Title: Understanding the Salt Lake Utah Participation Agreement in Connection with Secured Loan Agreement Introduction: The Salt Lake Utah Participation Agreement is a contractual document that plays a vital role in securing loans and facilitating cooperation between lenders and borrowers in the state of Utah. This comprehensive guide will navigate through the various aspects, clauses, and types of participation agreements associated with secured loan agreements in Salt Lake Utah. 1. Key Elements of the Salt Lake Utah Participation Agreement: — Identification of parties involved: The participation agreement outlines the details of all participating parties, including the borrower, lender, and potential participants. — Loan participation terms: It specifies the terms and conditions under which a lender or participant can purchase an interest in the loan. — Security provisions: The participation agreement defines the security pledged to secure the loan, ensuring the interests of all parties involved. — Loan administration: This section clarifies the roles and responsibilities of each party regarding loan management, repayment, and collection procedures. 2. Types of Salt Lake Utah Participation Agreements: — Principal Participation Agreement: This type of agreement allows a participant to actively engage in the primary lending activities, sharing both the risks and benefits of the loan alongside the lender. — Limited Participation Agreement: This agreement restricts the participant's involvement to a predetermined portion or percentage of the loan. It offers a more passive role, typically involving limited liability and reduced decision-making power. — Loan Syndication Agreement: A syndication agreement is often used for larger loan transactions. It involves multiple lenders, each participating in specific portions of the loan, and helps reduce individual risks for lenders while allowing borrowers to access higher loan amounts. 3. Key Considerations in Salt Lake Utah Participation Agreements: — Interest rates and fees: The agreement outlines the interest rates, fees, and reimbursement structures that participants and borrowers must adhere to. — Goals and obligations: Clear objectives and obligations for all parties are established, ensuring transparency and effective collaboration. — Default and repayment provisions: This section stipulates the consequences and remedies in case of default by the borrower and how repayment procedures will be conducted. — Confidentiality and privacy: Protection of sensitive information regarding the agreement, participants, and borrowers is ensured through appropriate confidentiality clauses. Conclusion: In Salt Lake Utah, the Participation Agreement in Connection with Secured Loan Agreement acts as a crucial legal document, enabling lenders and participants to collaborate in loan transactions securely. By clearly defining rights, responsibilities, and terms, these agreements facilitate efficient loan management and minimize potential risks. Familiarizing oneself with this comprehensive guide will aid in understanding the essence of the Salt Lake Utah Participation Agreement and ensure successful loan transactions.

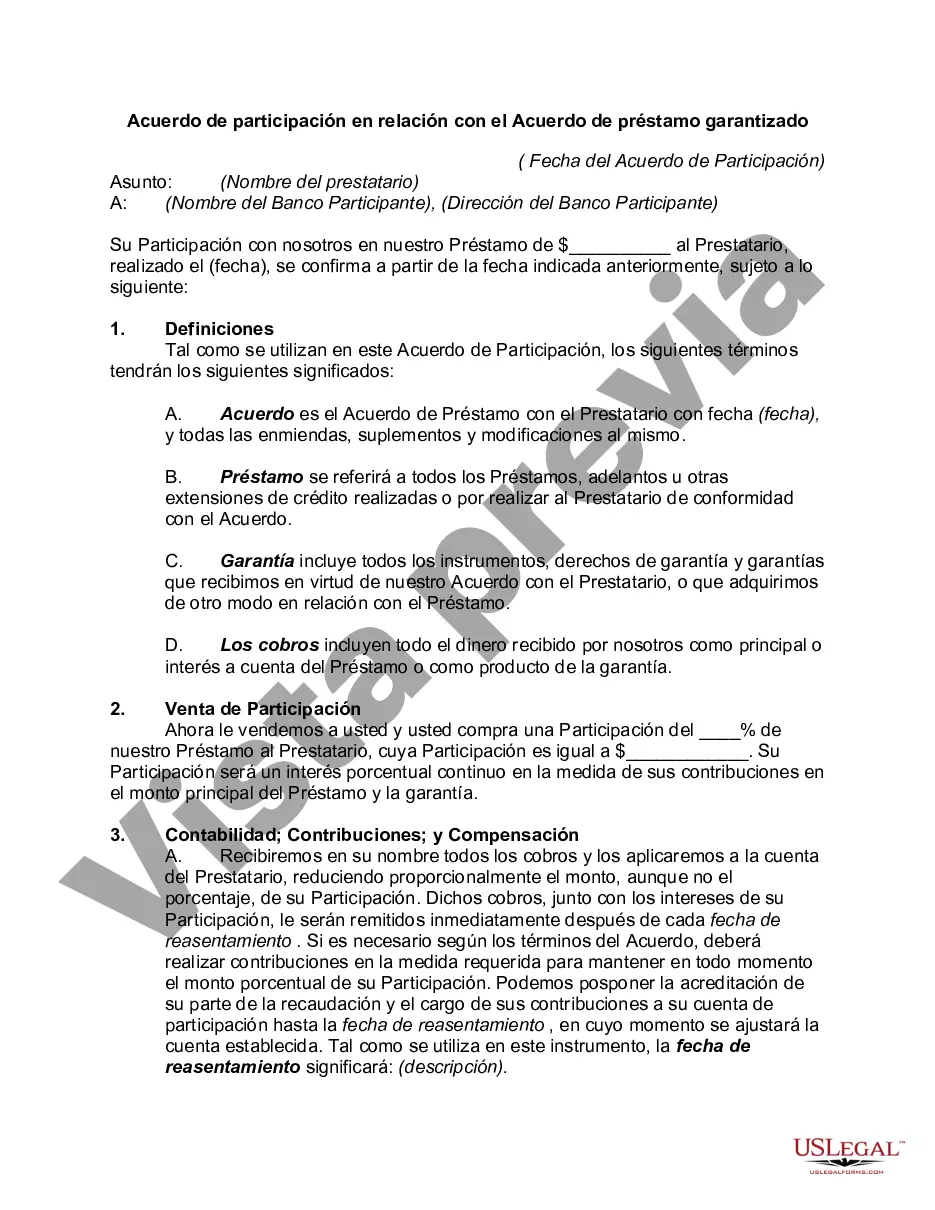

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Salt Lake Utah Acuerdo de participación en relación con el Acuerdo de préstamo garantizado - Participation Agreement in Connection with Secured Loan Agreement

Description

How to fill out Salt Lake Utah Acuerdo De Participación En Relación Con El Acuerdo De Préstamo Garantizado?

Laws and regulations in every area vary from state to state. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal documents. To avoid high priced legal assistance when preparing the Salt Lake Participation Agreement in Connection with Secured Loan Agreement, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal templates. It's an excellent solution for professionals and individuals looking for do-it-yourself templates for various life and business occasions. All the documents can be used many times: once you obtain a sample, it remains available in your profile for subsequent use. Thus, if you have an account with a valid subscription, you can simply log in and re-download the Salt Lake Participation Agreement in Connection with Secured Loan Agreement from the My Forms tab.

For new users, it's necessary to make some more steps to get the Salt Lake Participation Agreement in Connection with Secured Loan Agreement:

- Examine the page content to ensure you found the right sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Click on the Buy Now button to obtain the template when you find the right one.

- Opt for one of the subscription plans and log in or create an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Fill out and sign the template in writing after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal purposes. Find them all in clicks and keep your paperwork in order with the US Legal Forms!