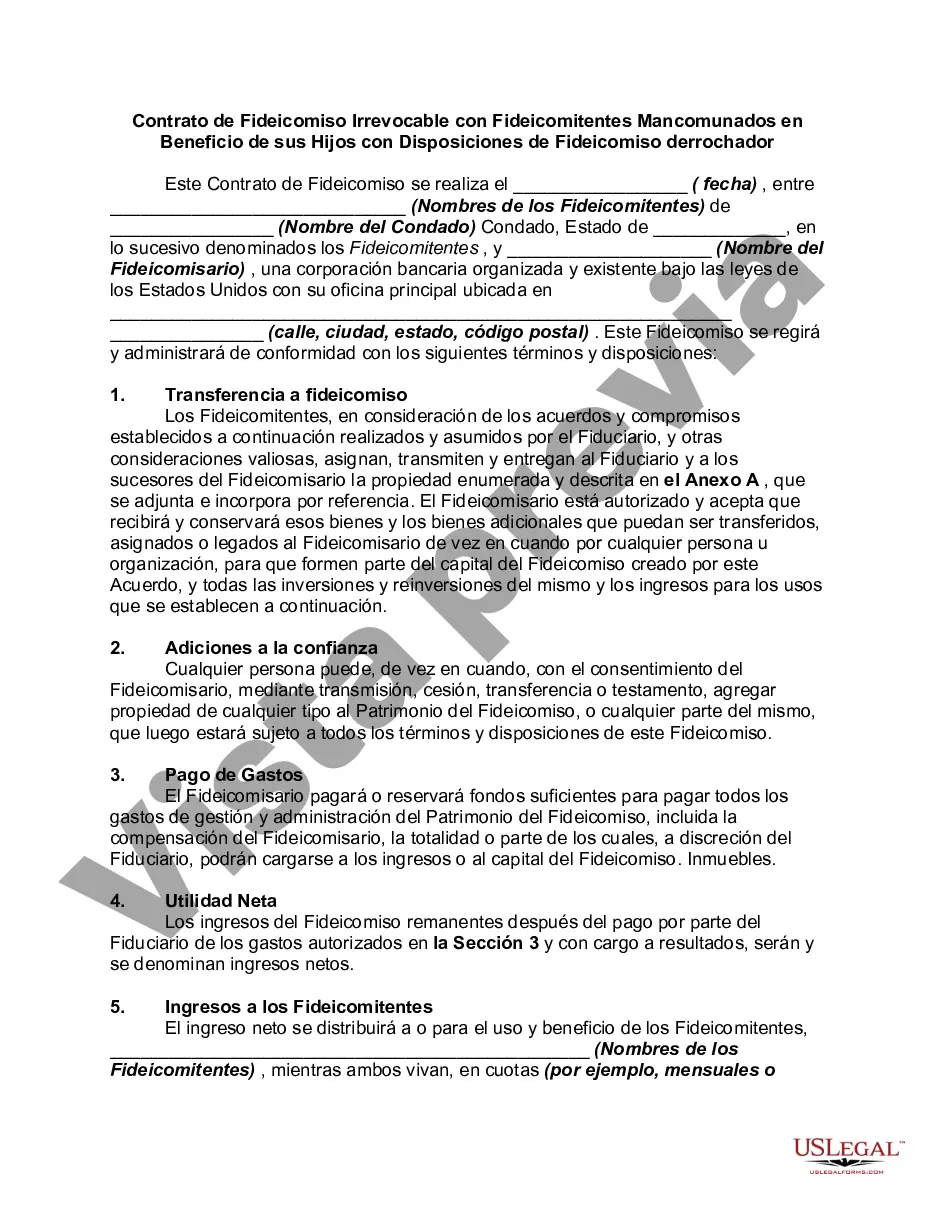

An irrevocable trust is a trust in which the trustor has not retained the right to revoke or amend the trust. Perhaps the principal advantage of the irrevocable inter vivos trust lies in income and estate tax savings. The major drawback is that the trust is, in fact, irrevocable. Thus, a trustor without considerable other means must seriously consider whether by creating such a trust he or she is jeopardizing his or her own security. Considerable foresight is required in drafting irrevocable trust agreements, since later amendment is precluded.

Federal tax aspects of a Trust wholly or partly for the benefit of the Trustor should be analyzed in considering whether to create such a Trust and in preparing the instrument. The Trustor is ordinarily subject to taxation on Trust income that may be paid to the Trustor or for the Trustor's benefit, and subject to Estate taxation on Trust property in which the Trustor had a beneficial interest at the time of the Trustor's death. Thus, a Trustor is generally subject to taxation on Trust income that is, or may be without the consent of an adverse party, distributed to the Trustor or the Trustor's spouse, or accumulated for the Trustor or the Trustor's spouse, or used to pay premiums on the Trustor's or the Trustor's spouse's life insurance. For purposes of the federal Estate tax, the Trustor's gross Estate will include the value of Trust property respecting which the Trustor has retained for his or her life or any period not ascertainable without reference to the Trustor's death or for any period that does not in fact end before the Trustor's death, the possession or enjoyment of, or the right to, the income from the property.

Alameda California Irrevocable Trust Agreement with Joint Trustees for Benefit of their Children with Spendthrift Trust Provisions is a legal document designed to protect and manage assets for the future benefit of children, while also preventing them from squandering or mismanaging their inheritance. This specific type of trust offers enhanced protection for the beneficiaries against creditors and potential financial risks. The Alameda California Irrevocable Trust Agreement with Joint Trustees for the Benefit of their Children with Spendthrift Trust Provisions offers several variations to suit individual needs and circumstances. Some possible types may include: 1. Standard Spendthrift Trust: This trust is established by parents, jointly acting as trustees, to secure and manage assets for their children's future benefit. It includes spendthrift provisions that protect the assets from being accessed by creditors and ensure responsible financial management. 2. Educational Trust: This trust variation focuses specifically on providing funds for the children's education and related expenses. It can be set up to cover tuition fees, books, and other necessary resources, ensuring that the beneficiaries receive a quality education without financial burdens. 3. Health and Welfare Trust: This trust type is established to safeguard assets for the purpose of healthcare and general welfare expenses for the children. It ensures that trusts' assets can only be used for approved medical treatments, insurance premiums, and other essential well-being needs. 4. Special Needs Trust: If a child has special needs or disabilities, this trust variation is suitable. It caters to their unique circumstances by providing financial support while preserving their eligibility for government programs and benefits. The trust can cover medical care, therapy, living arrangements, and other necessary expenses. 5. Asset Protection Trust: This type of irrevocable trust agreement focuses on shielding assets from potential lawsuits, divorce settlements, or creditors. The trustees establish the trust to protect their children's future inheritance, ensuring it remains secure and out of reach from any financial threats. The Alameda California Irrevocable Trust Agreement with Joint Trustees for Benefit of their Children with Spendthrift Trust Provisions offers flexibility and customization to meet the specific needs of families in Alameda, California. It is advisable to consult with a qualified attorney to determine the most suitable type of trust based on unique circumstances and goals.Alameda California Irrevocable Trust Agreement with Joint Trustees for Benefit of their Children with Spendthrift Trust Provisions is a legal document designed to protect and manage assets for the future benefit of children, while also preventing them from squandering or mismanaging their inheritance. This specific type of trust offers enhanced protection for the beneficiaries against creditors and potential financial risks. The Alameda California Irrevocable Trust Agreement with Joint Trustees for the Benefit of their Children with Spendthrift Trust Provisions offers several variations to suit individual needs and circumstances. Some possible types may include: 1. Standard Spendthrift Trust: This trust is established by parents, jointly acting as trustees, to secure and manage assets for their children's future benefit. It includes spendthrift provisions that protect the assets from being accessed by creditors and ensure responsible financial management. 2. Educational Trust: This trust variation focuses specifically on providing funds for the children's education and related expenses. It can be set up to cover tuition fees, books, and other necessary resources, ensuring that the beneficiaries receive a quality education without financial burdens. 3. Health and Welfare Trust: This trust type is established to safeguard assets for the purpose of healthcare and general welfare expenses for the children. It ensures that trusts' assets can only be used for approved medical treatments, insurance premiums, and other essential well-being needs. 4. Special Needs Trust: If a child has special needs or disabilities, this trust variation is suitable. It caters to their unique circumstances by providing financial support while preserving their eligibility for government programs and benefits. The trust can cover medical care, therapy, living arrangements, and other necessary expenses. 5. Asset Protection Trust: This type of irrevocable trust agreement focuses on shielding assets from potential lawsuits, divorce settlements, or creditors. The trustees establish the trust to protect their children's future inheritance, ensuring it remains secure and out of reach from any financial threats. The Alameda California Irrevocable Trust Agreement with Joint Trustees for Benefit of their Children with Spendthrift Trust Provisions offers flexibility and customization to meet the specific needs of families in Alameda, California. It is advisable to consult with a qualified attorney to determine the most suitable type of trust based on unique circumstances and goals.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.