Sometimes, a prior demand by a potential plaintiff for an accounting, and a refusal by the fiduciary to account, are conditions precedent to the bringing of an action for an accounting. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Santa Clara, California, Demand for Accounting from a Fiduciary: Santa Clara, California, known for its vibrant economy and diverse community, often witnesses a significant demand for accounting services from fiduciaries. A fiduciary, in the context of Santa Clara, refers to a person or entity entrusted with managing the financial affairs or assets of another individual or organization. These fiduciaries are legally obligated to act in the best interests of their clients and are required to provide thorough and transparent accounting reports to ensure accountability and compliance. The demand for accounting services stems from the need to maintain transparency, accuracy, and compliance in financial matters. Fiduciaries in Santa Clara often handle critical financial responsibilities, including estate planning, trust management, investment management, and retirement planning. As fiduciaries are entrusted with managing significant assets and making important financial decisions, their clients and beneficiaries have the right to demand timely and accurate accounting reports to ensure their financial interests are protected. The demand for accounting from a fiduciary in Santa Clara can be categorized into several types, each with its specific requirements and areas of focus: 1. Estate Accounting: A fiduciary responsible for managing the estate of a deceased person must prepare periodic accounting reports detailing the estate's financial transactions, assets, distributions, and any expenses incurred. This accounting ensures the proper management and distribution of the deceased person's assets as per their will or legal requirements. 2. Trust Accounting: Fiduciaries appointed to manage trusts, such as revocable living trusts or irrevocable trusts, must maintain accurate and up-to-date trust accounting. This includes recording income, expenses, distributions, and any changes in the trust's assets. Beneficiaries of the trust have the right to demand periodic accounting to ensure the fiduciary's compliance with their duties. 3. Investment Accounting: Fiduciaries who handle investment management are responsible for ensuring prudent investment decisions, maintaining investment records, and reporting the performance of the investments to their clients or beneficiaries. Investment accounting tracks the growth or depreciation of the investment portfolio and helps evaluate the fiduciary's performance. 4. Retirement Plan Accounting: Fiduciaries managing retirement plans, such as 401(k) plans or pension plans, must provide accurate accounting information to plan participants. This includes tracking contributions, investments, expenses, distributions, and the overall financial health of the retirement plan. Participants have the right to demand accounting reports to ensure compliance with legal standards and the fiduciary's obligations. In conclusion, Santa Clara, California, experiences a significant demand for accounting services from fiduciaries who manage various financial responsibilities. From estate and trust accounting to investment and retirement plan accounting, individuals and organizations rely on fiduciaries to provide transparent and accurate reports to safeguard their financial interests. Meeting this demand ensures compliance, transparency, and accountability within the fiduciary industry in Santa Clara, California.Santa Clara, California, Demand for Accounting from a Fiduciary: Santa Clara, California, known for its vibrant economy and diverse community, often witnesses a significant demand for accounting services from fiduciaries. A fiduciary, in the context of Santa Clara, refers to a person or entity entrusted with managing the financial affairs or assets of another individual or organization. These fiduciaries are legally obligated to act in the best interests of their clients and are required to provide thorough and transparent accounting reports to ensure accountability and compliance. The demand for accounting services stems from the need to maintain transparency, accuracy, and compliance in financial matters. Fiduciaries in Santa Clara often handle critical financial responsibilities, including estate planning, trust management, investment management, and retirement planning. As fiduciaries are entrusted with managing significant assets and making important financial decisions, their clients and beneficiaries have the right to demand timely and accurate accounting reports to ensure their financial interests are protected. The demand for accounting from a fiduciary in Santa Clara can be categorized into several types, each with its specific requirements and areas of focus: 1. Estate Accounting: A fiduciary responsible for managing the estate of a deceased person must prepare periodic accounting reports detailing the estate's financial transactions, assets, distributions, and any expenses incurred. This accounting ensures the proper management and distribution of the deceased person's assets as per their will or legal requirements. 2. Trust Accounting: Fiduciaries appointed to manage trusts, such as revocable living trusts or irrevocable trusts, must maintain accurate and up-to-date trust accounting. This includes recording income, expenses, distributions, and any changes in the trust's assets. Beneficiaries of the trust have the right to demand periodic accounting to ensure the fiduciary's compliance with their duties. 3. Investment Accounting: Fiduciaries who handle investment management are responsible for ensuring prudent investment decisions, maintaining investment records, and reporting the performance of the investments to their clients or beneficiaries. Investment accounting tracks the growth or depreciation of the investment portfolio and helps evaluate the fiduciary's performance. 4. Retirement Plan Accounting: Fiduciaries managing retirement plans, such as 401(k) plans or pension plans, must provide accurate accounting information to plan participants. This includes tracking contributions, investments, expenses, distributions, and the overall financial health of the retirement plan. Participants have the right to demand accounting reports to ensure compliance with legal standards and the fiduciary's obligations. In conclusion, Santa Clara, California, experiences a significant demand for accounting services from fiduciaries who manage various financial responsibilities. From estate and trust accounting to investment and retirement plan accounting, individuals and organizations rely on fiduciaries to provide transparent and accurate reports to safeguard their financial interests. Meeting this demand ensures compliance, transparency, and accountability within the fiduciary industry in Santa Clara, California.

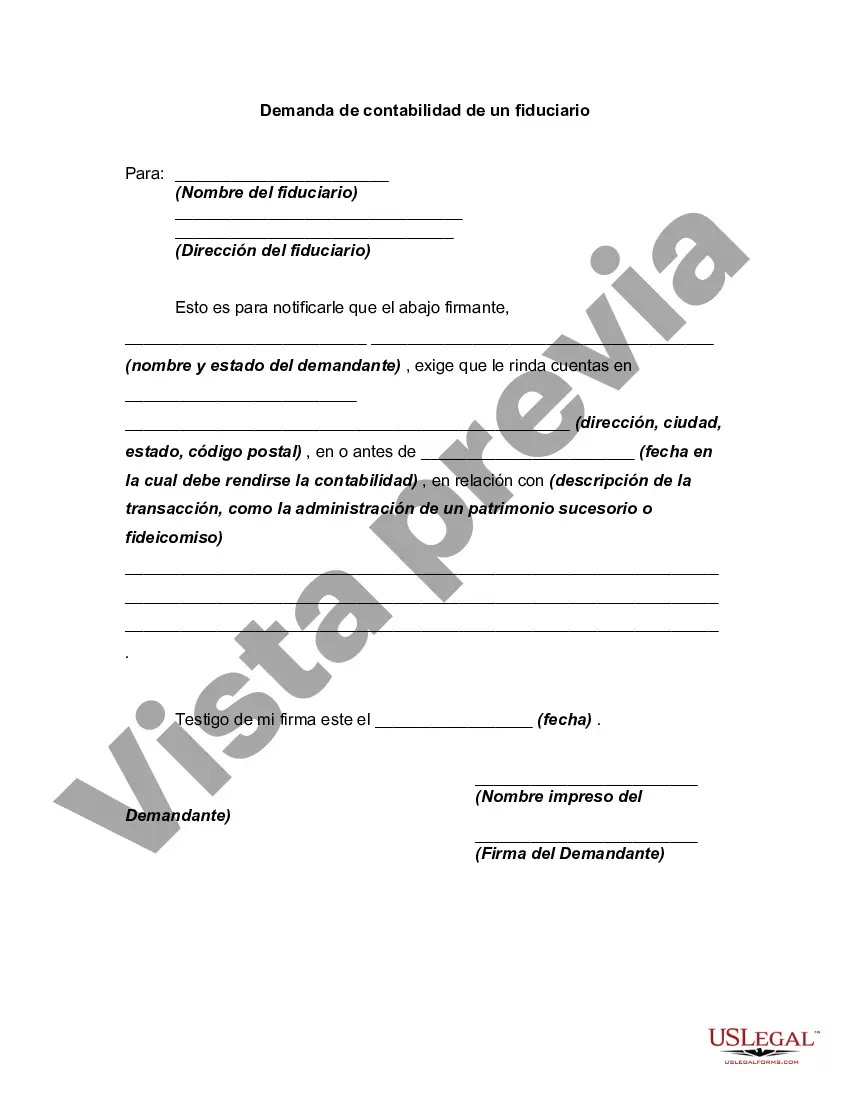

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.