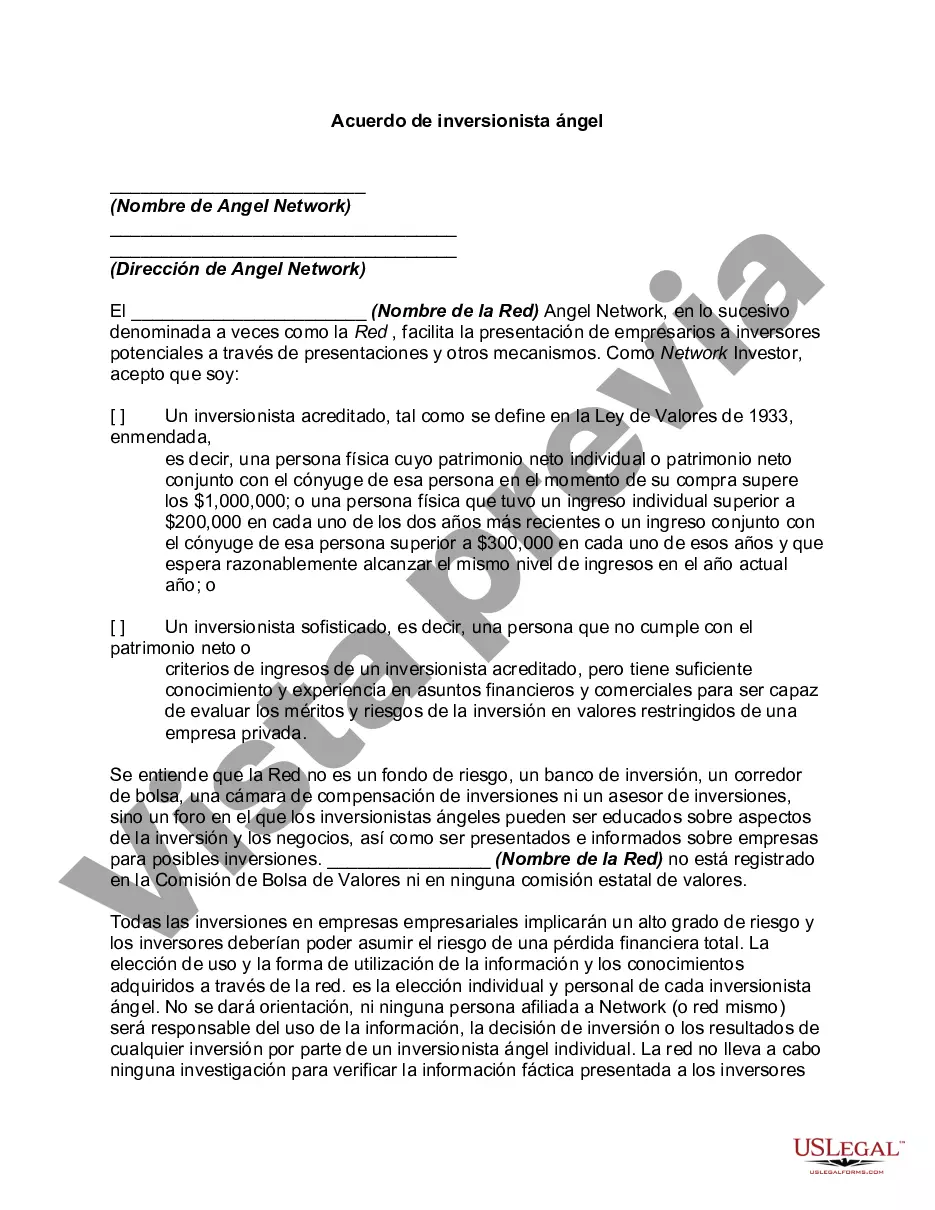

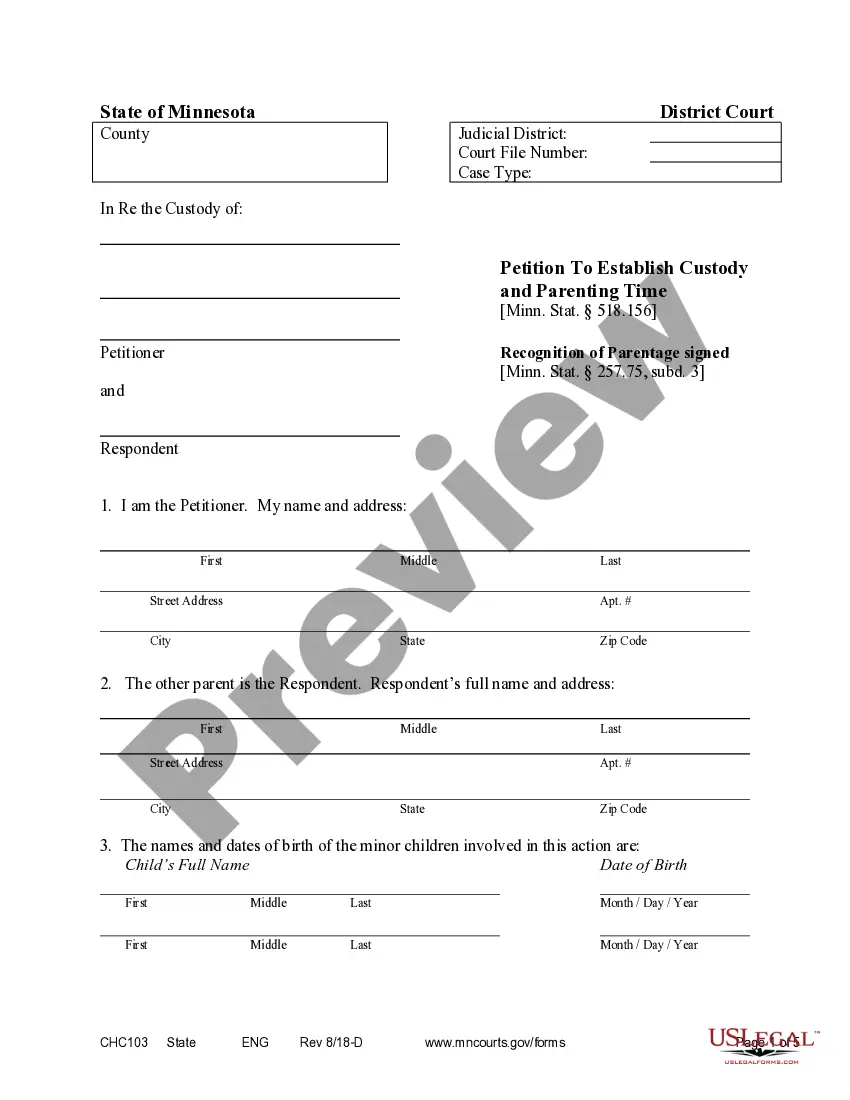

Clark Nevada Angel Investor Agreement is a legally binding document that outlines the terms and conditions between angel investors and startup companies based in Clark County, Nevada. This agreement serves as a key instrument in defining the investment relationship and protecting the interests of both parties involved. The Clark Nevada Angel Investor Agreement provides an avenue for angel investors to actively participate in the growth and development of early-stage companies in the region. By entering into this agreement, angel investors can contribute not only their financial resources but also their expertise, industry connections, and guidance to support the startup's success. The agreement typically covers various critical aspects of the investment, including the amount and method of funding, ownership stake, valuation of the company, exit strategies, and the level of involvement of the angel investor in the decision-making process. It also addresses issues such as intellectual property rights, non-disclosure agreements, non-compete clauses, and any specific conditions mutually agreed upon by the parties. While there may not be different types of Clark Nevada Angel Investor Agreements, the terms and conditions can vary depending on the specific needs and preferences of the parties involved. Some agreements may be structured as convertible notes, allowing the angel investor to convert their investment into equity at a predetermined valuation or triggering event. Other agreements may involve the issuance of preferred stock, granting the investor certain rights and privileges over common stockholders. It is crucial for both the startup company and the angel investor to carefully negotiate and draft the terms of the agreement to ensure clarity, fairness, and protection of their respective interests. While the agreement is a legal document, it also serves as a foundation for building a mutually beneficial and successful partnership between the angel investor and the startup. In summary, the Clark Nevada Angel Investor Agreement is an important contractual arrangement that facilitates the collaboration between angel investors and startup companies in Clark County, Nevada. It defines the terms of investment, outlines the roles and responsibilities of both parties, and serves as a framework for a fruitful and symbiotic relationship.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Clark Nevada Acuerdo de inversionista ángel - Angel Investor Agreement

Description

How to fill out Clark Nevada Acuerdo De Inversionista ángel?

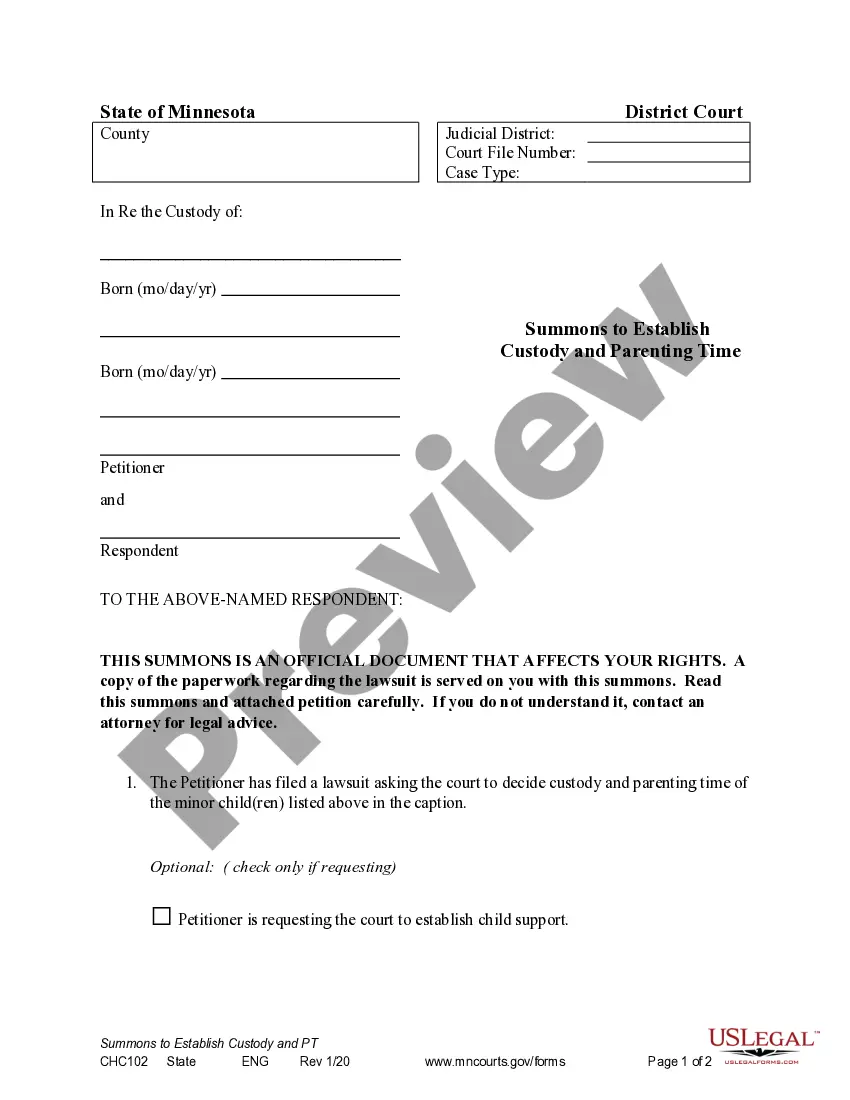

If you need to get a trustworthy legal paperwork supplier to get the Clark Angel Investor Agreement, look no further than US Legal Forms. Whether you need to start your LLC business or take care of your belongings distribution, we got you covered. You don't need to be well-versed in in law to find and download the needed form.

- You can search from over 85,000 forms categorized by state/county and situation.

- The intuitive interface, number of learning resources, and dedicated support team make it easy to get and complete different documents.

- US Legal Forms is a reliable service providing legal forms to millions of users since 1997.

You can simply type to look for or browse Clark Angel Investor Agreement, either by a keyword or by the state/county the form is created for. After locating required form, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's simple to start! Simply find the Clark Angel Investor Agreement template and take a look at the form's preview and description (if available). If you're comfortable with the template’s legalese, go ahead and click Buy now. Create an account and choose a subscription option. The template will be immediately ready for download once the payment is processed. Now you can complete the form.

Taking care of your legal affairs doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our rich collection of legal forms makes these tasks less costly and more reasonably priced. Create your first business, organize your advance care planning, create a real estate agreement, or complete the Clark Angel Investor Agreement - all from the comfort of your sofa.

Sign up for US Legal Forms now!