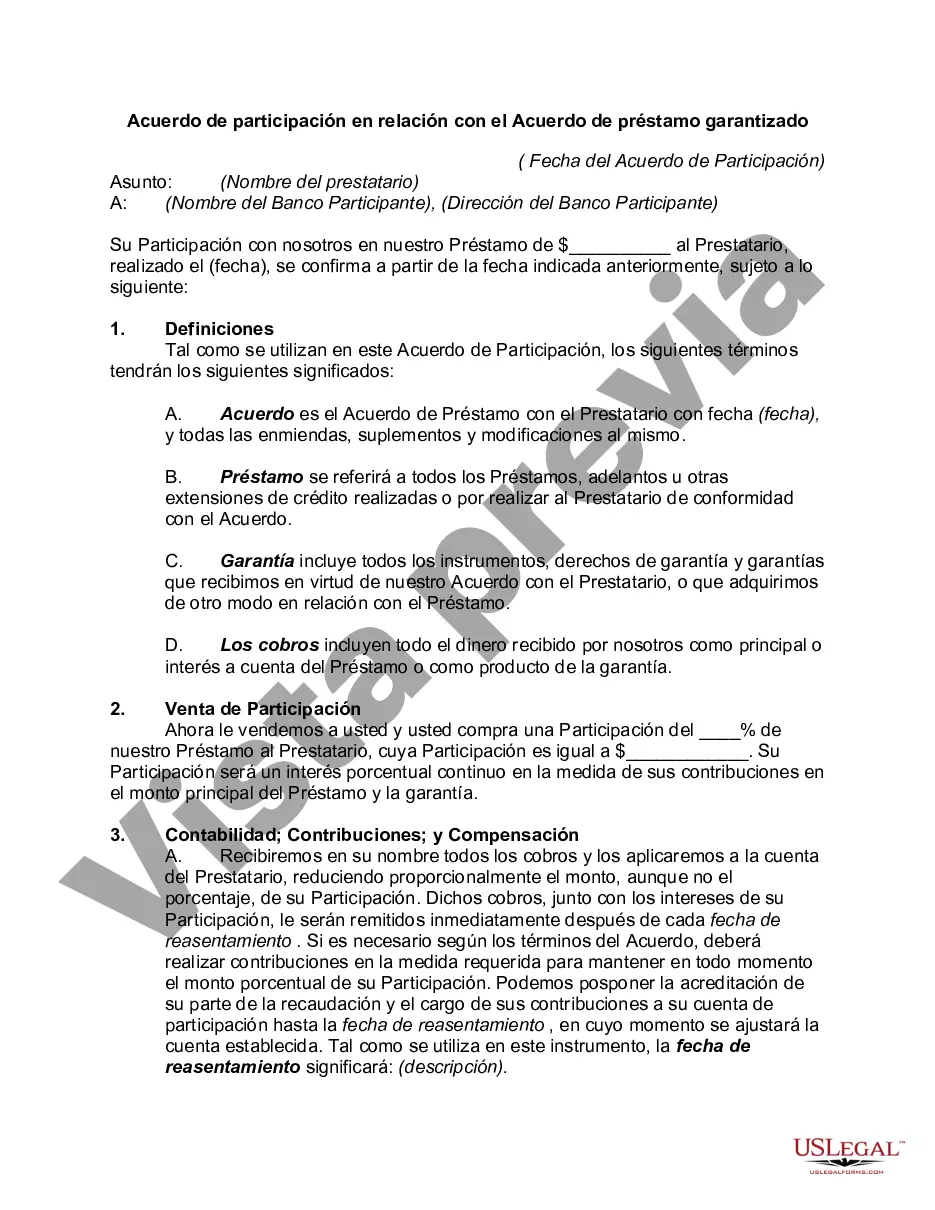

Mecklenburg North Carolina Participation Agreement in Connection with Secured Loan Agreement is a legal document that outlines the terms and conditions regarding the involvement of multiple parties in a secured loan transaction within Mecklenburg County, North Carolina. This agreement serves as a binding contract between the borrower, lender, and any other participants involved, ensuring that each party's rights and obligations are clearly defined. The Mecklenburg North Carolina Participation Agreement in Connection with Secured Loan Agreement typically includes the following key components: 1. Identification of Parties: The agreement begins by stating the names and contact information of all parties involved, including the borrower, lender, and any additional participants. 2. Loan Details: This section provides a detailed description of the secured loan, including the loan amount, interest rate, repayment terms, and any specific conditions or covenants to be followed. 3. Rights and Obligations: The agreement clearly outlines the rights and obligations of each party participating in the secured loan, including the borrower's responsibility for timely repayments, the lender's duties to disburse funds, and any specific requirements for collateral. 4. Collateral and Security: Details regarding the collateral offered to secure the loan are outlined in this section. It includes a description of the collateral, its valuation, and the rights and responsibilities of all parties involved in relation to the collateral. 5. Loan Participation: If there are multiple participants involved in the secured loan, this section will specify the percentage of loan participation for each party. It sets out the manner in which loan proceeds and repayments will be distributed among the participants. 6. Default and Remedies: The agreement includes provisions related to loan default, such as events triggering default, notice requirements, and the remedies available to the lender in case of default. It may also outline the rights of other participants in case of borrower default. 7. Governing Law and Jurisdiction: This section establishes that the Mecklenburg North Carolina Participation Agreement in Connection with Secured Loan Agreement is governed by North Carolina state laws. It also determines the jurisdiction and venue for any disputes arising from the agreement. Types of Mecklenburg North Carolina Participation Agreement in Connection with Secured Loan Agreement: 1. Primary Lender Agreement: This type of agreement involves a primary lender who provides the majority of the loan funds and assumes the primary responsibility for managing the loan. 2. Secondary Lender Agreement: In cases where multiple lenders are involved, a secondary lender agreement outlines the terms and conditions specific to the secondary lender's participation in the secured loan. 3. Co-borrower Agreement: If there are multiple borrowers on the secured loan, a co-borrower agreement details the rights and obligations of each co-borrower, as well as their joint liability for the loan. Overall, the Mecklenburg North Carolina Participation Agreement in Connection with Secured Loan Agreement ensures transparency and clarity in a secured loan transaction, safeguarding the interests of all participating parties and promoting a smooth loan process in compliance with applicable laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Mecklenburg North Carolina Acuerdo de participación en relación con el Acuerdo de préstamo garantizado - Participation Agreement in Connection with Secured Loan Agreement

Description

How to fill out Mecklenburg North Carolina Acuerdo De Participación En Relación Con El Acuerdo De Préstamo Garantizado?

Creating paperwork, like Mecklenburg Participation Agreement in Connection with Secured Loan Agreement, to take care of your legal affairs is a challenging and time-consumming process. A lot of circumstances require an attorney’s participation, which also makes this task expensive. Nevertheless, you can get your legal affairs into your own hands and deal with them yourself. US Legal Forms is here to the rescue. Our website comes with more than 85,000 legal forms crafted for a variety of cases and life circumstances. We make sure each form is compliant with the regulations of each state, so you don’t have to be concerned about potential legal problems associated with compliance.

If you're already familiar with our website and have a subscription with US, you know how straightforward it is to get the Mecklenburg Participation Agreement in Connection with Secured Loan Agreement form. Simply log in to your account, download the form, and customize it to your needs. Have you lost your form? Don’t worry. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new users is just as straightforward! Here’s what you need to do before downloading Mecklenburg Participation Agreement in Connection with Secured Loan Agreement:

- Make sure that your document is compliant with your state/county since the regulations for creating legal papers may vary from one state another.

- Learn more about the form by previewing it or going through a quick intro. If the Mecklenburg Participation Agreement in Connection with Secured Loan Agreement isn’t something you were looking for, then use the header to find another one.

- Log in or create an account to start using our website and get the form.

- Everything looks great on your side? Hit the Buy now button and choose the subscription plan.

- Pick the payment gateway and type in your payment details.

- Your template is ready to go. You can try and download it.

It’s an easy task to find and purchase the appropriate template with US Legal Forms. Thousands of organizations and individuals are already benefiting from our extensive library. Subscribe to it now if you want to check what other advantages you can get with US Legal Forms!