Maricopa Arizona Angel Investor Agreement is a legally binding contract between an angel investor and a startup company based in Maricopa, Arizona. This agreement outlines the investment terms and conditions, rights, and obligations of both parties involved. It provides a comprehensive framework for the angel investor to provide funding to the startup in exchange for equity or convertible debt. The Maricopa Arizona Angel Investor Agreement typically covers various essential aspects, including investment amount, valuation, ownership percentage, preferred or common shares, voting rights, board representation, anti-dilution provisions, liquidation preferences, and exit strategies. This agreement acts as a safeguard for the investor's financial interests while allowing the startup to access the necessary capital to grow and expand. There may be different types of Maricopa Arizona Angel Investor Agreements, varying based on specific terms and objectives. Some common types of agreements include: 1. Equity Investment Agreement: This type of agreement involves the angel investor acquiring equity shares in the startup company. The investor becomes a partial owner and shares in the company's success or failure. 2. Convertible Note Agreement: In this agreement, the angel investor provides a loan to the startup, which can convert into equity at a later date, typically during a subsequent funding round or when specific milestones are met. It offers flexibility for both parties while deferring the determination of the valuation until a later stage. 3. SAFE (Simple Agreement for Future Equity): This relatively new form of agreement is becoming increasingly popular in angel investing. Unlike traditional equity agreements, Safes represent the investor's right to future equity in the startup, removing the need to determine valuation during the initial investment. The investor receives equity when specific triggering events, such as a subsequent funding round, occur. Overall, the Maricopa Arizona Angel Investor Agreement is a vital tool for facilitating investment in startups within the Maricopa region. It enables entrepreneurs to secure vital funding for their ventures, while providing investors with returns on their investment and potential long-term rewards.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Maricopa Arizona Acuerdo de inversionista ángel - Angel Investor Agreement

Description

How to fill out Maricopa Arizona Acuerdo De Inversionista ángel?

How much time does it typically take you to create a legal document? Since every state has its laws and regulations for every life situation, finding a Maricopa Angel Investor Agreement suiting all regional requirements can be exhausting, and ordering it from a professional lawyer is often pricey. Many online services offer the most common state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive online catalog of templates, grouped by states and areas of use. In addition to the Maricopa Angel Investor Agreement, here you can get any specific form to run your business or personal affairs, complying with your county requirements. Specialists check all samples for their validity, so you can be certain to prepare your documentation properly.

Using the service is pretty straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the needed form, and download it. You can retain the document in your profile anytime in the future. Otherwise, if you are new to the platform, there will be some extra actions to complete before you obtain your Maricopa Angel Investor Agreement:

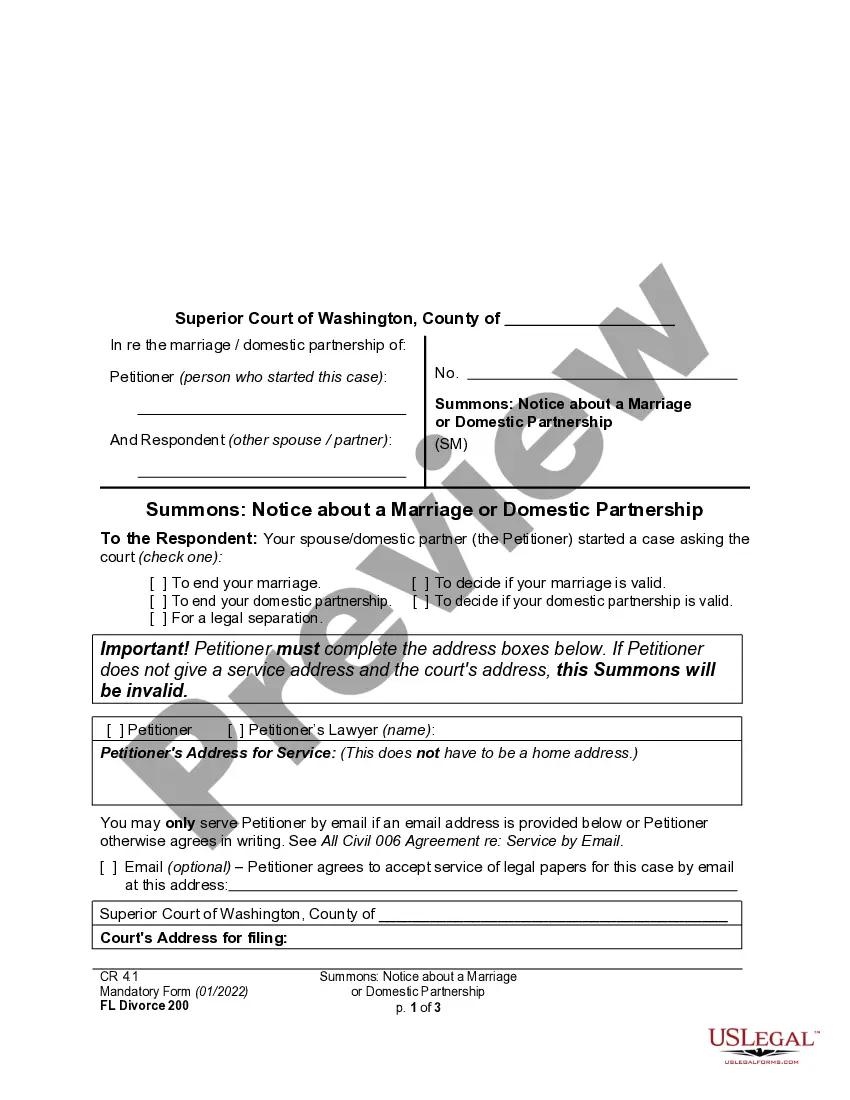

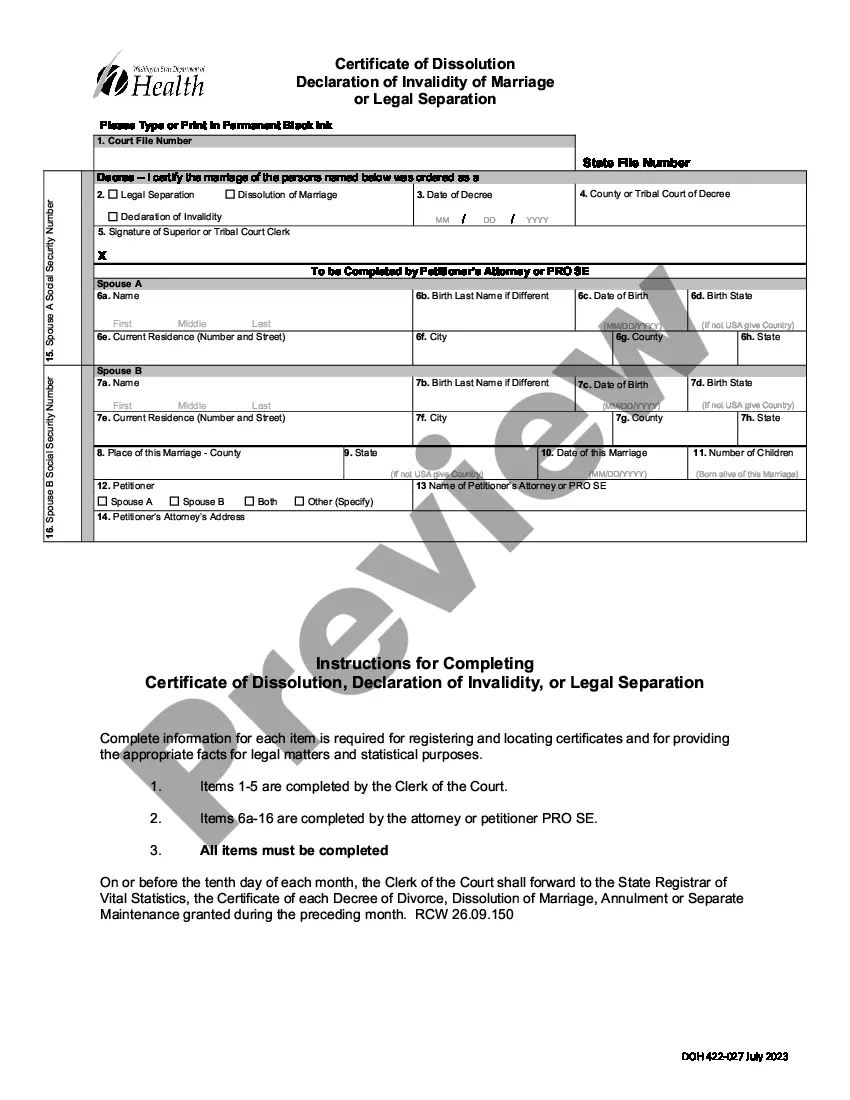

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another form using the related option in the header.

- Click Buy Now once you’re certain in the selected document.

- Select the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Maricopa Angel Investor Agreement.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased template, you can locate all the samples you’ve ever saved in your profile by opening the My Forms tab. Give it a try!