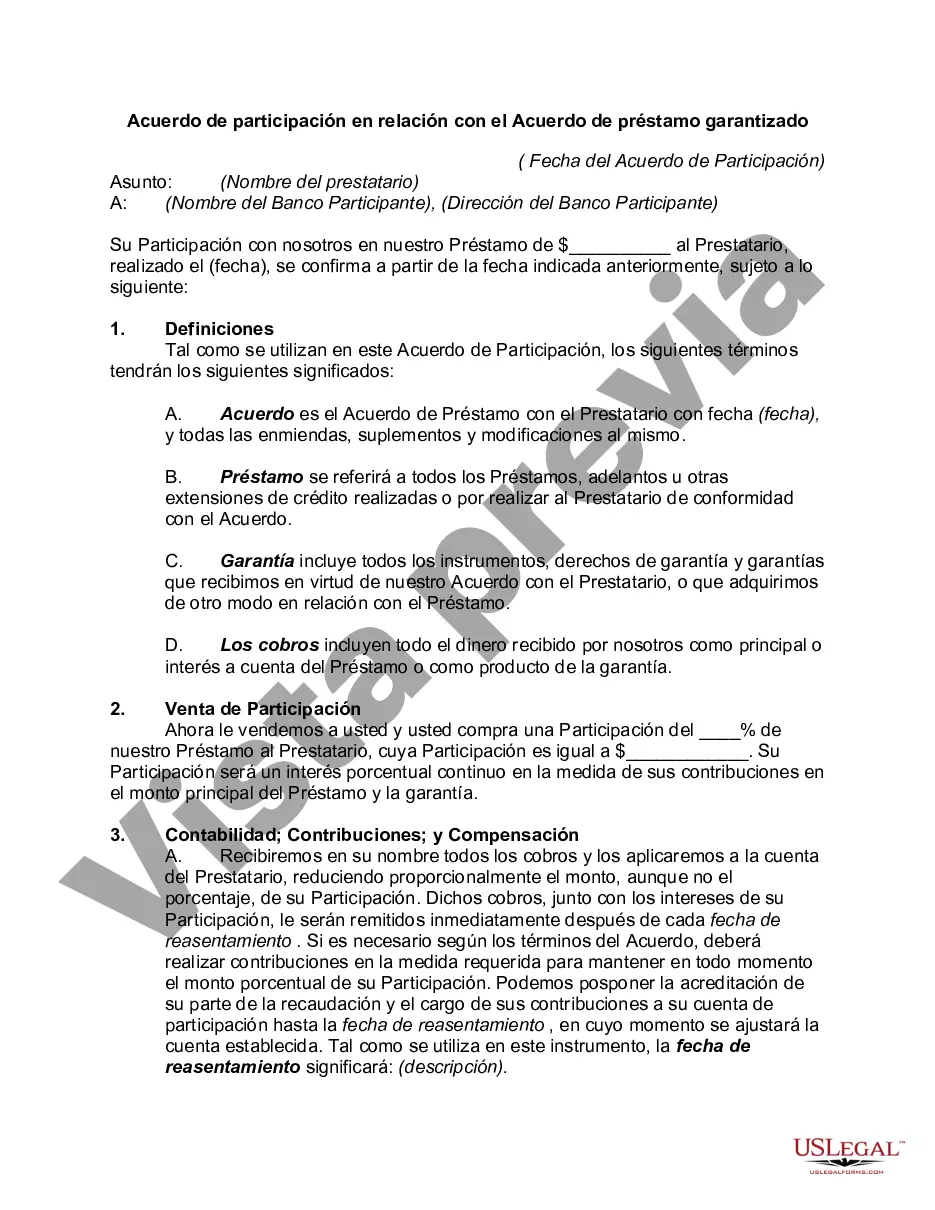

The Riverside California Participation Agreement in Connection with Secured Loan Agreement is a legal document that outlines the terms and conditions between a lender and a participant in a secured loan agreement. This agreement is specific to Riverside, California, and ensures that all parties involved are aware of their rights, responsibilities, and obligations. In a secured loan agreement, the borrower pledges an asset (such as real estate or equipment) as collateral to the lender to secure the loan. The participation agreement further details the rights and obligations of a participant who wishes to be involved in this loan agreement. Some relevant keywords to understand this agreement include: Riverside California, participation agreement, secured loan agreement, lender, borrower, collateral, asset, rights, responsibilities, obligations. There can be different types of Riverside California Participation Agreements in Connection with Secured Loan Agreements, including: 1. Fractional Loan Participation Agreement: This agreement allows a participant to invest in a portion or fraction of the total loan amount. The participant will share in the risks and benefits associated with the loan. 2. Whole Loan Participation Agreement: In this type of agreement, the participant agrees to purchase and own the entire loan, assuming all risks and benefits. The lender may transfer the entire loan to the participant to diversify its portfolio or mitigate risk. 3. Primary Participation Agreement: This agreement allows a participant to have a primary role in the loan agreement. They may have more control and decision-making power compared to other participants. 4. Secondary Participation Agreement: In this type of agreement, the participant plays a secondary role and may have limited decision-making power. They join the agreement after the primary participants and may have less exposure to risk. 5. Revolving Loan Participation Agreement: This agreement allows participants to continuously participate in multiple loan agreements. As loans are repaid, funds are made available for future participation in new loan opportunities. These variations of Riverside California Participation Agreements in Connection with Secured Loan Agreements cater to different investment preferences and risk appetites of participants, while ensuring compliance with local laws and regulations. It is essential for all parties involved to carefully review and understand the terms and conditions outlined in the agreement before entering into any secure loan agreement.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Riverside California Acuerdo de participación en relación con el Acuerdo de préstamo garantizado - Participation Agreement in Connection with Secured Loan Agreement

Description

How to fill out Riverside California Acuerdo De Participación En Relación Con El Acuerdo De Préstamo Garantizado?

Whether you intend to open your business, enter into a deal, apply for your ID update, or resolve family-related legal issues, you must prepare certain paperwork corresponding to your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and checked legal documents for any individual or business occurrence. All files are collected by state and area of use, so opting for a copy like Riverside Participation Agreement in Connection with Secured Loan Agreement is fast and easy.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you a few additional steps to obtain the Riverside Participation Agreement in Connection with Secured Loan Agreement. Adhere to the instructions below:

- Make certain the sample fulfills your personal needs and state law requirements.

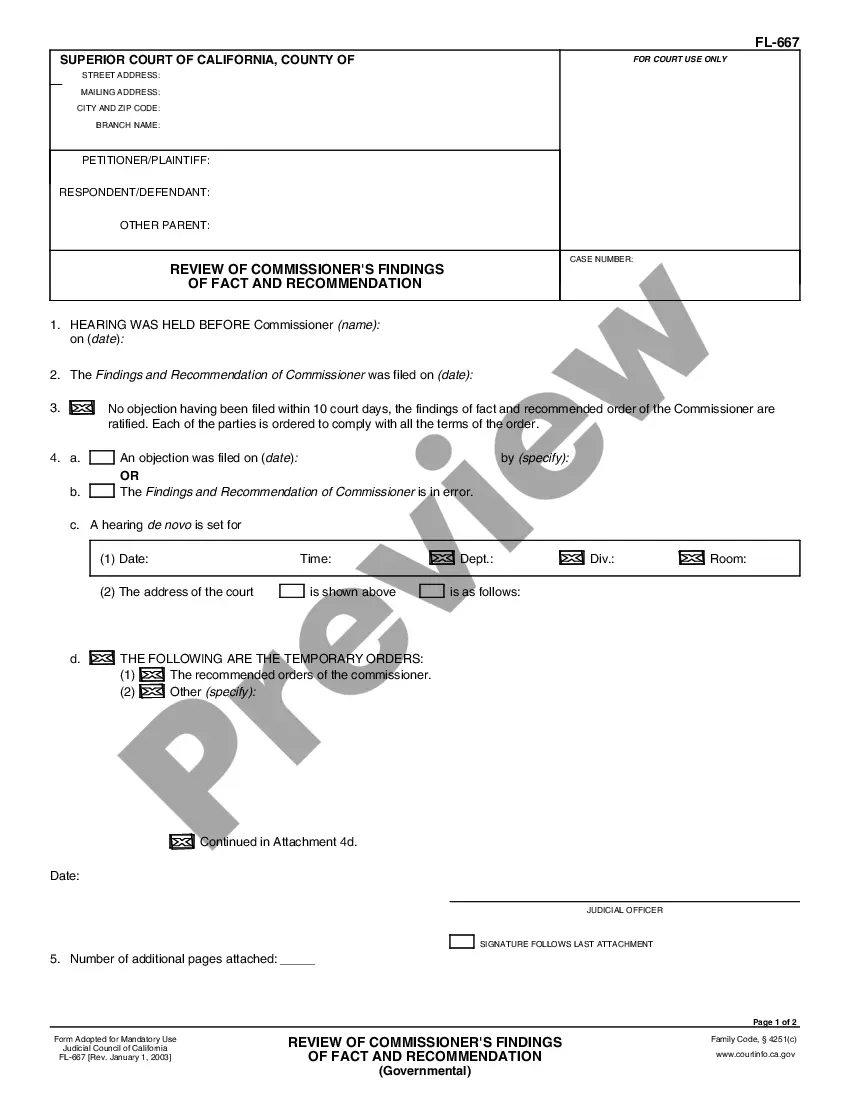

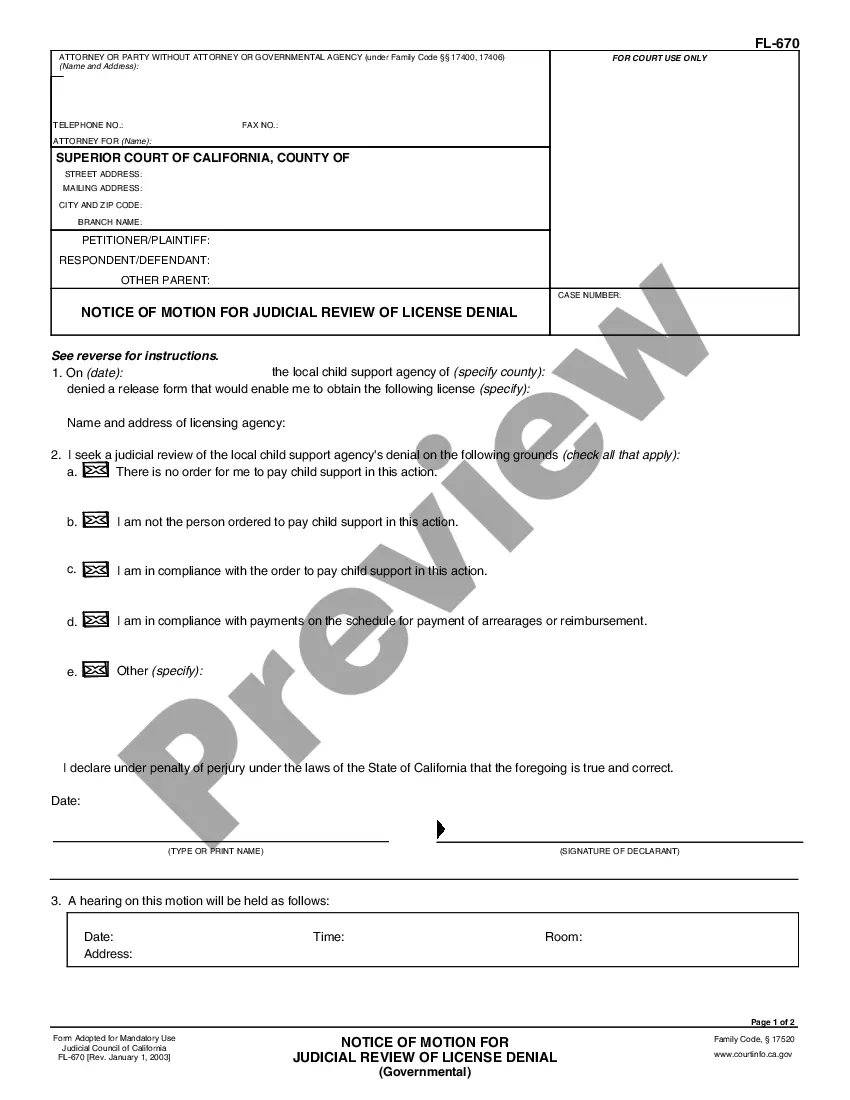

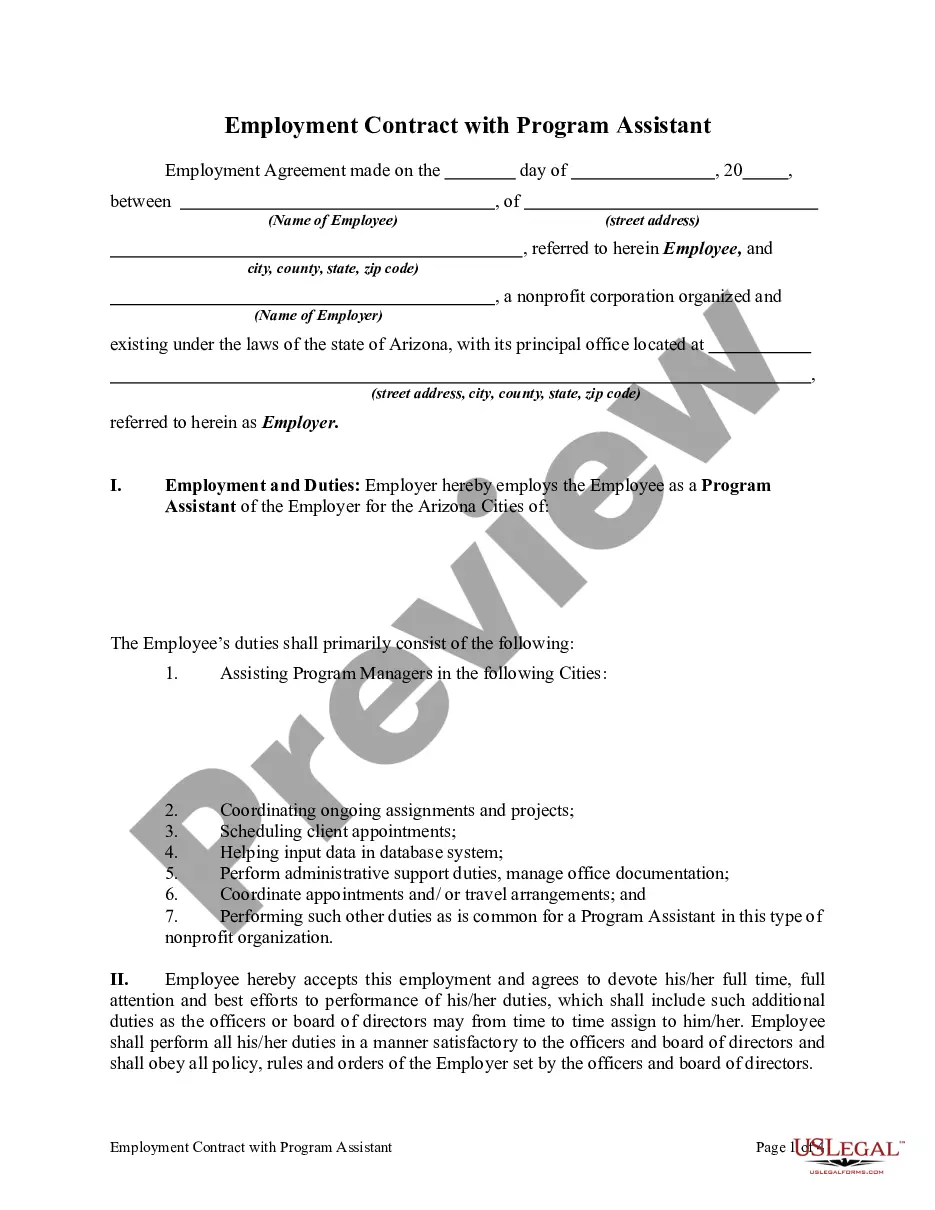

- Read the form description and check the Preview if available on the page.

- Make use of the search tab providing your state above to find another template.

- Click Buy Now to get the sample once you find the proper one.

- Choose the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Riverside Participation Agreement in Connection with Secured Loan Agreement in the file format you require.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our library are multi-usable. Having an active subscription, you can access all of your earlier acquired paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documents. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!