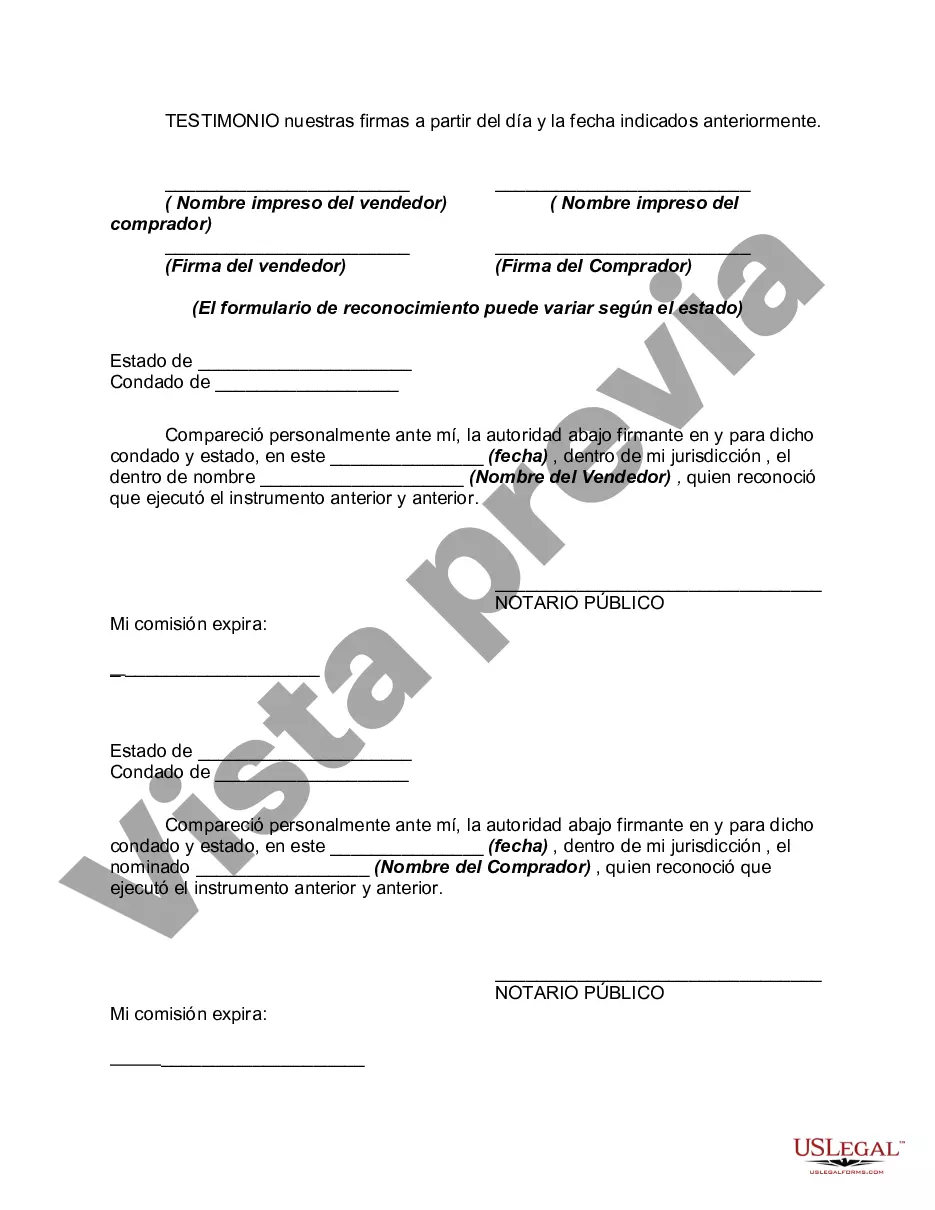

A Franklin Ohio Contract for the Sale of Motor Vehicle — Owner Financed with Provisions for Note and Security Agreement is a legally binding document that outlines the terms and conditions of a vehicle sale transaction, where the seller (usually the current owner of the vehicle) provides financing to the buyer. This type of contract is particularly useful when traditional financing options are not available or desirable to either party. The contract encompasses several key provisions that protect the interests of both the buyer and the seller. It includes pertinent details such as the names and addresses of the buyer and seller, the description of the motor vehicle being sold, its Vehicle Identification Number (VIN), make, model, and year, as well as the agreed-upon purchase price. In an Owner Financed Contract, the seller acts as the lender, allowing the buyer to make installment payments instead of paying the entire amount upfront. The contract clearly defines the terms of the financing agreement, including the down payment amount, the total amount to be financed, the interest rate, and the repayment schedule. It also states the consequences of default, such as repossession of the vehicle by the seller in case of non-payment. Moreover, provisions for a Note and Security Agreement are included in this type of contract. The Note outlines the details of the loan, such as the principal amount, the interest rate, and the repayment terms. It acts as an acknowledgment of debt and serves as evidence of the underlying obligation. The Security Agreement, on the other hand, creates a security interest in the vehicle being sold. This ensures that the seller has a legal claim over the vehicle until the buyer fully repays the loan. In the event of default, the seller can repossess the vehicle to mitigate their losses. Different variations of the Franklin Ohio Contract for the Sale of Motor Vehicle — Owner Financed with Provisions for Note and Security Agreement may exist depending on specific circumstances. For example, there could be contracts that differ in terms of down payment requirements, interest rates, or repayment schedules. It is crucial for both parties to review and agree upon all the terms and conditions before signing the contract to prevent any misunderstandings or disputes. Seeking legal advice or assistance is highly recommended ensuring compliance with relevant laws and to protect the rights and obligations of both parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Franklin Ohio Contrato de Venta de Vehículo Automotor - Dueño Financiado con Provisiones para Nota y Contrato de Garantía - Contract for the Sale of Motor Vehicle - Owner Financed with Provisions for Note and Security Agreement

Description

How to fill out Franklin Ohio Contrato De Venta De Vehículo Automotor - Dueño Financiado Con Provisiones Para Nota Y Contrato De Garantía?

A document routine always accompanies any legal activity you make. Opening a company, applying or accepting a job offer, transferring ownership, and lots of other life scenarios require you prepare formal paperwork that differs throughout the country. That's why having it all collected in one place is so valuable.

US Legal Forms is the most extensive online library of up-to-date federal and state-specific legal templates. Here, you can easily find and get a document for any individual or business objective utilized in your county, including the Franklin Contract for the Sale of Motor Vehicle - Owner Financed with Provisions for Note and Security Agreement.

Locating templates on the platform is amazingly straightforward. If you already have a subscription to our service, log in to your account, find the sample through the search bar, and click Download to save it on your device. After that, the Franklin Contract for the Sale of Motor Vehicle - Owner Financed with Provisions for Note and Security Agreement will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this quick guide to get the Franklin Contract for the Sale of Motor Vehicle - Owner Financed with Provisions for Note and Security Agreement:

- Make sure you have opened the proper page with your regional form.

- Utilize the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the form corresponds to your needs.

- Search for another document using the search option if the sample doesn't fit you.

- Click Buy Now when you find the necessary template.

- Select the appropriate subscription plan, then log in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and save the Franklin Contract for the Sale of Motor Vehicle - Owner Financed with Provisions for Note and Security Agreement on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the easiest and most reliable way to obtain legal paperwork. All the templates available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs properly with the US Legal Forms!