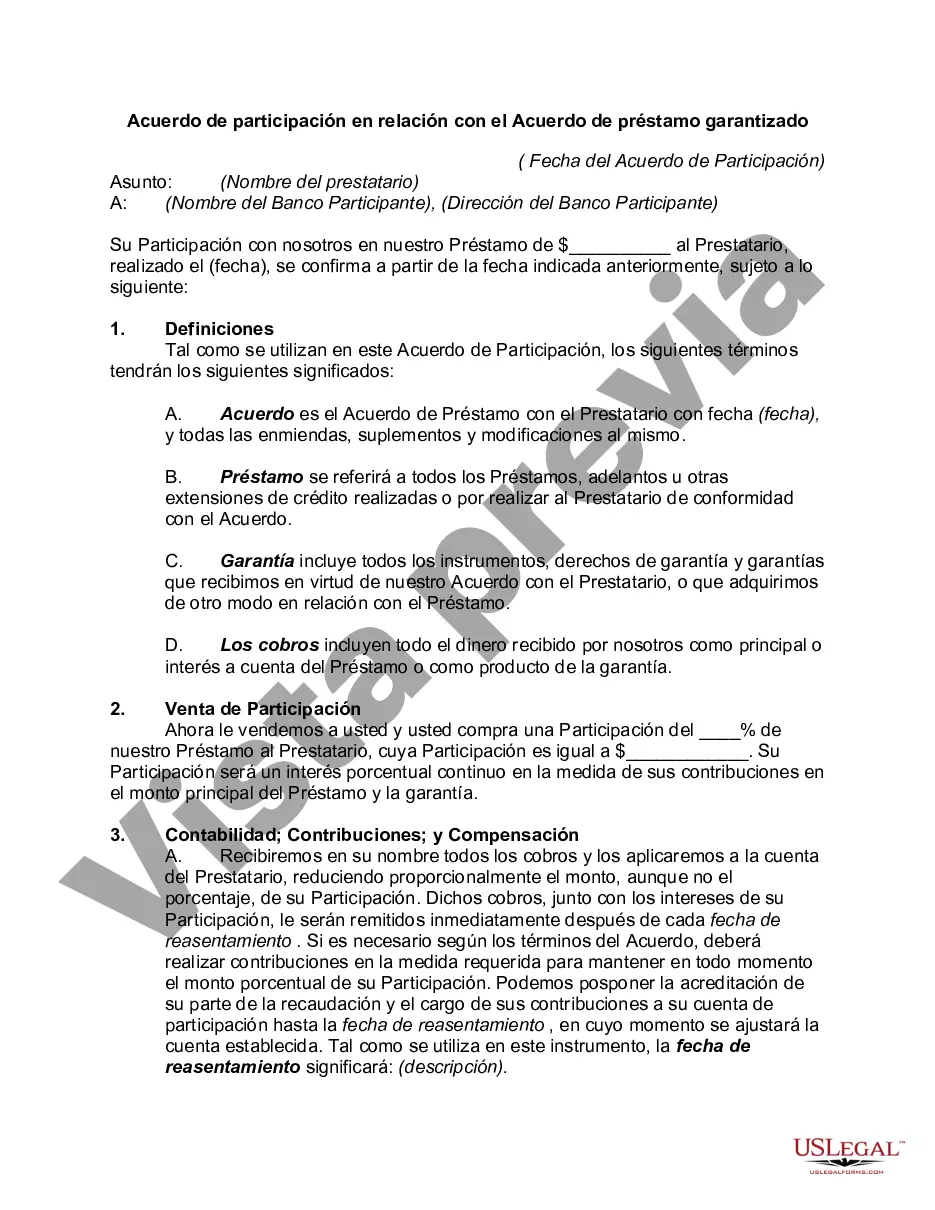

San Antonio, Texas Participation Agreement in Connection with Secured Loan Agreement is a legal document that outlines the terms and conditions between multiple parties when participating in a secured loan agreement in San Antonio, Texas. This type of agreement is commonly used in real estate and commercial lending transactions to specify the rights and responsibilities of each participant involved in the loan. The San Antonio, Texas Participation Agreement typically includes several crucial elements. Firstly, it identifies the parties involved in the agreement, such as the lender, borrower, and participant(s) contributing to the loan. Secondly, it defines the loan amount and the specific terms of participation, including the percentage of participation and the participant's pro rata share of the loan. Additionally, the agreement establishes the responsibilities of each party, such as the borrower's obligations to repay the loan and the lender's duty to disburse funds accordingly. Within San Antonio, Texas, there may be different types of participation agreements associated with secured loan agreements, depending on the specific details of the transaction. Some different types that can be encountered include: 1. Senior Participation Agreement: This type of agreement is entered into by a participant who contributes a larger sum of money and takes priority over other participants in terms of repayment and foreclosure rights. 2. Mezzanine Participation Agreement: Mezzanine participation involves a participant who contributes subordinated capital, usually to bridge the gap between the senior loan and the borrower's equity. In this case, the participant's rights and repayment are subordinate to the senior participants. 3. Junior Participation Agreement: A junior participant enters this type of agreement to contribute a smaller amount of capital, and their rights and repayment are subordinate to both the senior participants and the mezzanine participants, if applicable. 4. Syndicated Participation Agreement: In cases where multiple participants collectively provide the loan, a syndicated participation agreement is utilized. This agreement defines the rights and obligations of all participants involved in the syndicate. Regardless of the specific type, all San Antonio, Texas Participation Agreements in Connection with Secured Loan Agreements aim to establish a clear framework for the participants, ensuring transparency and outlining their respective roles and obligations in the loan transaction. It is vital for all parties involved to carefully review and understand these agreements before entering into a secured loan agreement in San Antonio, Texas.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Antonio Texas Acuerdo de participación en relación con el Acuerdo de préstamo garantizado - Participation Agreement in Connection with Secured Loan Agreement

Description

How to fill out San Antonio Texas Acuerdo De Participación En Relación Con El Acuerdo De Préstamo Garantizado?

Creating legal forms is a necessity in today's world. However, you don't always need to seek professional help to draft some of them from the ground up, including San Antonio Participation Agreement in Connection with Secured Loan Agreement, with a service like US Legal Forms.

US Legal Forms has over 85,000 forms to select from in different types ranging from living wills to real estate paperwork to divorce documents. All forms are organized based on their valid state, making the searching process less frustrating. You can also find detailed resources and guides on the website to make any tasks related to document completion simple.

Here's how you can purchase and download San Antonio Participation Agreement in Connection with Secured Loan Agreement.

- Go over the document's preview and description (if provided) to get a basic idea of what you’ll get after getting the document.

- Ensure that the template of your choosing is specific to your state/county/area since state laws can affect the validity of some documents.

- Examine the similar forms or start the search over to locate the appropriate file.

- Hit Buy now and create your account. If you already have an existing one, choose to log in.

- Pick the option, then a needed payment method, and purchase San Antonio Participation Agreement in Connection with Secured Loan Agreement.

- Choose to save the form template in any available format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the appropriate San Antonio Participation Agreement in Connection with Secured Loan Agreement, log in to your account, and download it. Needless to say, our platform can’t take the place of an attorney completely. If you have to deal with an exceptionally challenging case, we recommend using the services of a lawyer to examine your form before executing and submitting it.

With over 25 years on the market, US Legal Forms proved to be a go-to platform for various legal forms for millions of customers. Become one of them today and purchase your state-compliant paperwork effortlessly!