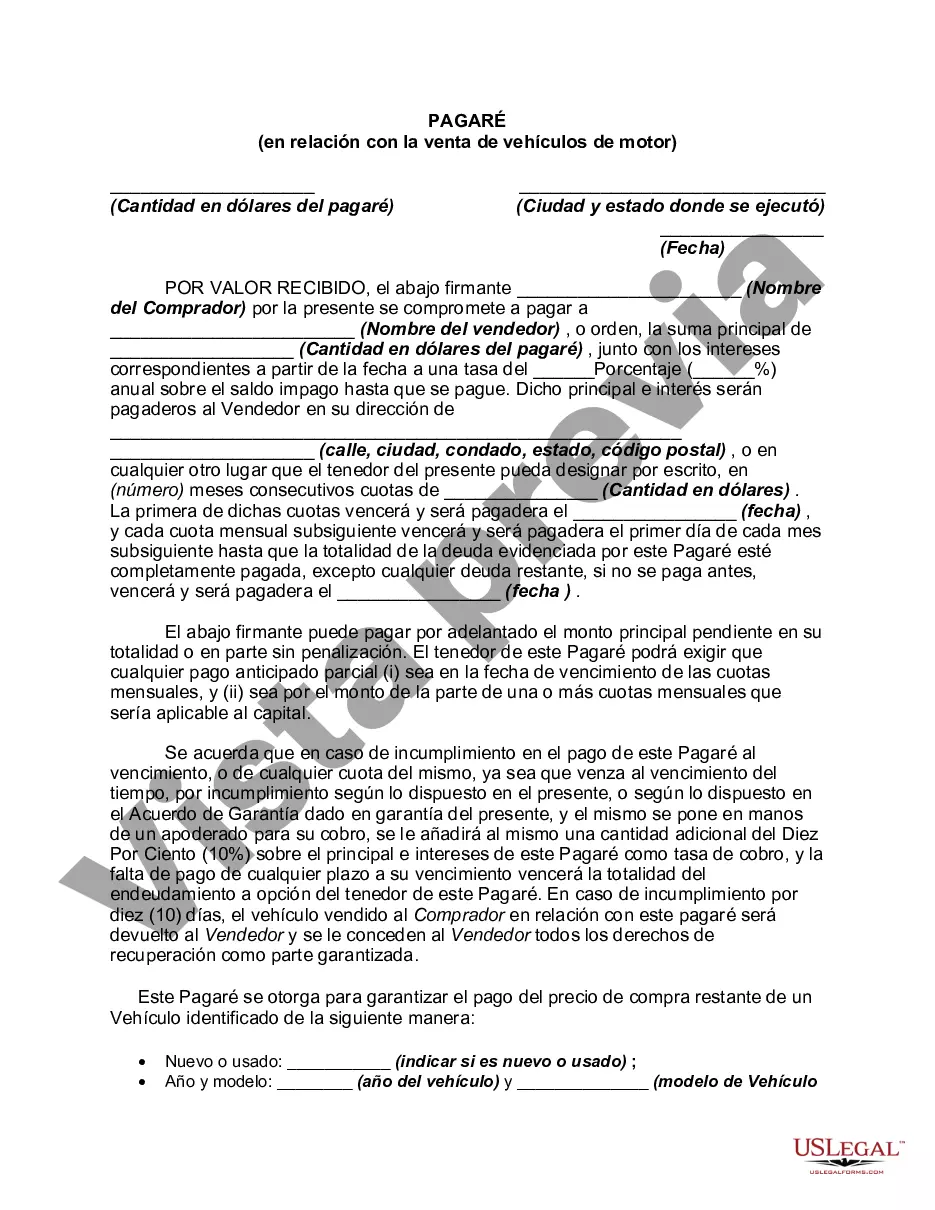

A Bronx New York Promissory Note in connection with the sale of a motor vehicle is a legally binding document that outlines the terms and conditions of a loan agreement between the buyer and seller of the vehicle. It serves as a written promise that the buyer will repay the seller a specific amount of money over an agreed-upon period. The promissory note includes important details such as the names and contact information of both parties, the vehicle's make, model, and identification number, the loan amount, interest rate, repayment schedule, and any penalties or late fees. It also highlights the consequences of defaulting on payments and the procedures for dispute resolution. Different types of Bronx New York Promissory Notes in connection with the sale of a motor vehicle may include: 1. Installment Promissory Note: This type of promissory note allows the buyer to repay the loan amount in equal monthly or quarterly installments over a specified duration. It may also include interest payments. 2. Balloon Promissory Note: In this case, the buyer makes smaller monthly payments, but a large final payment (balloon payment) is due at the end of the loan term. This type is popular for buyers who plan to refinance or sell the vehicle before the balloon payment comes due. 3. Secured Promissory Note: When a vehicle is used as collateral, the promissory note is secured, meaning that if the buyer defaults on payments, the seller can repossess the vehicle. This type provides some assurance for the seller. 4. Unsecured Promissory Note: Unlike a secured promissory note, this type does not involve any collateral. Therefore, the buyer's creditworthiness and trustworthiness become crucial factors for the seller to consider before entering into the agreement. It's important for both parties involved in the sale to carefully review and understand the terms of the promissory note before signing it. Seeking legal advice or consulting with an attorney in Bronx, New York, can provide guidance and ensure compliance with local laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Bronx New York Pagaré en relación con la venta de vehículos de motor - Promissory Note in Connection with Sale of Motor Vehicle

Description

How to fill out Bronx New York Pagaré En Relación Con La Venta De Vehículos De Motor?

Laws and regulations in every sphere differ around the country. If you're not an attorney, it's easy to get lost in countless norms when it comes to drafting legal documents. To avoid high priced legal assistance when preparing the Bronx Promissory Note in Connection with Sale of Motor Vehicle, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal forms. It's an excellent solution for specialists and individuals looking for do-it-yourself templates for different life and business occasions. All the forms can be used multiple times: once you obtain a sample, it remains available in your profile for further use. Therefore, when you have an account with a valid subscription, you can simply log in and re-download the Bronx Promissory Note in Connection with Sale of Motor Vehicle from the My Forms tab.

For new users, it's necessary to make some more steps to get the Bronx Promissory Note in Connection with Sale of Motor Vehicle:

- Take a look at the page content to make sure you found the correct sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Use the Buy Now button to obtain the template once you find the appropriate one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Complete and sign the template in writing after printing it or do it all electronically.

That's the simplest and most cost-effective way to get up-to-date templates for any legal reasons. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!