Orange California Participation Agreement in Connection with Secured Loan Agreement: The Orange California Participation Agreement in connection with a secured loan agreement is a legal document that outlines the terms and conditions between multiple parties involved in a secured loan transaction in Orange, California. The agreement specifies the rights, responsibilities, and obligations of each party to ensure a smooth and collaborative loan process. In this agreement, there may be different types depending on the specific terms and conditions agreed upon by the involved parties. Some types of Orange California Participation Agreements in connection with a secured loan agreement include: 1. Syndicated Participation Agreement: This type of agreement occurs when multiple lenders pool their funds together to fund a loan. Each lender has a specific participation percentage, which determines their share of the loan and their corresponding interest, fees, and repayment obligations. 2. Subordinated Participation Agreement: A subordinated participation agreement is formed when a participant agrees to take a subordinate or lower priority position in the repayment hierarchy. This means that the participant will be repaid after other senior participants in case of default or liquidation. 3. Senior Participation Agreement: A senior participation agreement is when a participant agrees to have a higher priority in the repayment hierarchy. They will be repaid before any subordinated participants in case of default or liquidation. 4. Mezzanine Participation Agreement: This agreement is typically used in real estate financing transactions. It allows a participant to provide financing between the equity and debt components of a transaction. Mezzanine financing combines elements of both debt and equity, typically with higher interest rates, to bridge the financing gap. The Orange California Participation Agreement in Connection with a Secured Loan Agreement typically includes key provisions such as loan amount, interest rate, repayment terms, default provisions, collateral details, and specifics regarding the participation interest, which describes each participant's rights and obligations in the loan. Overall, the Orange California Participation Agreement in Connection with a Secured Loan Agreement serves as a crucial legal document that helps establish the framework for cooperation and collaboration between lenders, borrowers, and other participants involved in funding secured loans in Orange, California.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Orange California Acuerdo de participación en relación con el Acuerdo de préstamo garantizado - Participation Agreement in Connection with Secured Loan Agreement

Description

How to fill out Orange California Acuerdo De Participación En Relación Con El Acuerdo De Préstamo Garantizado?

Creating legal forms is a necessity in today's world. Nevertheless, you don't always need to seek professional help to draft some of them from the ground up, including Orange Participation Agreement in Connection with Secured Loan Agreement, with a service like US Legal Forms.

US Legal Forms has more than 85,000 templates to choose from in various categories varying from living wills to real estate papers to divorce documents. All forms are organized based on their valid state, making the searching process less challenging. You can also find detailed materials and tutorials on the website to make any activities related to document completion straightforward.

Here's how you can locate and download Orange Participation Agreement in Connection with Secured Loan Agreement.

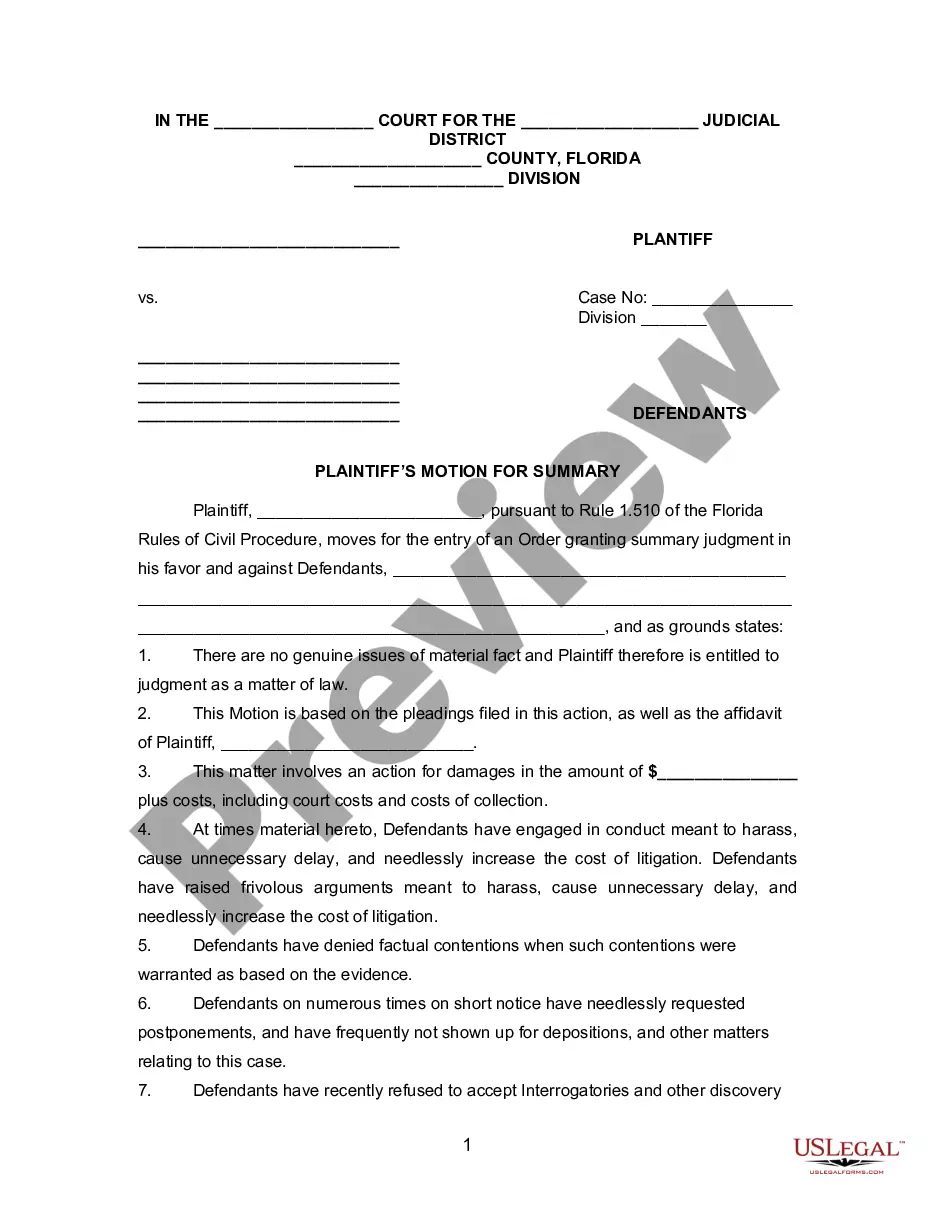

- Take a look at the document's preview and outline (if provided) to get a basic idea of what you’ll get after getting the form.

- Ensure that the template of your choice is specific to your state/county/area since state laws can affect the validity of some documents.

- Examine the similar document templates or start the search over to find the right file.

- Click Buy now and register your account. If you already have an existing one, choose to log in.

- Choose the pricing {plan, then a needed payment method, and purchase Orange Participation Agreement in Connection with Secured Loan Agreement.

- Choose to save the form template in any offered file format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the appropriate Orange Participation Agreement in Connection with Secured Loan Agreement, log in to your account, and download it. Of course, our platform can’t take the place of a lawyer entirely. If you have to deal with an extremely challenging situation, we recommend using the services of a lawyer to review your document before signing and submitting it.

With over 25 years on the market, US Legal Forms proved to be a go-to platform for various legal forms for millions of users. Become one of them today and get your state-specific paperwork with ease!