reporting, and compliance matters to ensure transparency and accountability to donors, board members, and regulatory agencies. In conclusion, San Diego's demand for accounting services from fiduciaries is fueled by its aging population, thriving business sector, and vibrant nonprofit community. Trust, estate, guardianship, and nonprofit accounting are some key types of fiduciary services required in the city. Fiduciaries play a critical role in managing financial affairs, providing expertise, and ensuring compliance, ultimately contributing to the financial well-being and stability of individuals, families, and organizations in San Diego.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.