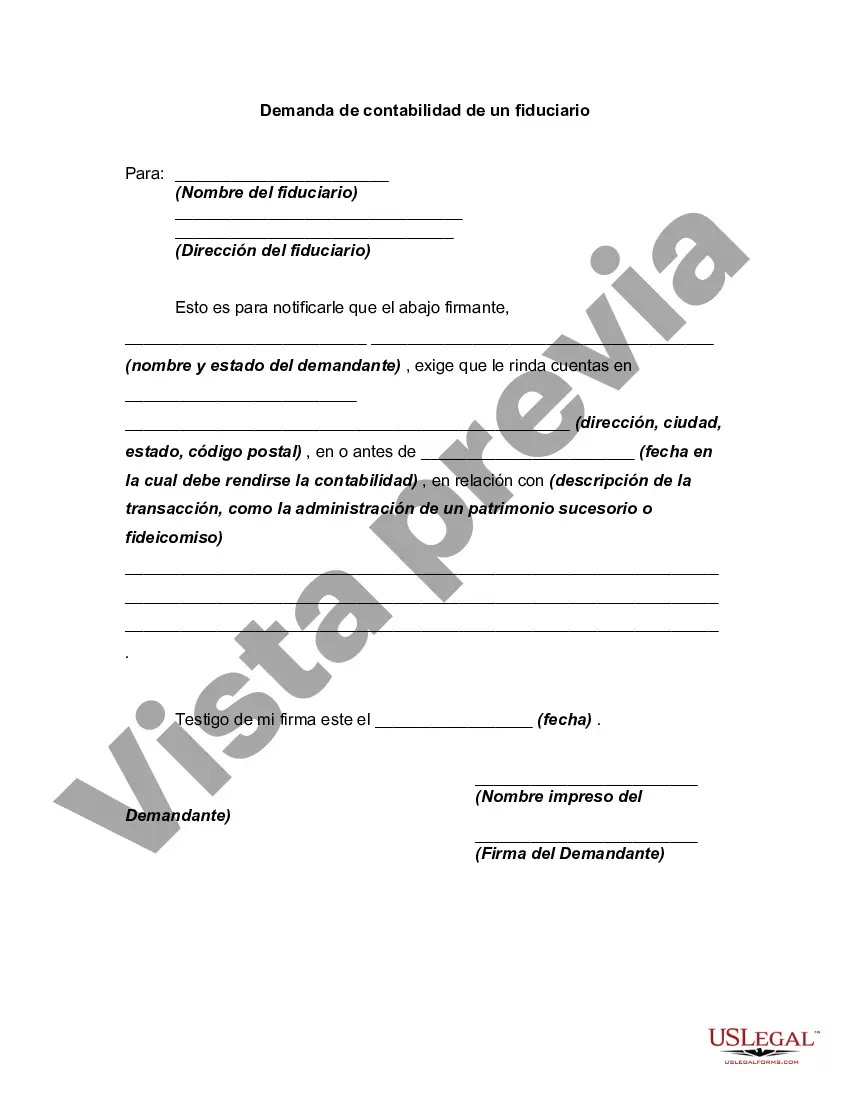

Sometimes, a prior demand by a potential plaintiff for an accounting, and a refusal by the fiduciary to account, are conditions precedent to the bringing of an action for an accounting. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

San Jose, California, is known for its thriving business environment, with numerous individuals and companies seeking professional accounting services from fiduciaries. Demand for accounting services in San Jose is high due to several factors, including the city's strong economy, presence of multinational corporations, and many small businesses and startups. Accounting plays a crucial role in the financial management of businesses and individuals, ensuring accurate record-keeping, tax compliance, and financial decision-making. Fiduciaries, who are entrusted with managing the financial affairs and assets of individuals or organizations, frequently require accounting services to fulfill their responsibilities effectively. The demand for accounting from fiduciaries in San Jose encompasses various types, including: 1. Estate Accounting: In cases where a fiduciary is appointed to administer an estate, they need comprehensive accounting services to track income, expenses, and distributions accurately. This type of accounting ensures the proper management and distribution of assets in accordance with the estate owner's wishes and legal requirements. 2. Trust Accounting: Fiduciaries managing trusts must maintain meticulous accounts detailing all financial transactions related to the trust assets. Trust accounting involves monitoring income, expenses, and distributions to beneficiaries. Accurate accounting helps ensure transparency, prevent fraud, and fulfill legal obligations. 3. Corporate Fiduciary Accounting: Businesses often hire fiduciaries to manage their financial affairs, such as investment portfolios, retirement plans, and employee benefit programs. Accounting services for corporate fiduciaries involve comprehensive financial reporting, budgeting, cash flow analysis, and tax planning to optimize financial performance and compliance. 4. Guardianship Accounting: Fiduciaries appointed to manage the financial affairs of minors or incapacitated individuals require accounting services to safeguard their assets. Guardianship accounting track income, expenses, and distributions to ensure the individual's financial well-being and adherence to legal requirements. In conclusion, the demand for accounting from fiduciaries in San Jose, California, is driven by the city's vibrant business landscape, presence of multinational corporations, and a large base of small businesses and startups. Estate accounting, trust accounting, corporate fiduciary accounting, and guardianship accounting are among the different types of accounting services sought by fiduciaries in San Jose. These accounting services ensure proper financial management, compliance, and decision-making, benefiting both businesses and individuals.San Jose, California, is known for its thriving business environment, with numerous individuals and companies seeking professional accounting services from fiduciaries. Demand for accounting services in San Jose is high due to several factors, including the city's strong economy, presence of multinational corporations, and many small businesses and startups. Accounting plays a crucial role in the financial management of businesses and individuals, ensuring accurate record-keeping, tax compliance, and financial decision-making. Fiduciaries, who are entrusted with managing the financial affairs and assets of individuals or organizations, frequently require accounting services to fulfill their responsibilities effectively. The demand for accounting from fiduciaries in San Jose encompasses various types, including: 1. Estate Accounting: In cases where a fiduciary is appointed to administer an estate, they need comprehensive accounting services to track income, expenses, and distributions accurately. This type of accounting ensures the proper management and distribution of assets in accordance with the estate owner's wishes and legal requirements. 2. Trust Accounting: Fiduciaries managing trusts must maintain meticulous accounts detailing all financial transactions related to the trust assets. Trust accounting involves monitoring income, expenses, and distributions to beneficiaries. Accurate accounting helps ensure transparency, prevent fraud, and fulfill legal obligations. 3. Corporate Fiduciary Accounting: Businesses often hire fiduciaries to manage their financial affairs, such as investment portfolios, retirement plans, and employee benefit programs. Accounting services for corporate fiduciaries involve comprehensive financial reporting, budgeting, cash flow analysis, and tax planning to optimize financial performance and compliance. 4. Guardianship Accounting: Fiduciaries appointed to manage the financial affairs of minors or incapacitated individuals require accounting services to safeguard their assets. Guardianship accounting track income, expenses, and distributions to ensure the individual's financial well-being and adherence to legal requirements. In conclusion, the demand for accounting from fiduciaries in San Jose, California, is driven by the city's vibrant business landscape, presence of multinational corporations, and a large base of small businesses and startups. Estate accounting, trust accounting, corporate fiduciary accounting, and guardianship accounting are among the different types of accounting services sought by fiduciaries in San Jose. These accounting services ensure proper financial management, compliance, and decision-making, benefiting both businesses and individuals.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.