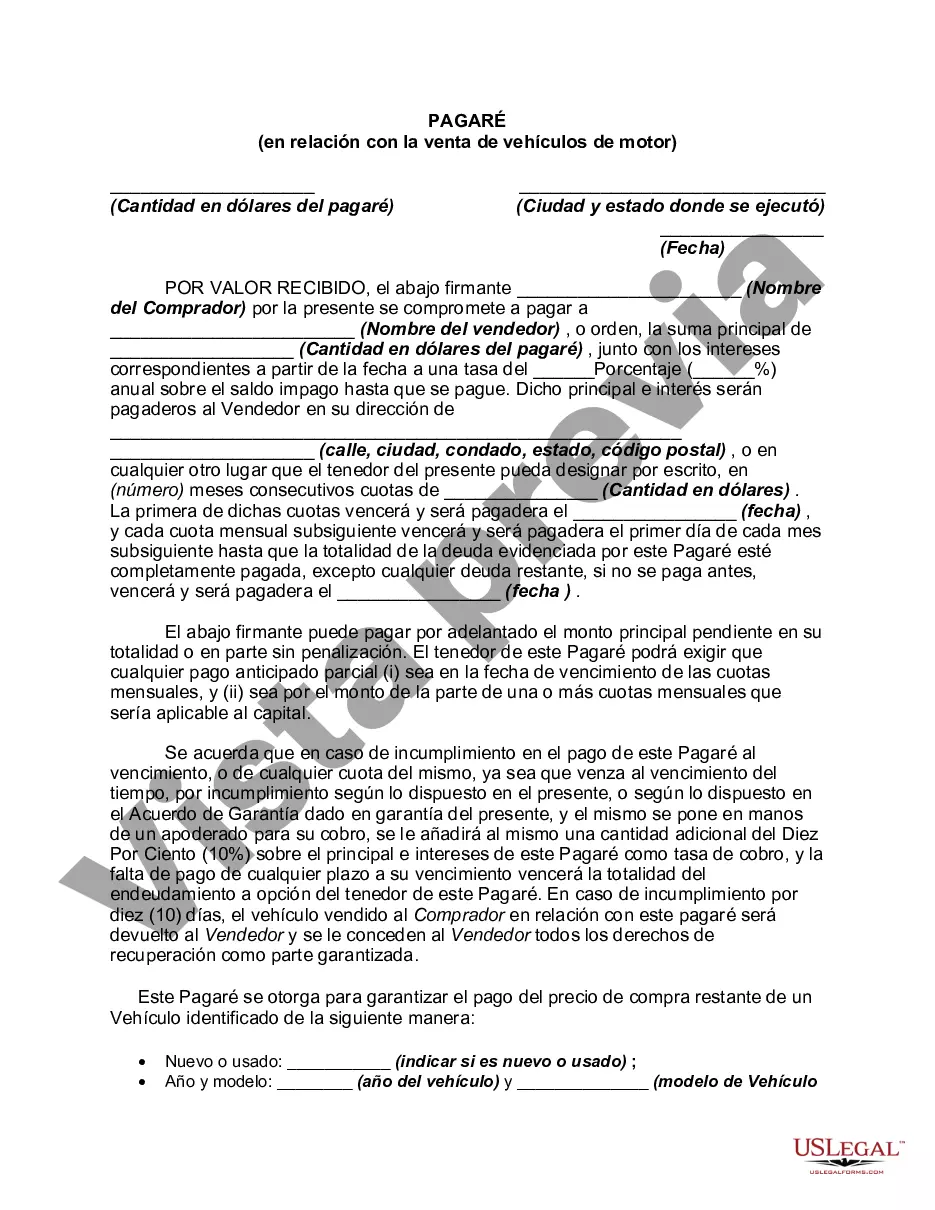

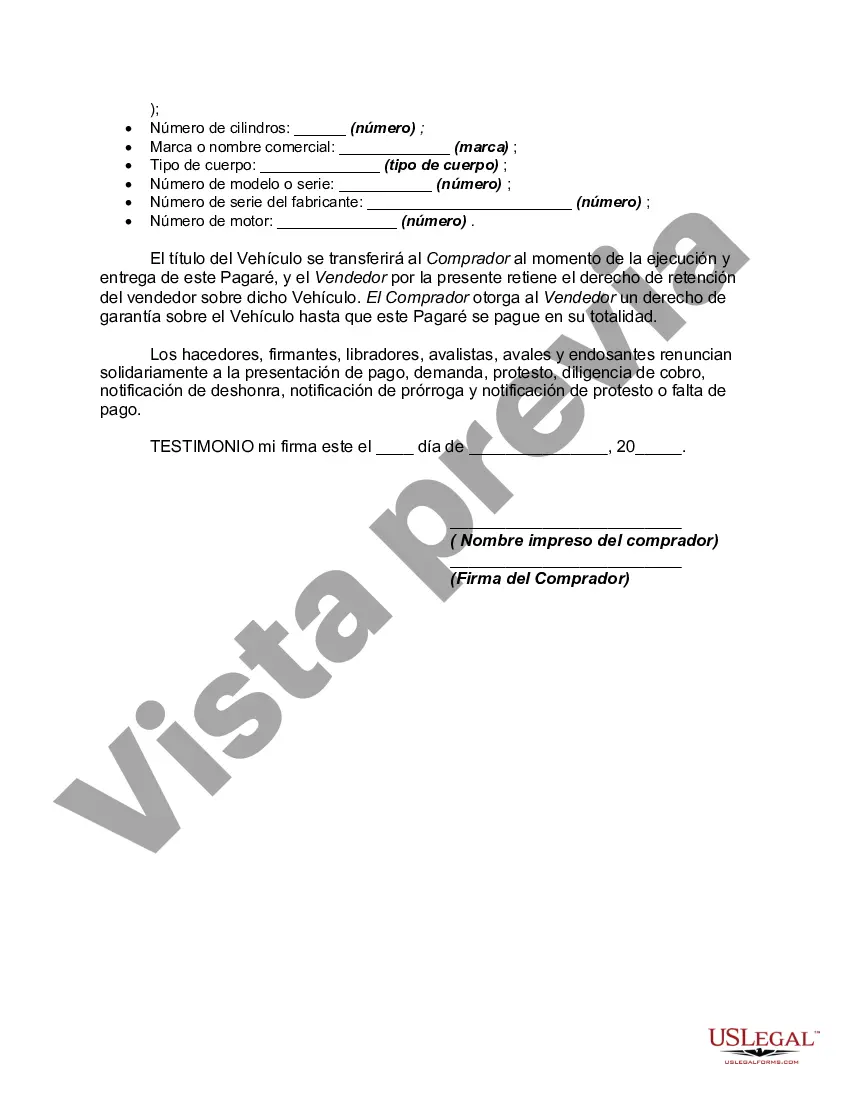

A Maricopa Arizona Promissory Note in Connection with the Sale of a Motor Vehicle is a legal document that outlines the terms and conditions of a loan agreement between a seller (lender) and a buyer (borrower) for the purchase of a motor vehicle. It serves as evidence of the debt and contains specific details regarding the transaction. The Maricopa Arizona Promissory Note includes key information such as the names and contact information of both parties, the description of the motor vehicle being sold, the purchase price, and the repayment terms. The terms typically include the repayment schedule, interest rate (if applicable), late payment penalties, and any other relevant provisions. This document protects the interests of both the seller and the buyer and establishes a legally binding agreement. There are various types of Maricopa Arizona Promissory Notes in Connection with the Sale of a Motor Vehicle, including: 1. Simple Promissory Note: This is the most common type of promissory note used in such transactions. It outlines basic repayment terms without any complex provisions. 2. Installment Promissory Note: This type of note specifies that the buyer will repay the loan amount in multiple installments over a certain period, typically including interest. 3. Secured Promissory Note: In this case, the seller may ask for collateral, such as another valuable asset, to secure the loan. If the buyer fails to repay the loan, the seller can repossess the collateral to recover the outstanding amount. 4. Balloon Promissory Note: This note involves regular payments for a specific period, with a lump sum (balloon payment) due at the end of the term. This option may be useful if the buyer cannot afford higher monthly payments initially but expects increased cash flow later. 5. Variable Rate Promissory Note: This type of note includes an adjustable interest rate, meaning that the interest may fluctuate over the loan term. The terms and conditions specify how the interest rate adjusts and what index it is tied to. 6. Personal Guarantee Promissory Note: In certain cases, the lender may require a third party, such as a family member or friend, to cosign the note. This person becomes responsible for the loan if the buyer defaults on payments. When creating or signing a Maricopa Arizona Promissory Note in Connection with the Sale of a Motor Vehicle, it is important to consult with a legal professional to ensure compliance with local laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Maricopa Arizona Pagaré en relación con la venta de vehículos de motor - Promissory Note in Connection with Sale of Motor Vehicle

Description

How to fill out Maricopa Arizona Pagaré En Relación Con La Venta De Vehículos De Motor?

Dealing with legal forms is a must in today's world. Nevertheless, you don't always need to look for qualified assistance to create some of them from scratch, including Maricopa Promissory Note in Connection with Sale of Motor Vehicle, with a service like US Legal Forms.

US Legal Forms has more than 85,000 templates to select from in different types ranging from living wills to real estate paperwork to divorce papers. All forms are arranged according to their valid state, making the searching process less overwhelming. You can also find detailed resources and guides on the website to make any tasks related to paperwork execution straightforward.

Here's how you can locate and download Maricopa Promissory Note in Connection with Sale of Motor Vehicle.

- Take a look at the document's preview and description (if available) to get a basic information on what you’ll get after downloading the form.

- Ensure that the document of your choice is adapted to your state/county/area since state regulations can impact the legality of some documents.

- Examine the related forms or start the search over to find the appropriate file.

- Click Buy now and register your account. If you already have an existing one, select to log in.

- Pick the option, then a suitable payment method, and purchase Maricopa Promissory Note in Connection with Sale of Motor Vehicle.

- Select to save the form template in any available file format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the appropriate Maricopa Promissory Note in Connection with Sale of Motor Vehicle, log in to your account, and download it. Of course, our website can’t replace a lawyer entirely. If you have to cope with an extremely complicated case, we advise getting a lawyer to check your form before executing and submitting it.

With more than 25 years on the market, US Legal Forms became a go-to provider for various legal forms for millions of users. Become one of them today and purchase your state-specific documents with ease!