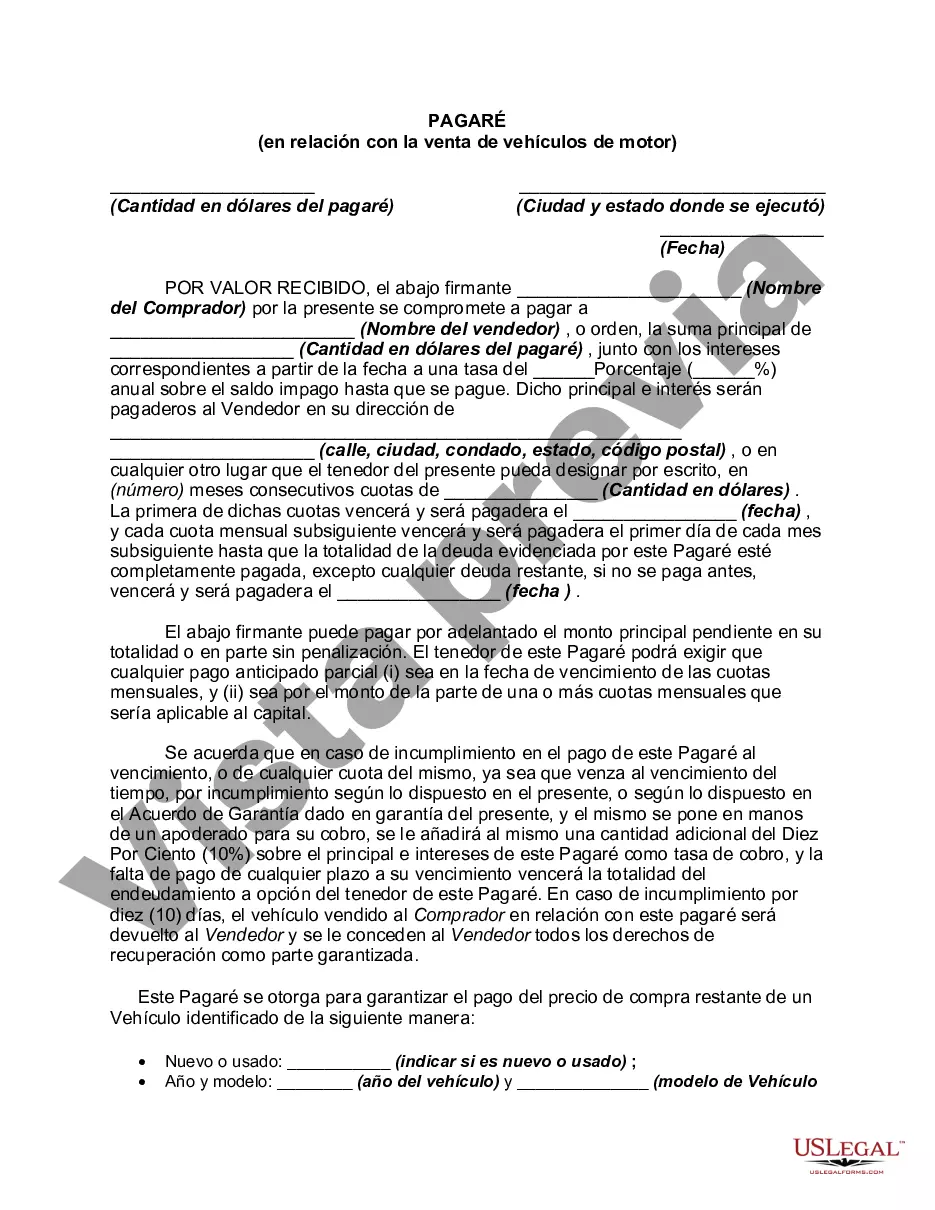

A Houston Texas Promissory Note in Connection with Sale of Motor Vehicle is a legally binding document that outlines the terms and conditions of a loan agreement between a buyer and a seller when it comes to purchasing a motor vehicle. This promissory note serves as evidence of a debt owed by the buyer to the seller, and it provides a structure for repayment. Keywords: Houston Texas, Promissory Note, sale of motor vehicle, loan agreement, buyer, seller, terms and conditions, debt, repayment. There are several types of Houston Texas Promissory Notes in Connection with Sale of Motor Vehicle that can be used depending on the specific circumstances and preferences of the parties involved. Some common types include: 1. Installment Promissory Note: This type of promissory note specifies that the buyer will repay the loan amount in fixed monthly installments over a predetermined period. It outlines the amount of each installment, the interest rate, and any other conditions agreed upon. 2. Balloon Promissory Note: In this type of promissory note, the buyer agrees to make regular payments for a specific period, after which a larger lump-sum payment (balloon payment) is due. This can be beneficial to buyers who might not have all the funds upfront but expect to have them in the future. 3. Simple Promissory Note: This is a straightforward and basic promissory note without any added complexity. It includes the agreed-upon loan amount, the interest rate, repayment terms, and any other essential terms and conditions. 4. Secured Promissory Note: This type of promissory note includes a provision for collateral. The buyer pledges specific assets as security for the loan, usually the motor vehicle being purchased. In case of default, the seller has the right to seize the collateral as compensation. 5. Unsecured Promissory Note: Unlike a secured promissory note, this type does not require collateral. It relies solely on the buyer's creditworthiness and trustworthiness to repay the loan. The use of these different types of promissory notes allows parties involved in the sale of a motor vehicle to customize the terms of the agreement based on their specific needs and preferences.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Houston Texas Pagaré en relación con la venta de vehículos de motor - Promissory Note in Connection with Sale of Motor Vehicle

Description

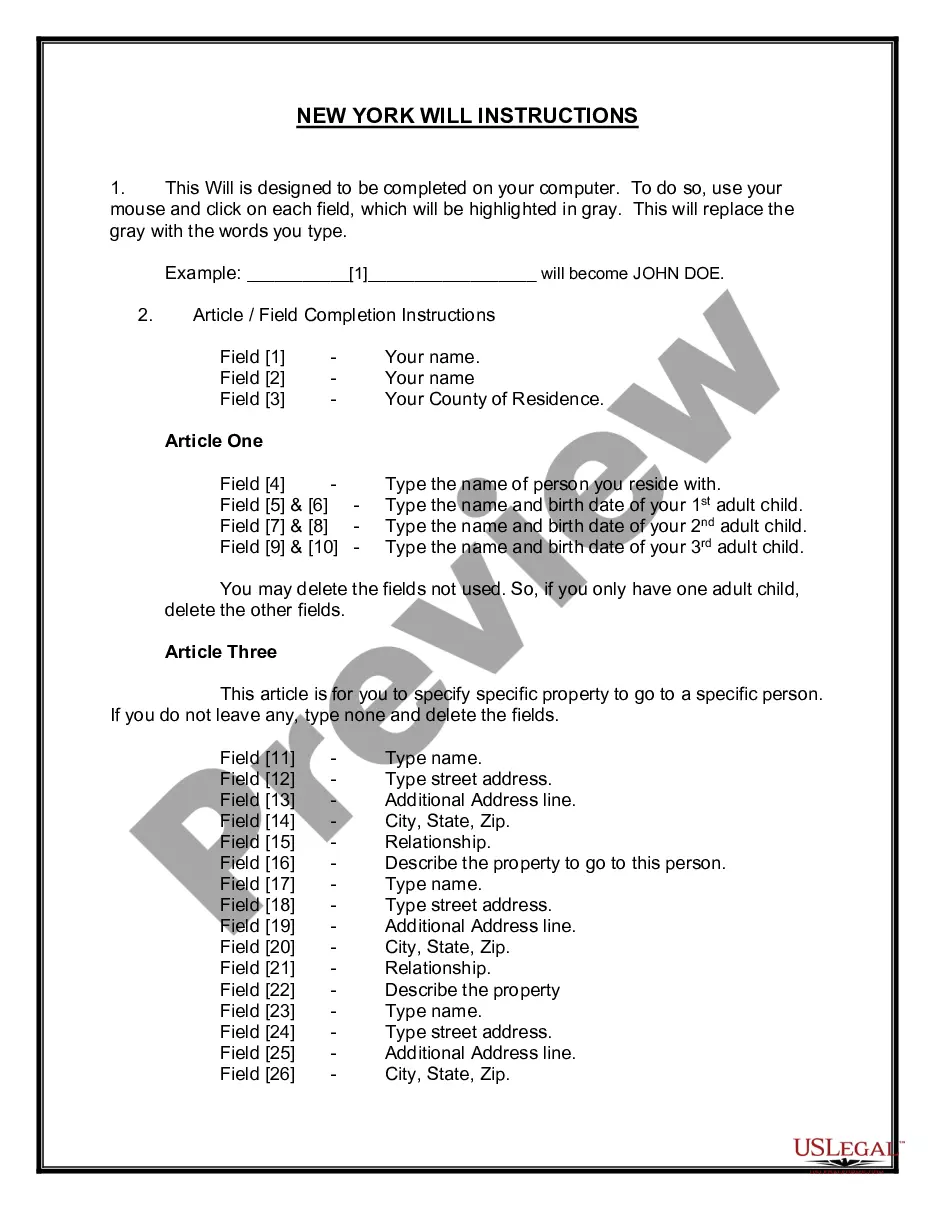

How to fill out Houston Texas Pagaré En Relación Con La Venta De Vehículos De Motor?

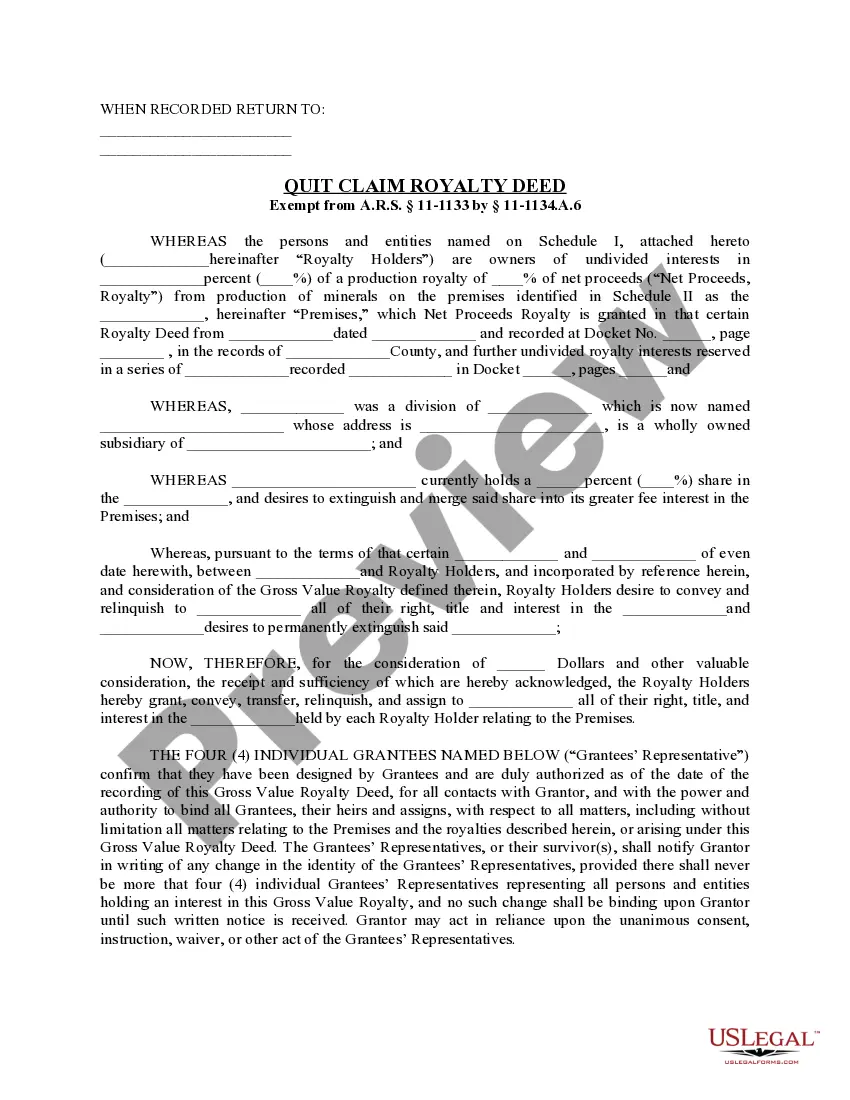

Do you need to quickly create a legally-binding Houston Promissory Note in Connection with Sale of Motor Vehicle or maybe any other document to manage your personal or business affairs? You can go with two options: contact a professional to draft a valid document for you or create it entirely on your own. Luckily, there's a third solution - US Legal Forms. It will help you receive professionally written legal papers without having to pay unreasonable fees for legal services.

US Legal Forms provides a huge catalog of over 85,000 state-compliant document templates, including Houston Promissory Note in Connection with Sale of Motor Vehicle and form packages. We provide documents for a myriad of life circumstances: from divorce papers to real estate document templates. We've been on the market for over 25 years and gained a rock-solid reputation among our clients. Here's how you can become one of them and get the necessary document without extra hassles.

- To start with, double-check if the Houston Promissory Note in Connection with Sale of Motor Vehicle is adapted to your state's or county's regulations.

- In case the form comes with a desciption, make sure to verify what it's suitable for.

- Start the search again if the document isn’t what you were hoping to find by utilizing the search bar in the header.

- Choose the plan that is best suited for your needs and proceed to the payment.

- Choose the format you would like to get your form in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already registered an account, you can easily log in to it, locate the Houston Promissory Note in Connection with Sale of Motor Vehicle template, and download it. To re-download the form, just go to the My Forms tab.

It's effortless to find and download legal forms if you use our catalog. Additionally, the paperwork we provide are updated by industry experts, which gives you greater confidence when writing legal matters. Try US Legal Forms now and see for yourself!