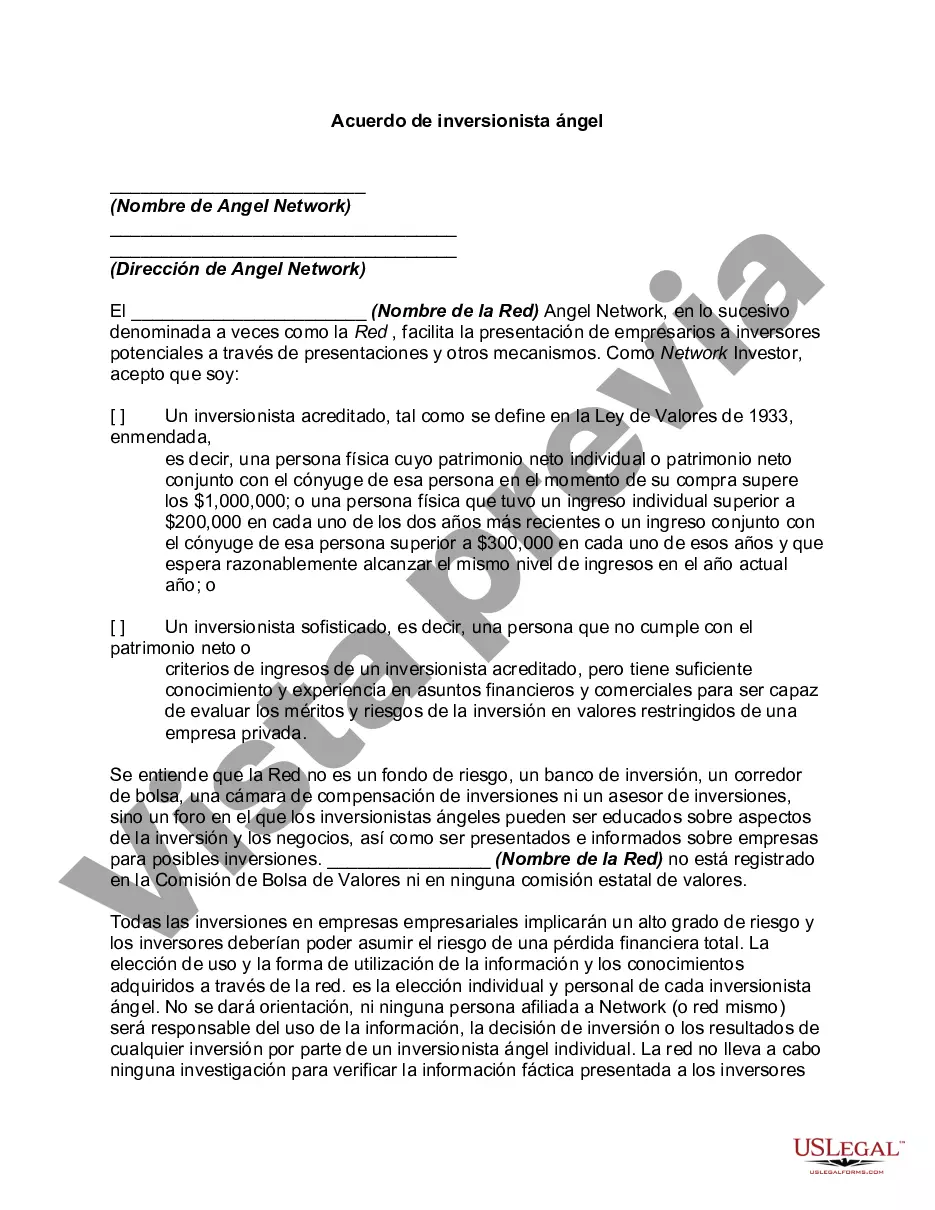

Dallas Texas Angel Investor Agreement is a legally binding contract between an angel investor and an entrepreneur or startup company based in Dallas, Texas. This agreement outlines the terms and conditions under which the angel investor will provide funding or investment to the entrepreneur's business venture in return for a share of future profits or ownership stake in the company. The Dallas Texas Angel Investor Agreement serves as a crucial document that facilitates the process of fundraising and plays a significant role in protecting the rights and interests of both parties involved. It sets forth provisions related to the investment amount, equity percentage, voting rights, board representation, exit strategies, and potential profit-sharing arrangements. The specific terms and clauses included in a Dallas Texas Angel Investor Agreement may vary depending on the nature of the investment, the industry, and the preferences of both the investor and the entrepreneur. Some common types of Dallas Texas Angel Investor Agreements include: 1. Equity-based Agreement: This type of agreement involves the angel investor acquiring an ownership stake in the company in exchange for their investment. The ownership may be in the form of common shares, preferred shares, or convertible notes. 2. Convertible Note Agreement: In this agreement, the angel investor provides a loan to the entrepreneur, which can be converted into equity at a later stage, typically during a subsequent funding round or upon a specific event, such as the company's acquisition or initial public offering (IPO). 3. Royalty-based Agreement: This agreement structure entitles the angel investor to receive a certain percentage of the company's future revenue or profits based on agreed-upon terms. It doesn't involve diluting the entrepreneur's ownership stake but rather allows the investor to benefit from the company's success. 4. SAFE Agreement: Simplified Agreement for Future Equity (SAFE) is a popular agreement type in the startup ecosystem. SAFE agreements enable angel investors to invest in companies without determining the valuation upfront. Instead, they offer a promise of equity in the future, often triggered by a subsequent funding round or milestone. When entering into a Dallas Texas Angel Investor Agreement, it is vital for both parties to seek legal advice to ensure the agreement aligns with their interests and abides by applicable state laws and regulations. This type of agreement plays a pivotal role in enabling startups and entrepreneurs in Dallas, Texas, to secure crucial funding from angel investors while establishing a mutually beneficial relationship for future growth and success.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Dallas Texas Acuerdo de inversionista ángel - Angel Investor Agreement

Description

How to fill out Dallas Texas Acuerdo De Inversionista ángel?

Drafting paperwork for the business or individual needs is always a big responsibility. When creating an agreement, a public service request, or a power of attorney, it's crucial to consider all federal and state regulations of the particular region. However, small counties and even cities also have legislative procedures that you need to consider. All these details make it stressful and time-consuming to create Dallas Angel Investor Agreement without expert assistance.

It's possible to avoid spending money on attorneys drafting your documentation and create a legally valid Dallas Angel Investor Agreement by yourself, using the US Legal Forms web library. It is the largest online collection of state-specific legal templates that are professionally verified, so you can be sure of their validity when selecting a sample for your county. Earlier subscribed users only need to log in to their accounts to save the needed document.

If you still don't have a subscription, follow the step-by-step instruction below to obtain the Dallas Angel Investor Agreement:

- Look through the page you've opened and verify if it has the sample you require.

- To achieve this, use the form description and preview if these options are available.

- To locate the one that meets your requirements, use the search tab in the page header.

- Recheck that the sample complies with juridical standards and click Buy Now.

- Pick the subscription plan, then sign in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever obtained never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and quickly get verified legal forms for any situation with just a couple of clicks!