Participations in the loan are sold by the lead bank to other banks. A separate contract called a loan participation agreement is structured and agreed among the banks. Loan participations can either be made with equal risk sharing for all loan participants, or on a senior/subordinated basis, where the senior lender is paid first and the subordinate loan participation paid only if there is sufficient funds left over to make the payments.

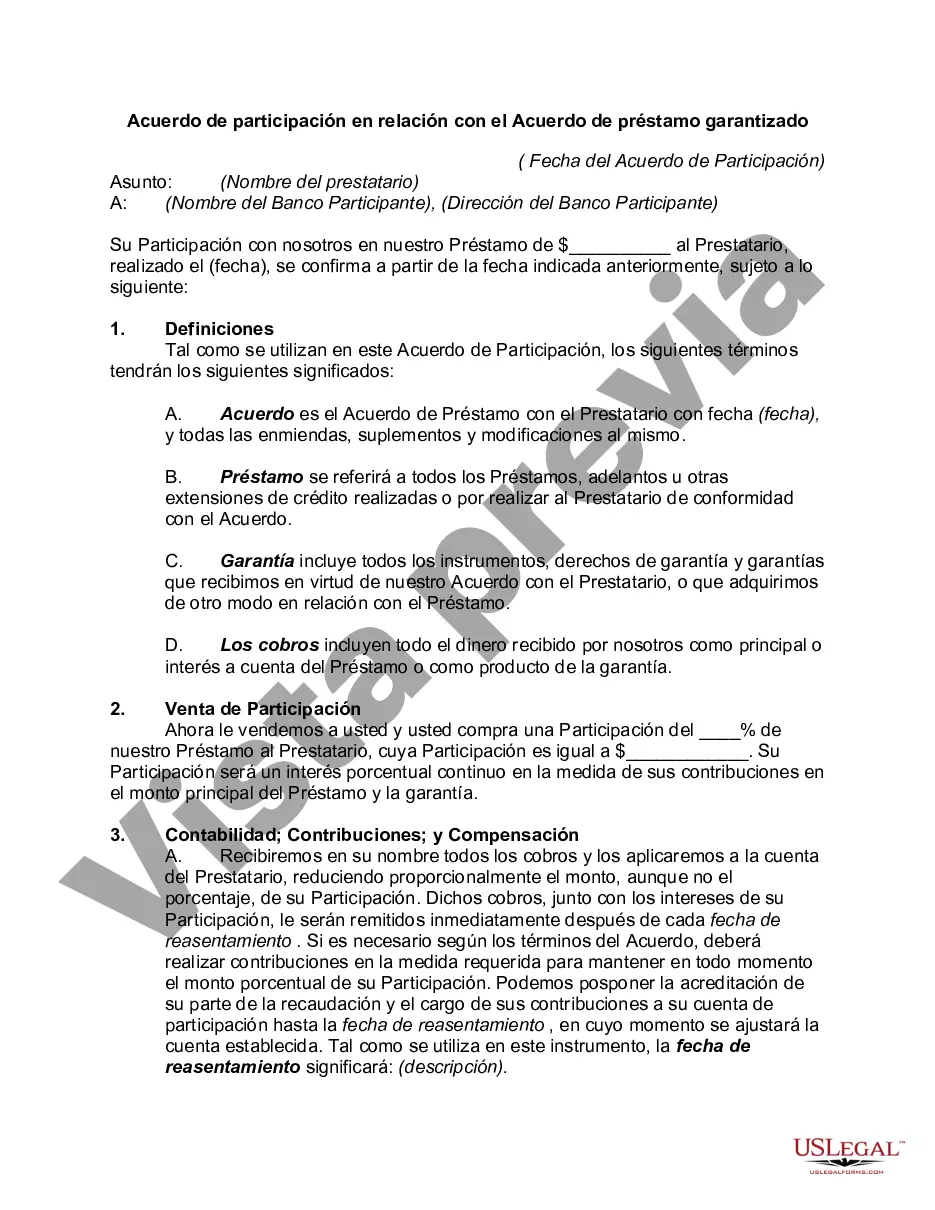

The Harris Texas Participation Agreement in Connection with Secured Loan Agreement is a legal document that outlines the terms and conditions of a loan arrangement between a lender and a borrower. This agreement specifies the participation of Harris County, Texas, in the loan transaction, particularly in securing the loan. A participation agreement is a common instrument used when multiple parties wish to collaborate on financing a loan. In the case of Harris Texas, the county acts as a participant alongside the lender, typically a financial institution, which funds the loan. This arrangement offers various advantages and mitigates risks for both parties involved. One type of Harris Texas Participation Agreement in Connection with Secured Loan Agreement is the Partial Participation Agreement. Under this agreement, Harris County agrees to fund a portion of the loan while the primary lender finances the remainder. This strategy allows the lender to reduce its exposure while still providing the borrower with the necessary amount of capital. Another type is the Joint Participation Agreement. In this scenario, Harris County and the lender jointly participate in funding the loan, typically on an equal or predetermined ratio. Both parties share the risk and earn returns proportionate to their contribution. This agreement promotes cooperation and diversifies the risks associated with the loan. The features and provisions covered in the Harris Texas Participation Agreement in Connection with Secured Loan Agreement may include: 1. Loan Amount: The agreement specifies the total loan amount required and the specific portion to be contributed by Harris County. 2. Security Interest: It outlines the collateral pledged by the borrower to secure the loan, such as real estate, personal property, or other valuable assets. 3. Payment Terms: The agreement indicates the terms for repayment, including the interest rate, payment schedule, and any additional fees or penalties. 4. Default and Remedies: It outlines the consequences if the borrower defaults on the loan and highlights the remedies available to the lender and Harris County. 5. Rights and Obligations: The agreement addresses the respective rights, responsibilities, and obligations of Harris County and the lender throughout the loan period. 6. Transfer of Interests: The agreement may stipulate whether Harris County or the lender can transfer their participation interests in the loan to other parties. 7. Dispute Resolution: It defines the procedures for resolving any disputes or disagreements that may arise during the course of the loan. The Harris Texas Participation Agreement in Connection with Secured Loan Agreement ensures that Harris County has a vested interest in the loan transaction and shares in the risks and rewards along with the lender. This collaboration facilitates access to capital for borrowers and allows Harris County to support economic growth and development within its jurisdiction.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.