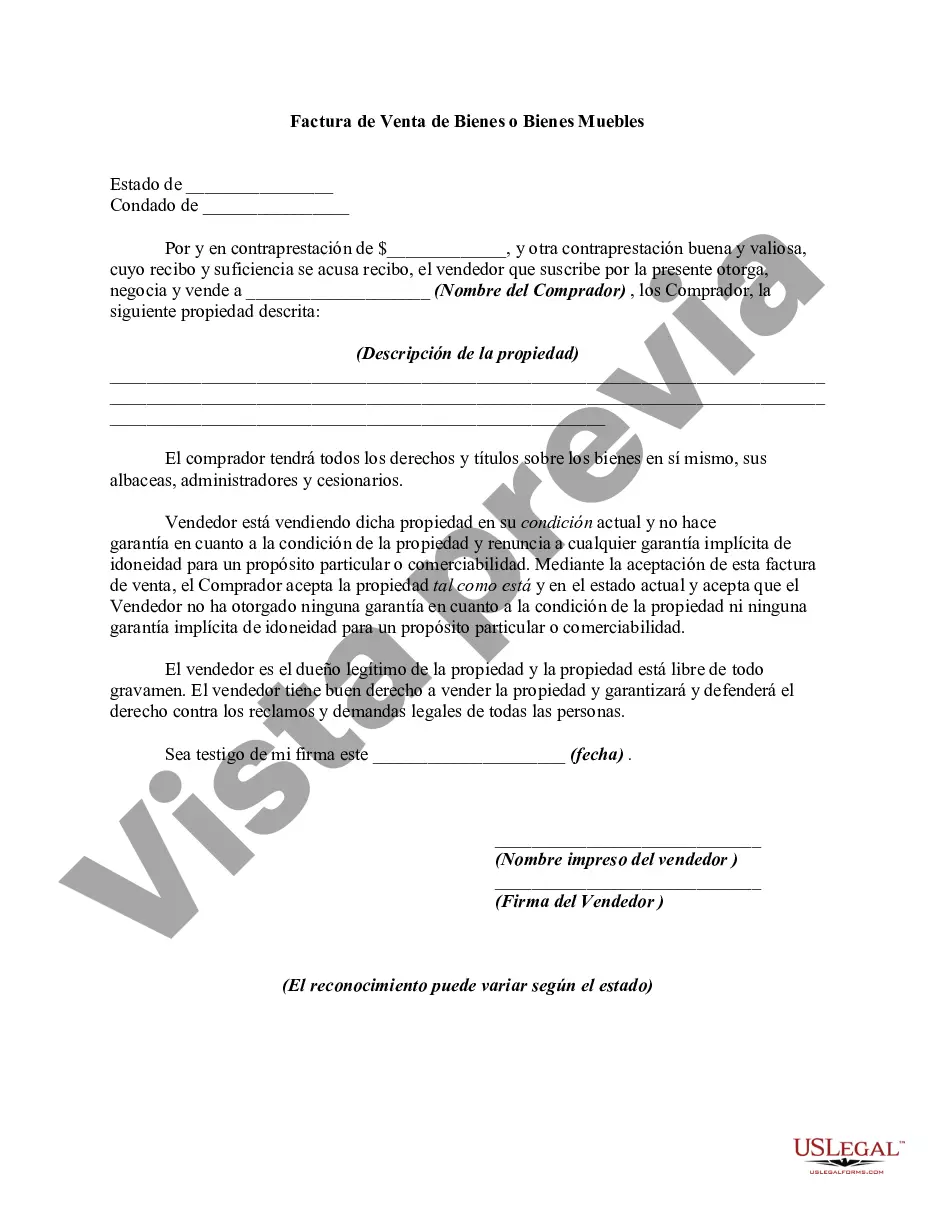

A bill of sale is a document that transfers ownership of an asset from a seller to the buyer. It can also serve as a basic agreement for sale of goods, and a sales receipt.

Miami-Dade County, located in the southeastern part of Florida, has specific regulations and requirements for the Bill of Sale of Goods or Personal Property. The Miami-Dade Florida Bill of Sale is a legal document used to transfer ownership rights of goods or personal property from one party to another within the county. This document serves as proof of the transaction and protects the rights of both the buyer and the seller. The Miami-Dade Florida Bill of Sale of Goods or Personal Property includes essential information such as the date of the sale, the names and addresses of the buyer and the seller, a detailed description of the goods or personal property being sold, the purchase price or consideration, any included warranties or guarantees, and signatures of both parties. There are different types of Miami-Dade Florida Bills of Sale, depending on the nature of the transaction and the type of property being transferred. Some common variations include: 1. Automobile Bill of Sale: This type of bill of sale is used when transferring ownership of a motor vehicle, whether it is a car, truck, motorcycle, or another type of vehicle. It includes specific details such as the make, model, year, identification number, and mileage (if applicable) of the vehicle being sold. 2. Boat Bill of Sale: When buying or selling a watercraft, including boats, yachts, or jet skis, a boat bill of sale is required. This document includes information such as the hull identification number (IN), registration details, make, model, and any included equipment or accessories. 3. Furniture or Personal Property Bill of Sale: This type of bill of sale is applicable when selling or buying furniture, household appliances, electronics, or any other movable personal property. It includes a detailed description of the items, their condition, and the price agreed upon. It is crucial to ensure accuracy and completeness in the Miami-Dade Florida Bill of Sale of Goods or Personal Property to avoid any future disputes. Both the buyer and the seller should retain a copy of the signed document for their records. Additionally, it is advisable to consult with a legal professional or utilize templates provided by the Miami-Dade County government to ensure compliance with all applicable laws and regulations.

Miami-Dade County, located in the southeastern part of Florida, has specific regulations and requirements for the Bill of Sale of Goods or Personal Property. The Miami-Dade Florida Bill of Sale is a legal document used to transfer ownership rights of goods or personal property from one party to another within the county. This document serves as proof of the transaction and protects the rights of both the buyer and the seller. The Miami-Dade Florida Bill of Sale of Goods or Personal Property includes essential information such as the date of the sale, the names and addresses of the buyer and the seller, a detailed description of the goods or personal property being sold, the purchase price or consideration, any included warranties or guarantees, and signatures of both parties. There are different types of Miami-Dade Florida Bills of Sale, depending on the nature of the transaction and the type of property being transferred. Some common variations include: 1. Automobile Bill of Sale: This type of bill of sale is used when transferring ownership of a motor vehicle, whether it is a car, truck, motorcycle, or another type of vehicle. It includes specific details such as the make, model, year, identification number, and mileage (if applicable) of the vehicle being sold. 2. Boat Bill of Sale: When buying or selling a watercraft, including boats, yachts, or jet skis, a boat bill of sale is required. This document includes information such as the hull identification number (IN), registration details, make, model, and any included equipment or accessories. 3. Furniture or Personal Property Bill of Sale: This type of bill of sale is applicable when selling or buying furniture, household appliances, electronics, or any other movable personal property. It includes a detailed description of the items, their condition, and the price agreed upon. It is crucial to ensure accuracy and completeness in the Miami-Dade Florida Bill of Sale of Goods or Personal Property to avoid any future disputes. Both the buyer and the seller should retain a copy of the signed document for their records. Additionally, it is advisable to consult with a legal professional or utilize templates provided by the Miami-Dade County government to ensure compliance with all applicable laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.