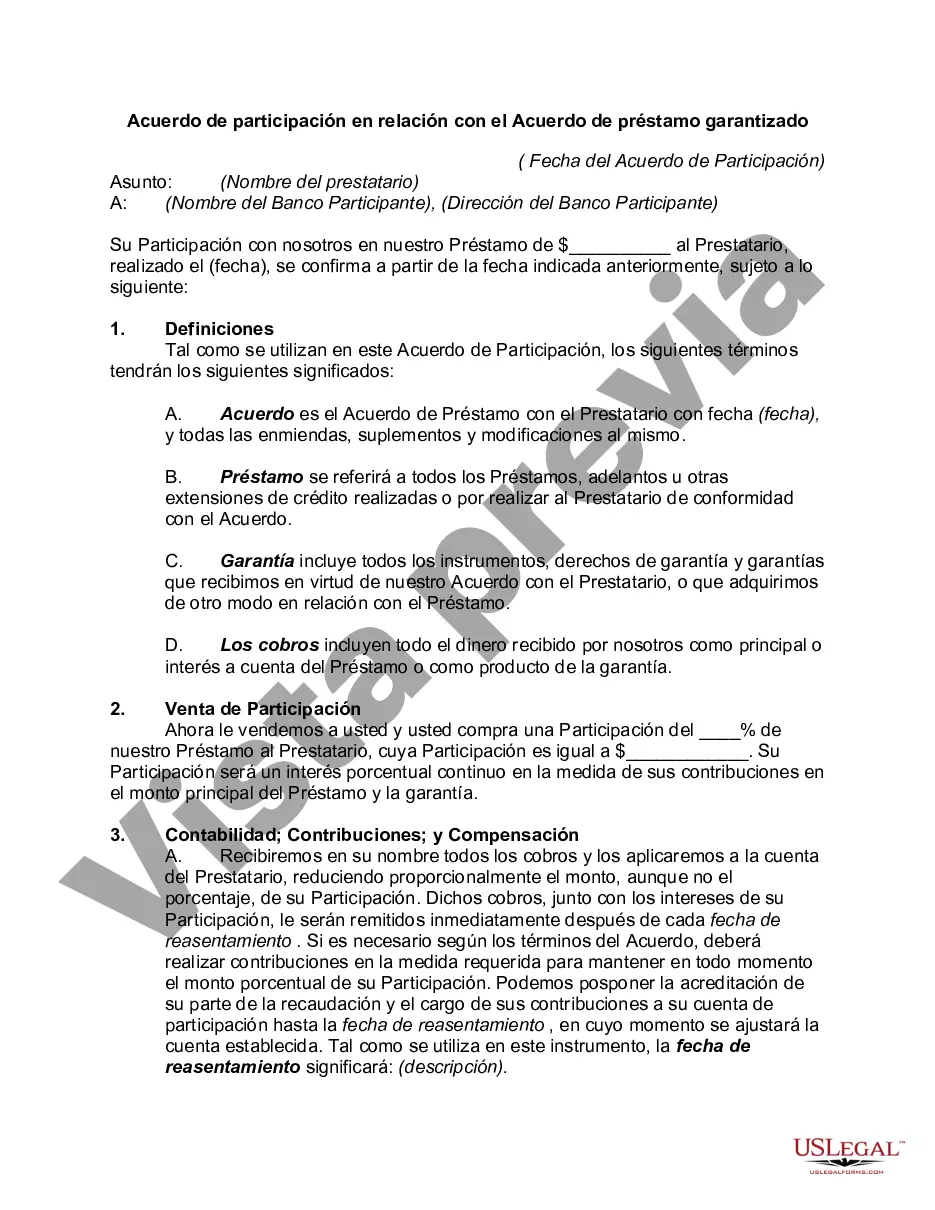

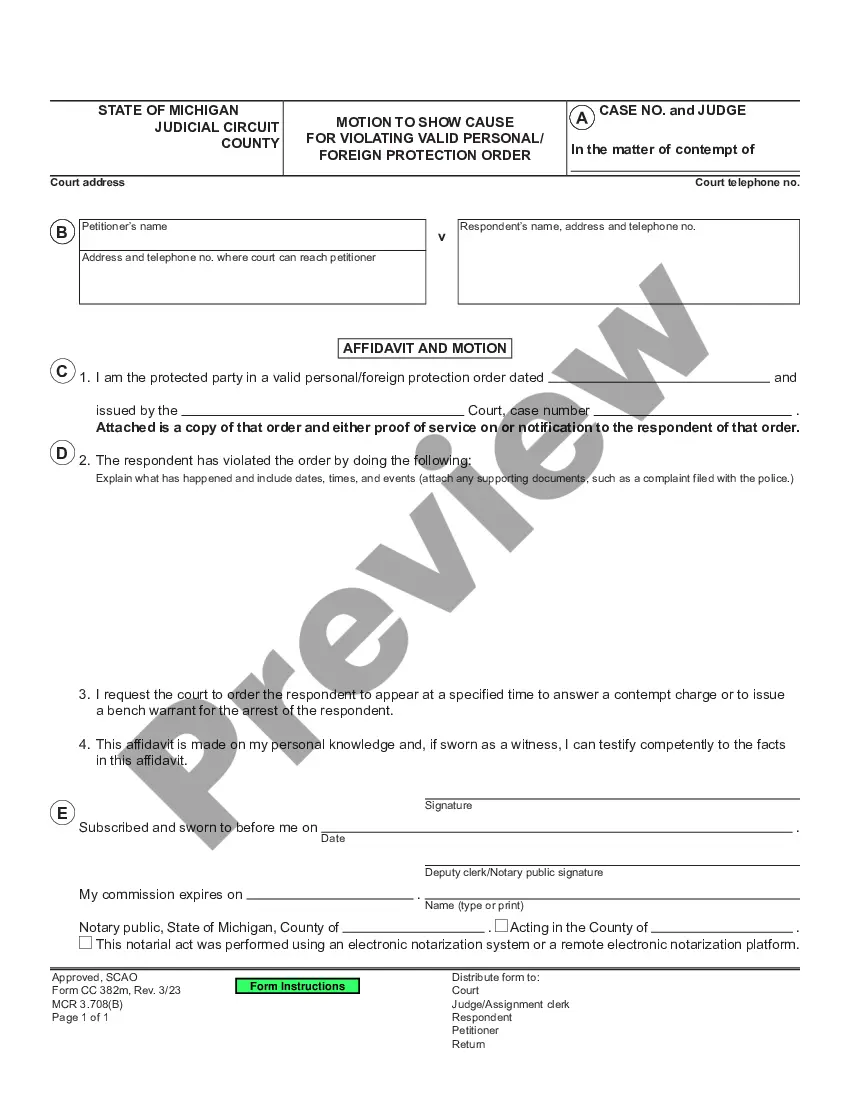

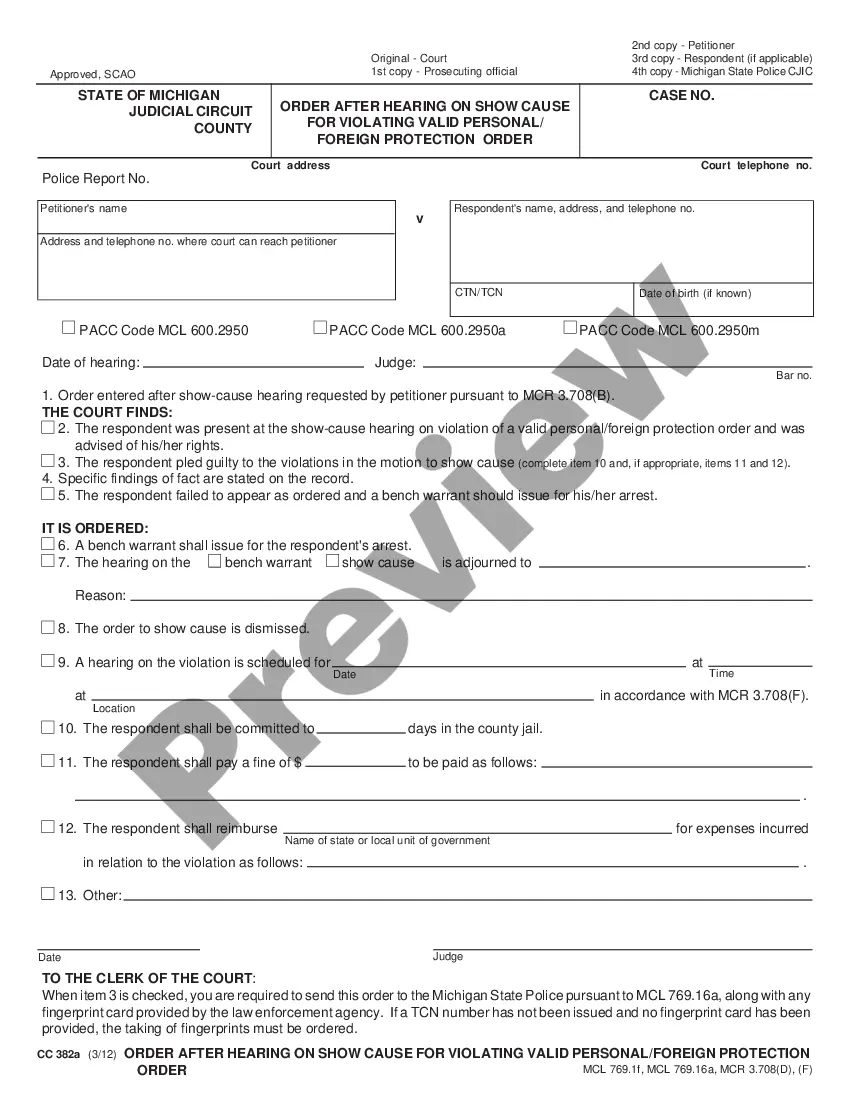

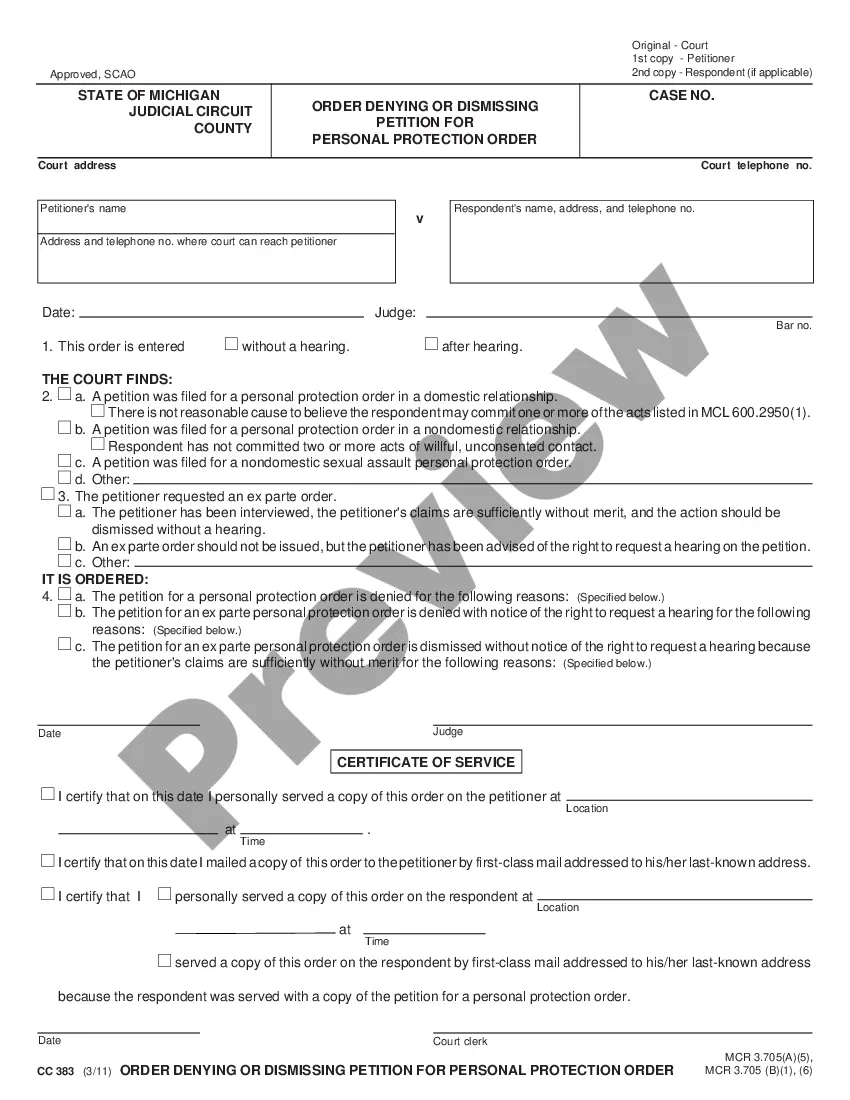

The Dallas Texas Participation Agreement in Connection with a Secured Loan Agreement is a legal document that outlines the terms and conditions agreed upon by the lender and borrower in a secured loan transaction. This agreement is designed to protect the rights and interests of both parties involved. Keywords: Dallas Texas, Participation Agreement, Secured Loan Agreement, legal document, terms and conditions, lender, borrower, secured loan transaction, rights, interests. There can be different types of Dallas Texas Participation Agreement in Connection with a Secured Loan Agreement, including the following: 1. Single Lender Participation Agreement: This type of agreement is used when there is only one lender involved in the secured loan transaction. It specifies the terms of participation and the lender's rights and obligations. 2. Multiple Lender Participation Agreement: In cases where multiple lenders are involved in the secured loan transaction, this agreement comes into play. It outlines the terms of participation for each lender and their respective rights and obligations. 3. Junior Participation Agreement: A junior participation agreement is used when a subordinated lender is participating in the secured loan. This agreement establishes the rights and obligations of the junior lender and defines the order of priority for repayment in case of default. 4. Senior Participation Agreement: Contrary to the junior participation agreement, the senior participation agreement establishes the terms of participation for the primary or senior lender in a secured loan transaction. It outlines their rights, obligations, and priority for repayment. 5. Intercreditor Agreement: An intercreditor agreement is not specifically a participation agreement but is often used in connection with secured loan agreements. It governs the relationship between multiple lenders, defining their respective rights, priorities, and actions in case of default or insolvency. Overall, the Dallas Texas Participation Agreement in Connection with a Secured Loan Agreement serves as a crucial legal instrument that ensures the smooth execution and protection of both parties' rights in a secured loan transaction. The specific type of agreement will depend on the number and hierarchy of lenders involved, each having their unique set of terms and conditions.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Dallas Texas Acuerdo de participación en relación con el Acuerdo de préstamo garantizado - Participation Agreement in Connection with Secured Loan Agreement

Description

How to fill out Dallas Texas Acuerdo De Participación En Relación Con El Acuerdo De Préstamo Garantizado?

Laws and regulations in every area vary around the country. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal documents. To avoid pricey legal assistance when preparing the Dallas Participation Agreement in Connection with Secured Loan Agreement, you need a verified template valid for your region. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal forms. It's a perfect solution for specialists and individuals looking for do-it-yourself templates for various life and business situations. All the documents can be used multiple times: once you purchase a sample, it remains accessible in your profile for further use. Therefore, if you have an account with a valid subscription, you can simply log in and re-download the Dallas Participation Agreement in Connection with Secured Loan Agreement from the My Forms tab.

For new users, it's necessary to make some more steps to get the Dallas Participation Agreement in Connection with Secured Loan Agreement:

- Analyze the page content to make sure you found the appropriate sample.

- Utilize the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to get the document when you find the appropriate one.

- Opt for one of the subscription plans and log in or create an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Complete and sign the document in writing after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!