Sometimes, a prior demand by a potential plaintiff for an accounting, and a refusal by the fiduciary to account, are conditions precedent to the bringing of an action for an accounting. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Wake North Carolina Demand for Accounting from a Fiduciary: When it comes to financial management, Wake North Carolina residents value the importance of transparency and accountability. This is evident in the growing demand for accounting services from fiduciaries, as individuals seek to safeguard their financial affairs and ensure their assets are managed responsibly. A fiduciary refers to a person or entity entrusted with the management and protection of another party's financial interests. This could include professionals such as trustees, executors, administrators, or representatives appointed to handle someone's estate or assets. To ensure that these fiduciaries are performing their duties in a fiduciary capacity, Wake North Carolina residents have become increasingly proactive in requesting accounting reports. Demand for accounting from a fiduciary arises from the need to maintain transparency and accountability in the management of financial affairs. Wake North Carolina residents want to have a clear understanding of how their assets are being handled and whether the fiduciary is acting in their best interests. This demand helps provide peace of mind and safeguards against potential mismanagement or fraud. There are various types of Wake North Carolina demand for accounting from a fiduciary, including: 1. Estate Accounting: Wake North Carolina residents who have appointed an executor or personal representative for their estate often request regular accounting reports. This type of accounting documents all estate-related financial transactions, ensuring transparency in the distribution of assets and fulfillment of liabilities. 2. Trust Accounting: Wake North Carolina residents who establish trusts, be it revocable living trusts, testamentary trusts, or special needs trusts, require thorough accounting from their chosen fiduciaries. Trust accounting encompasses the financial activities and transactions related to the management and distribution of trust assets. 3. Guardianship Accounting: In cases of incapacitated individuals, a guardian is appointed to make decisions and manage their financial affairs. The demand for accounting in guardianship ensures that the guardian is fulfilling their duties properly, protecting the ward's financial interests and reporting on financial activities. The Wake North Carolina demand for accounting from a fiduciary demonstrates the commitment of residents to financial transparency, ensuring that their assets are managed ethically and responsibly. By requesting comprehensive accounting reports, individuals can verify that fiduciaries are upholding their legal obligations and adhering to high ethical standards. Keywords: Wake North Carolina, demand for accounting, fiduciary, transparency, accountability, financial management, trustees, executors, administrators, representatives, estate accounting, trust accounting, guardianship accounting, financial transparency, mismanagement, fraud.Wake North Carolina Demand for Accounting from a Fiduciary: When it comes to financial management, Wake North Carolina residents value the importance of transparency and accountability. This is evident in the growing demand for accounting services from fiduciaries, as individuals seek to safeguard their financial affairs and ensure their assets are managed responsibly. A fiduciary refers to a person or entity entrusted with the management and protection of another party's financial interests. This could include professionals such as trustees, executors, administrators, or representatives appointed to handle someone's estate or assets. To ensure that these fiduciaries are performing their duties in a fiduciary capacity, Wake North Carolina residents have become increasingly proactive in requesting accounting reports. Demand for accounting from a fiduciary arises from the need to maintain transparency and accountability in the management of financial affairs. Wake North Carolina residents want to have a clear understanding of how their assets are being handled and whether the fiduciary is acting in their best interests. This demand helps provide peace of mind and safeguards against potential mismanagement or fraud. There are various types of Wake North Carolina demand for accounting from a fiduciary, including: 1. Estate Accounting: Wake North Carolina residents who have appointed an executor or personal representative for their estate often request regular accounting reports. This type of accounting documents all estate-related financial transactions, ensuring transparency in the distribution of assets and fulfillment of liabilities. 2. Trust Accounting: Wake North Carolina residents who establish trusts, be it revocable living trusts, testamentary trusts, or special needs trusts, require thorough accounting from their chosen fiduciaries. Trust accounting encompasses the financial activities and transactions related to the management and distribution of trust assets. 3. Guardianship Accounting: In cases of incapacitated individuals, a guardian is appointed to make decisions and manage their financial affairs. The demand for accounting in guardianship ensures that the guardian is fulfilling their duties properly, protecting the ward's financial interests and reporting on financial activities. The Wake North Carolina demand for accounting from a fiduciary demonstrates the commitment of residents to financial transparency, ensuring that their assets are managed ethically and responsibly. By requesting comprehensive accounting reports, individuals can verify that fiduciaries are upholding their legal obligations and adhering to high ethical standards. Keywords: Wake North Carolina, demand for accounting, fiduciary, transparency, accountability, financial management, trustees, executors, administrators, representatives, estate accounting, trust accounting, guardianship accounting, financial transparency, mismanagement, fraud.

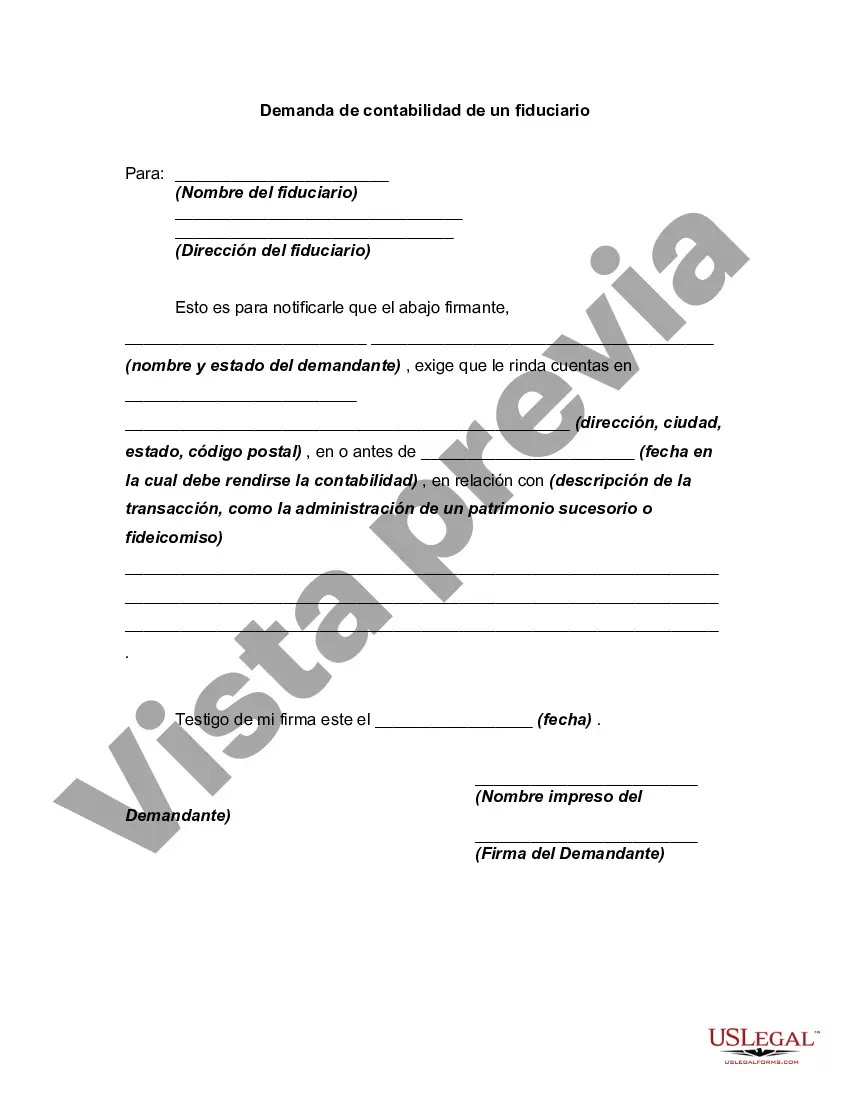

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.