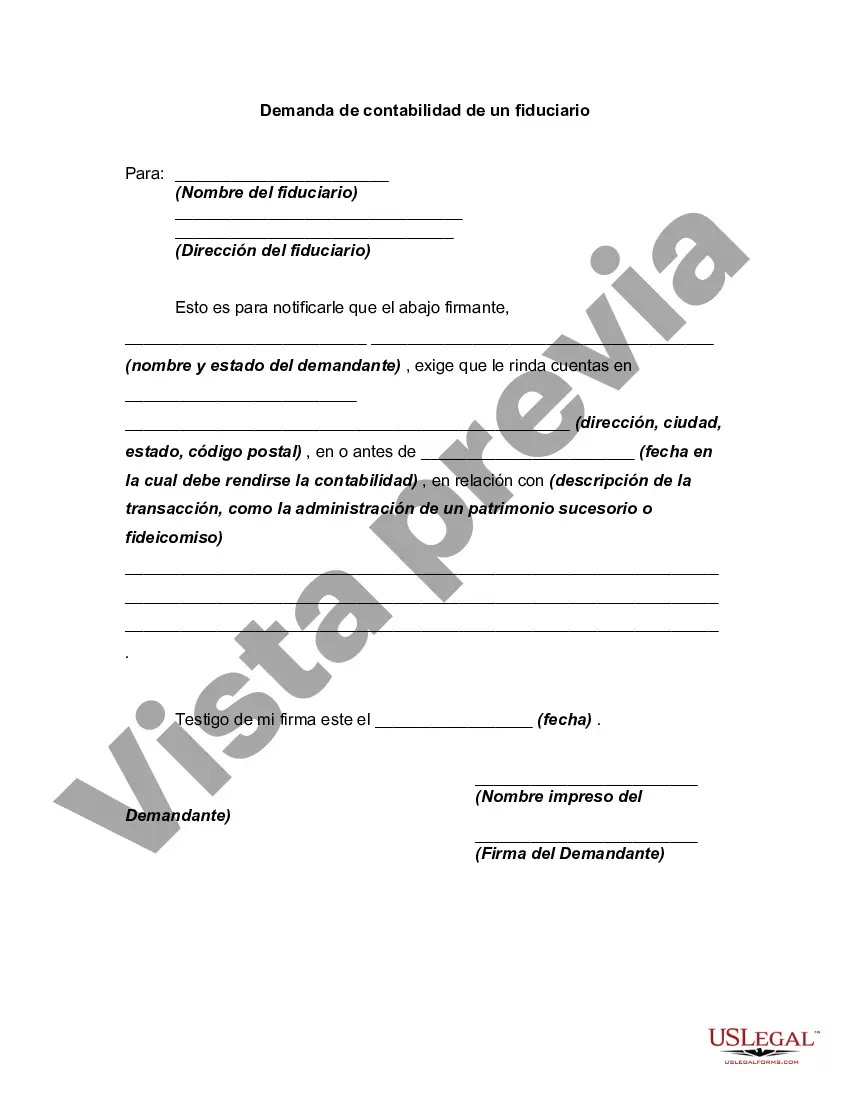

Sometimes, a prior demand by a potential plaintiff for an accounting, and a refusal by the fiduciary to account, are conditions precedent to the bringing of an action for an accounting. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Travis Texas Demand for Accounting from a Fiduciary: In Travis, Texas, the demand for accounting from a fiduciary has been steadily increasing. Individuals and organizations are recognizing the importance of sound financial management, especially when it comes to assets held by a fiduciary. A fiduciary is an individual or entity entrusted with managing assets on behalf of others, and ensuring transparency and accountability is crucial in this role. Accounting services for fiduciaries in Travis, Texas encompass various responsibilities to meet the demands of different situations. Here are some types of demand for accounting from a fiduciary in Travis, Texas: 1. Estate Accounting: One specific area of demand is estate accounting, which involves managing and accounting for assets held within an estate. Whether it's tracking financial transactions, evaluating investment performance, or preparing financial statements, estate accounting is essential to ensure proper asset management as per the estate plan. 2. Trust Accounting: Trust accounting focuses on the financial management of trusts, where the fiduciary has the responsibility of managing assets on behalf of beneficiaries. Trust accounting involve comprehensive tracking of income, expenses, and any changes made within the trust. Regular reports and statements must be prepared to provide transparency to the beneficiaries. 3. Guardianship Accounting: Another area is guardianship accounting, where a fiduciary manages the finances of an incapacitated individual or a minor. The fiduciary is responsible for maintaining accurate records, managing expenses, and providing detailed accounting reports to the court or other interested parties. Ensuring the protected person's financial well-being is the primary concern in guardianship accounting. 4. Corporate or Institutional Fiduciary Accounting: This type of accounting pertains to fiduciaries operating within corporate or institutional settings. These fiduciaries often handle large-scale financial transactions, investment portfolios, and complex accounting tasks. The demand for accounting services in this context involves tax planning, auditing, compliance, and financial reporting on a corporation or institutional level. Regardless of the type of demand, a fiduciary's accounting services in Travis, Texas should be thorough, accurate, and comply with relevant regulatory requirements. They must focus on providing transparency, maintaining records, and producing timely and accurate financial reports to fulfill their fiduciary obligations. With the growing awareness of the importance of fiduciary accounting in Travis, Texas, the demand for specialized accounting professionals in this field is rising. Professionals who understand the local legal, tax, and financial frameworks can effectively meet these demands and provide confidence and peace of mind to those who entrust their assets to fiduciaries in Travis, Texas.Travis Texas Demand for Accounting from a Fiduciary: In Travis, Texas, the demand for accounting from a fiduciary has been steadily increasing. Individuals and organizations are recognizing the importance of sound financial management, especially when it comes to assets held by a fiduciary. A fiduciary is an individual or entity entrusted with managing assets on behalf of others, and ensuring transparency and accountability is crucial in this role. Accounting services for fiduciaries in Travis, Texas encompass various responsibilities to meet the demands of different situations. Here are some types of demand for accounting from a fiduciary in Travis, Texas: 1. Estate Accounting: One specific area of demand is estate accounting, which involves managing and accounting for assets held within an estate. Whether it's tracking financial transactions, evaluating investment performance, or preparing financial statements, estate accounting is essential to ensure proper asset management as per the estate plan. 2. Trust Accounting: Trust accounting focuses on the financial management of trusts, where the fiduciary has the responsibility of managing assets on behalf of beneficiaries. Trust accounting involve comprehensive tracking of income, expenses, and any changes made within the trust. Regular reports and statements must be prepared to provide transparency to the beneficiaries. 3. Guardianship Accounting: Another area is guardianship accounting, where a fiduciary manages the finances of an incapacitated individual or a minor. The fiduciary is responsible for maintaining accurate records, managing expenses, and providing detailed accounting reports to the court or other interested parties. Ensuring the protected person's financial well-being is the primary concern in guardianship accounting. 4. Corporate or Institutional Fiduciary Accounting: This type of accounting pertains to fiduciaries operating within corporate or institutional settings. These fiduciaries often handle large-scale financial transactions, investment portfolios, and complex accounting tasks. The demand for accounting services in this context involves tax planning, auditing, compliance, and financial reporting on a corporation or institutional level. Regardless of the type of demand, a fiduciary's accounting services in Travis, Texas should be thorough, accurate, and comply with relevant regulatory requirements. They must focus on providing transparency, maintaining records, and producing timely and accurate financial reports to fulfill their fiduciary obligations. With the growing awareness of the importance of fiduciary accounting in Travis, Texas, the demand for specialized accounting professionals in this field is rising. Professionals who understand the local legal, tax, and financial frameworks can effectively meet these demands and provide confidence and peace of mind to those who entrust their assets to fiduciaries in Travis, Texas.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.