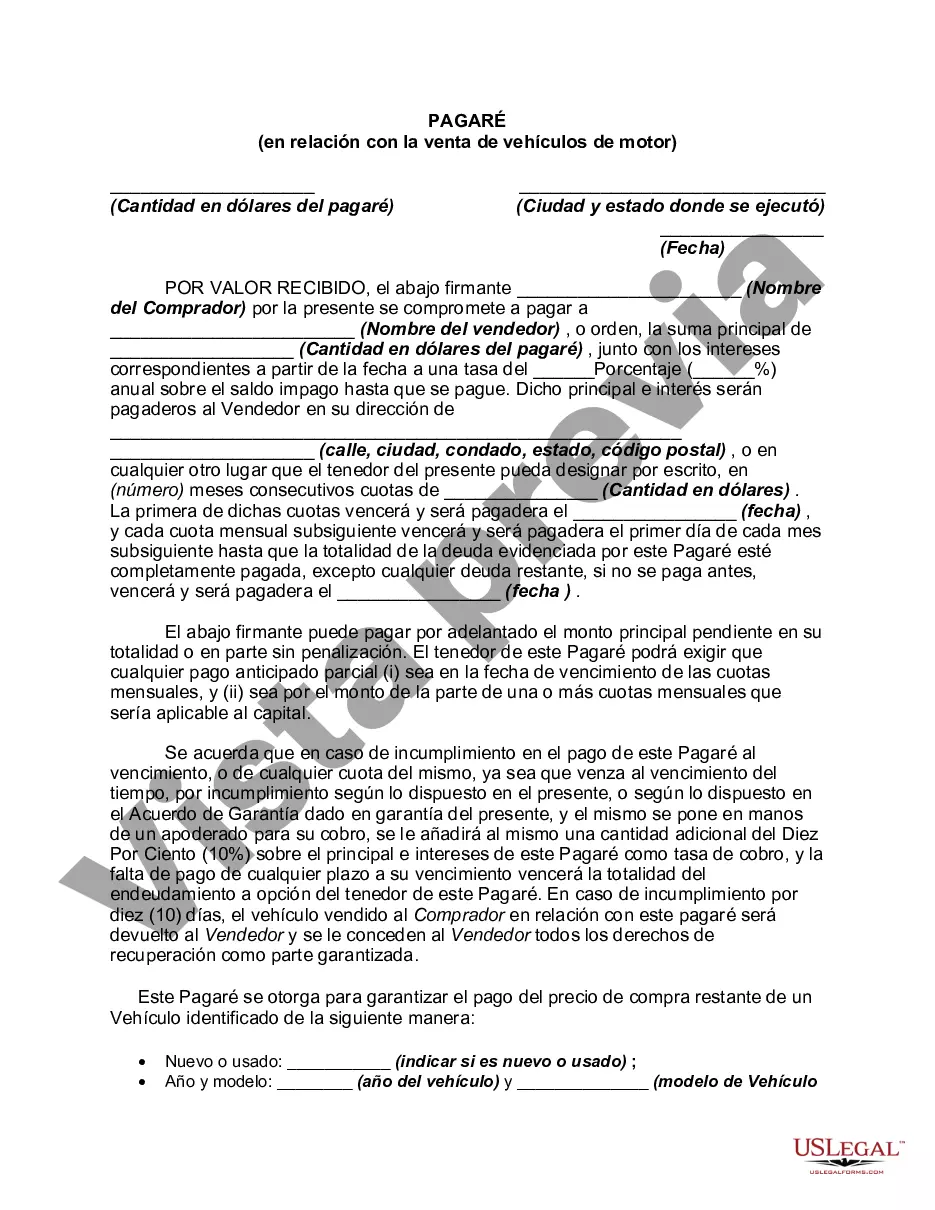

A Phoenix Arizona Promissory Note in connection with the sale of a motor vehicle is a legally-binding agreement that outlines the terms and conditions of a loan taken to purchase a vehicle. This document serves as a written evidence of the loan and protects the rights of both the buyer and the seller. The Phoenix Arizona Promissory Note includes several essential elements, such as the names and contact details of the buyer and seller, details of the vehicle being sold, loan amount, interest rate, repayment terms, and any penalties or fees in case of default. This document also often requires the buyer to provide collateral or a security interest in the vehicle until the loan is fully repaid. It's crucial to note that the Phoenix Arizona Promissory Note should comply with the state's specific regulations and laws governing motor vehicle sales and loans. These laws may vary from state to state, so it's essential to ensure that the agreement adheres to all applicable provisions in Phoenix, Arizona. When it comes to different types of Phoenix Arizona Promissory Notes related to the sale of motor vehicles, there are a few variations that address specific scenarios or preferences: 1. Simple Promissory Note: This is the most common type of promissory note used in Phoenix, Arizona, and states the basic terms of the motor vehicle loan, including the loan amount, interest rate, and repayment schedule. 2. Secured Promissory Note: This type includes provisions for collateral, such as the vehicle being purchased. It outlines how the collateral will be handled in case of default, repossession, or sale to recover the outstanding balance. 3. Balloon Payment Promissory Note: If the buyer prefers lower monthly payments over a specific term with a large lump sum due at the end, a balloon payment note can be used. This type of note outlines the smaller payments and the final balloon payment required to fully satisfy the loan. 4. Installment Promissory Note: An installment note divides the loan amount into equal monthly payments over a specified period, including principal and interest. This type of note simplifies repayment by setting a fixed amount to be paid regularly until the loan is fully repaid. When drafting or entering into a Phoenix Arizona Promissory Note in connection with the sale of a motor vehicle, it is highly recommended seeking legal advice to ensure compliance with all relevant laws and protect the rights of both parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Phoenix Arizona Pagaré en relación con la venta de vehículos de motor - Promissory Note in Connection with Sale of Motor Vehicle

Description

How to fill out Phoenix Arizona Pagaré En Relación Con La Venta De Vehículos De Motor?

Are you looking to quickly create a legally-binding Phoenix Promissory Note in Connection with Sale of Motor Vehicle or probably any other document to take control of your own or corporate affairs? You can go with two options: contact a legal advisor to write a valid paper for you or create it completely on your own. Thankfully, there's an alternative solution - US Legal Forms. It will help you receive neatly written legal documents without having to pay unreasonable prices for legal services.

US Legal Forms offers a rich catalog of more than 85,000 state-specific document templates, including Phoenix Promissory Note in Connection with Sale of Motor Vehicle and form packages. We provide documents for a myriad of life circumstances: from divorce papers to real estate documents. We've been on the market for more than 25 years and gained a spotless reputation among our clients. Here's how you can become one of them and get the needed document without extra hassles.

- To start with, carefully verify if the Phoenix Promissory Note in Connection with Sale of Motor Vehicle is adapted to your state's or county's regulations.

- In case the form comes with a desciption, make sure to verify what it's intended for.

- Start the searching process over if the template isn’t what you were seeking by using the search box in the header.

- Select the subscription that is best suited for your needs and move forward to the payment.

- Select the file format you would like to get your form in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already set up an account, you can easily log in to it, find the Phoenix Promissory Note in Connection with Sale of Motor Vehicle template, and download it. To re-download the form, just go to the My Forms tab.

It's stressless to buy and download legal forms if you use our catalog. Additionally, the documents we offer are updated by law professionals, which gives you greater peace of mind when writing legal affairs. Try US Legal Forms now and see for yourself!