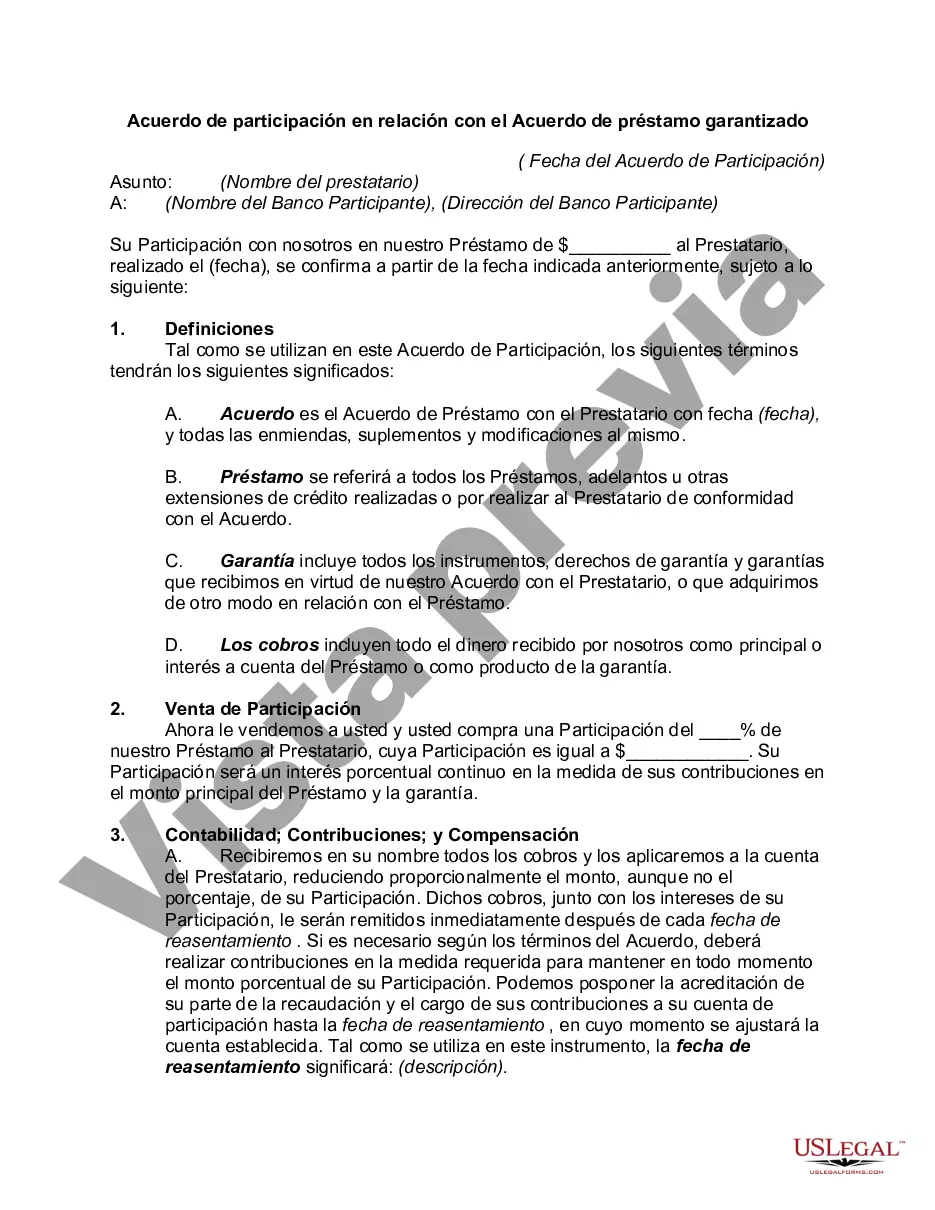

The Fairfax Virginia Participation Agreement in Connection with a Secured Loan Agreement is a legal document that outlines the terms and conditions of a partnership between a lender and a participant for a secured loan in the state of Virginia. This agreement is crucial for protecting the rights and responsibilities of all parties involved in the loan transaction. In such an agreement, there can be various types of participation agreements based on the specific situation and preferences of the lender and participant. Some common types include: 1. Direct Participation Agreement: This type of agreement involves a single participant who directly enters into a partnership with the lender. The participant agrees to contribute a certain amount of funds towards the loan in exchange for a share of the profits or interest accrued. 2. Indirect Participation Agreement: In this agreement, the lender may choose to have multiple participants who indirectly contribute to the loan. Each participant might invest in a separate entity that, in turn, provides the funds to the lender. The profits and interest are distributed to the participants based on their respective investments. 3. Limited Participation Agreement: A limited participation agreement allows a participant to have minimal involvement in the loan transaction. The participant's role is restricted to providing a predetermined amount of funds and receiving a fixed return on investment. 4. Full Participation Agreement: Unlike a limited participation agreement, a full participation agreement grants the participant more involvement in the loan process. The participant may have the authority to make decisions regarding the loan terms, disbursement of funds, and collection of profits. 5. Revolving Participation Agreement: In this type of agreement, the participant agrees to make successive contributions to the loan or provide a line of credit. As the borrower repays the loan amount, the participant's funds become available for reinvestment, creating a revolving credit arrangement. Regardless of the type of Fairfax Virginia Participation Agreement in Connection with a Secured Loan Agreement, it typically specifies crucial information such as the loan amount, interest rate, repayment terms, collateral, loan maturity dates, participant's contribution, profit-sharing ratios, dispute resolution procedures, and default consequences. It is essential for both the lender and participant to carefully review and understand the terms stated in the participation agreement before entering into the secured loan arrangement. Seeking legal counsel is strongly advised to ensure compliance with relevant laws and protect both parties' interests.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Fairfax Virginia Acuerdo de participación en relación con el Acuerdo de préstamo garantizado - Participation Agreement in Connection with Secured Loan Agreement

Description

How to fill out Fairfax Virginia Acuerdo De Participación En Relación Con El Acuerdo De Préstamo Garantizado?

How much time does it usually take you to draw up a legal document? Given that every state has its laws and regulations for every life situation, locating a Fairfax Participation Agreement in Connection with Secured Loan Agreement suiting all regional requirements can be stressful, and ordering it from a professional attorney is often pricey. Many web services offer the most popular state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive web collection of templates, gathered by states and areas of use. Aside from the Fairfax Participation Agreement in Connection with Secured Loan Agreement, here you can get any specific document to run your business or personal affairs, complying with your regional requirements. Experts check all samples for their actuality, so you can be certain to prepare your paperwork correctly.

Using the service is remarkably simple. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the required form, and download it. You can get the file in your profile at any moment later on. Otherwise, if you are new to the website, there will be a few more steps to complete before you get your Fairfax Participation Agreement in Connection with Secured Loan Agreement:

- Examine the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Search for another document utilizing the related option in the header.

- Click Buy Now when you’re certain in the selected file.

- Decide on the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Fairfax Participation Agreement in Connection with Secured Loan Agreement.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased template, you can find all the samples you’ve ever saved in your profile by opening the My Forms tab. Give it a try!