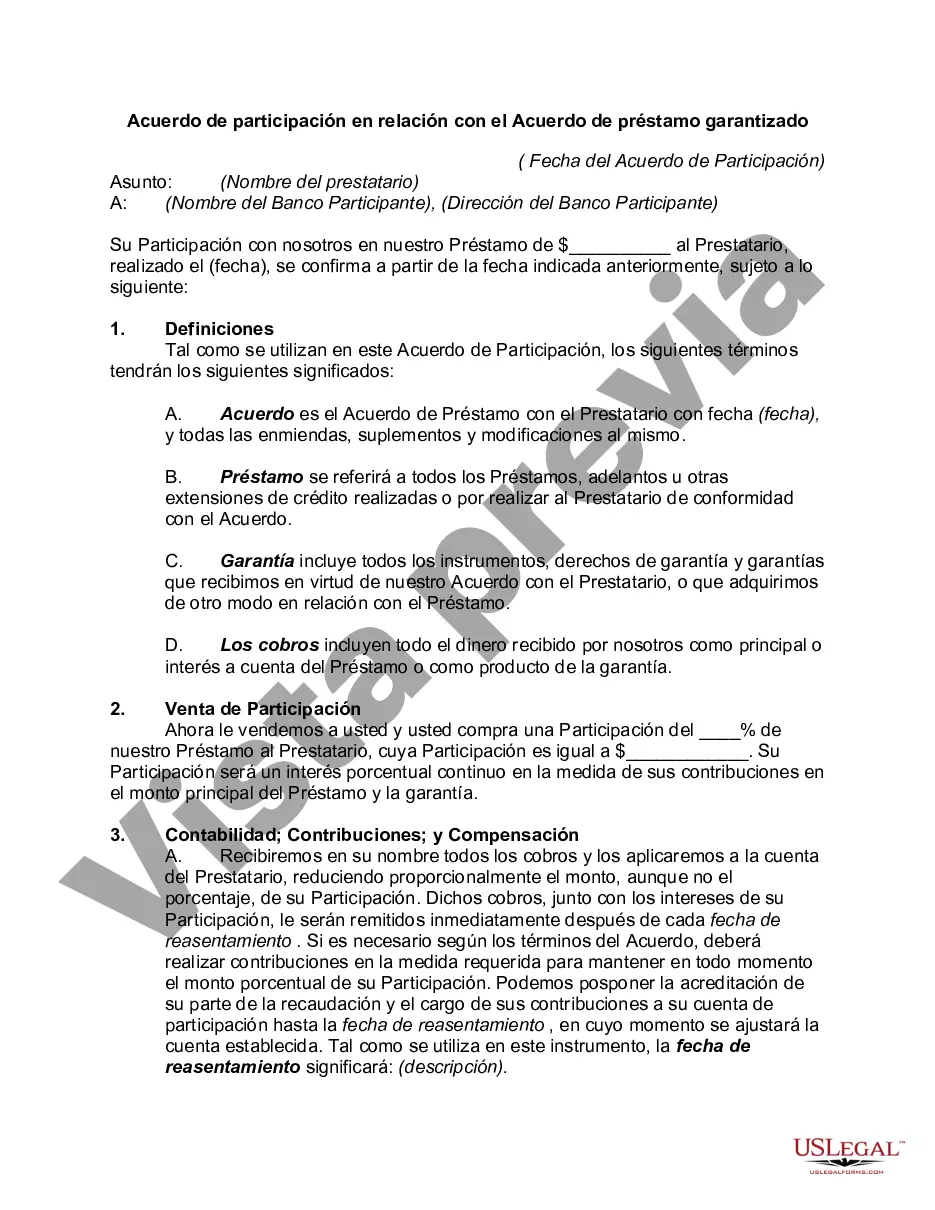

Maricopa, Arizona Participation Agreement in Connection with Secured Loan Agreement is a legal document that outlines the terms and conditions of a secured loan agreement in the context of Maricopa, Arizona. This agreement is crucial when multiple parties are involved in a loan, such as a lender, borrower, and a participant who is interested in sharing the risks and benefits of the loan. The Participation Agreement clarifies the role and responsibilities of each party and allocates the rights and obligations associated with the loan. It sets out the terms for the participant's involvement, including the extent of their financial contribution, interest rates, repayment terms, and collateral arrangements. In Maricopa, Arizona, there are various types of Participation Agreements that can be associated with a Secured Loan Agreement, depending on the specific circumstances and parties involved. Some common types include: 1. Individual Participation Agreement: This refers to a situation where an individual or an entity participates in a secured loan agreement alongside the lender and borrower. The terms and conditions are tailored to the individual participant's needs and requirements. 2. Syndicated Participation Agreement: In this scenario, multiple participants come together to share the benefits and risks of the loan. The agreement outlines the syndication process, the rights and obligations of each participant, and the mechanisms for decision-making. 3. Subordinated Participation Agreement: This type of agreement is entered into when a participant agrees to have their position subordinate to that of the primary lender. In case of default, the participant agrees to be repaid after the primary lender has been satisfied. 4. Mezzanine Participation Agreement: This agreement is typically used in situations where a participant provides funding that lies between the debt and equity levels. The participant usually takes on a higher level of risk but also has the potential for higher returns. It is important to note that the exact terms and conditions of a Maricopa, Arizona Participation Agreement in Connection with Secured Loan Agreement may vary depending on the specific needs and negotiations of the parties involved. Therefore, seeking legal advice and conducting due diligence is crucial when entering into such agreements to ensure compliance with local laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Maricopa Arizona Acuerdo de participación en relación con el Acuerdo de préstamo garantizado - Participation Agreement in Connection with Secured Loan Agreement

Description

How to fill out Maricopa Arizona Acuerdo De Participación En Relación Con El Acuerdo De Préstamo Garantizado?

If you need to find a reliable legal document provider to get the Maricopa Participation Agreement in Connection with Secured Loan Agreement, consider US Legal Forms. No matter if you need to start your LLC business or take care of your belongings distribution, we got you covered. You don't need to be well-versed in in law to locate and download the appropriate form.

- You can browse from over 85,000 forms categorized by state/county and case.

- The intuitive interface, number of learning resources, and dedicated support team make it easy to find and execute various papers.

- US Legal Forms is a reliable service providing legal forms to millions of users since 1997.

You can simply select to search or browse Maricopa Participation Agreement in Connection with Secured Loan Agreement, either by a keyword or by the state/county the form is intended for. After locating required form, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's simple to get started! Simply find the Maricopa Participation Agreement in Connection with Secured Loan Agreement template and check the form's preview and description (if available). If you're comfortable with the template’s language, go ahead and hit Buy now. Register an account and choose a subscription plan. The template will be immediately available for download once the payment is completed. Now you can execute the form.

Handling your law-related affairs doesn’t have to be pricey or time-consuming. US Legal Forms is here to prove it. Our rich variety of legal forms makes this experience less costly and more reasonably priced. Create your first business, organize your advance care planning, create a real estate contract, or complete the Maricopa Participation Agreement in Connection with Secured Loan Agreement - all from the comfort of your sofa.

Join US Legal Forms now!