The Nassau New York Contract for the Sale of Motor Vehicle — Owner Financed with Provisions for Note and Security Agreement is a legally-binding document that facilitates the purchase of a motor vehicle in Nassau, New York. This contract is specifically designed for owner financing transactions, allowing the buyer to make payments directly to the seller over a predetermined period. This contract includes various provisions to protect the interests of both the buyer and seller. It establishes the terms and conditions of the sale, including the purchase price, payment schedule, and interest rate. Additionally, it outlines the rights and responsibilities of both parties during the course of the agreement. The provisions for note and security agreement in this contract outline the details regarding the buyer's promissory note and the security interests granted by the buyer to the seller. The promissory note specifies the terms of repayment, including the amount and frequency of payments, any penalties for late payments, and the consequences of defaulting on the loan. The security agreement establishes the collateral security interest the seller holds over the vehicle until the loan is fully repaid. There are several types of Nassau New York Contracts for the Sale of Motor Vehicle — Owner Financed with Provisions for Note and Security Agreement, each tailored to specific circumstances and preferences of the parties involved. Some common variations include: 1. Simple Owner Financing Contract: This contract is suitable for a straightforward owner-financed transaction without any intricate terms or additional clauses. 2. Extended Payment Contract: This type of contract allows for a longer payback period, allowing the buyer to make smaller monthly payments over an extended period, usually with an increased interest rate. 3. Balloon Payment Contract: This contract involves regular monthly installments, but with a large final payment, often called a balloon payment, due at the end of the term. This option may be advantageous for buyers who expect an influx of funds at a specified time, such as the payout of an insurance settlement, tax refund, or an upcoming bonus. 4. Collateral Protection Contract: This particular contract includes additional provisions that ensure the seller's interests are safeguarded. It may include clauses like insurance requirements, maintenance obligations, and remedies for default to protect the seller from potential losses. Regardless of the specific type, it is crucial for both parties to thoroughly review and understand the terms of their Nassau New York Contract for the Sale of Motor Vehicle — Owner Financed with Provisions for Note and Security Agreement before signing it. Seeking legal advice or consultation may be wise to ensure compliance with relevant state laws and regulations.

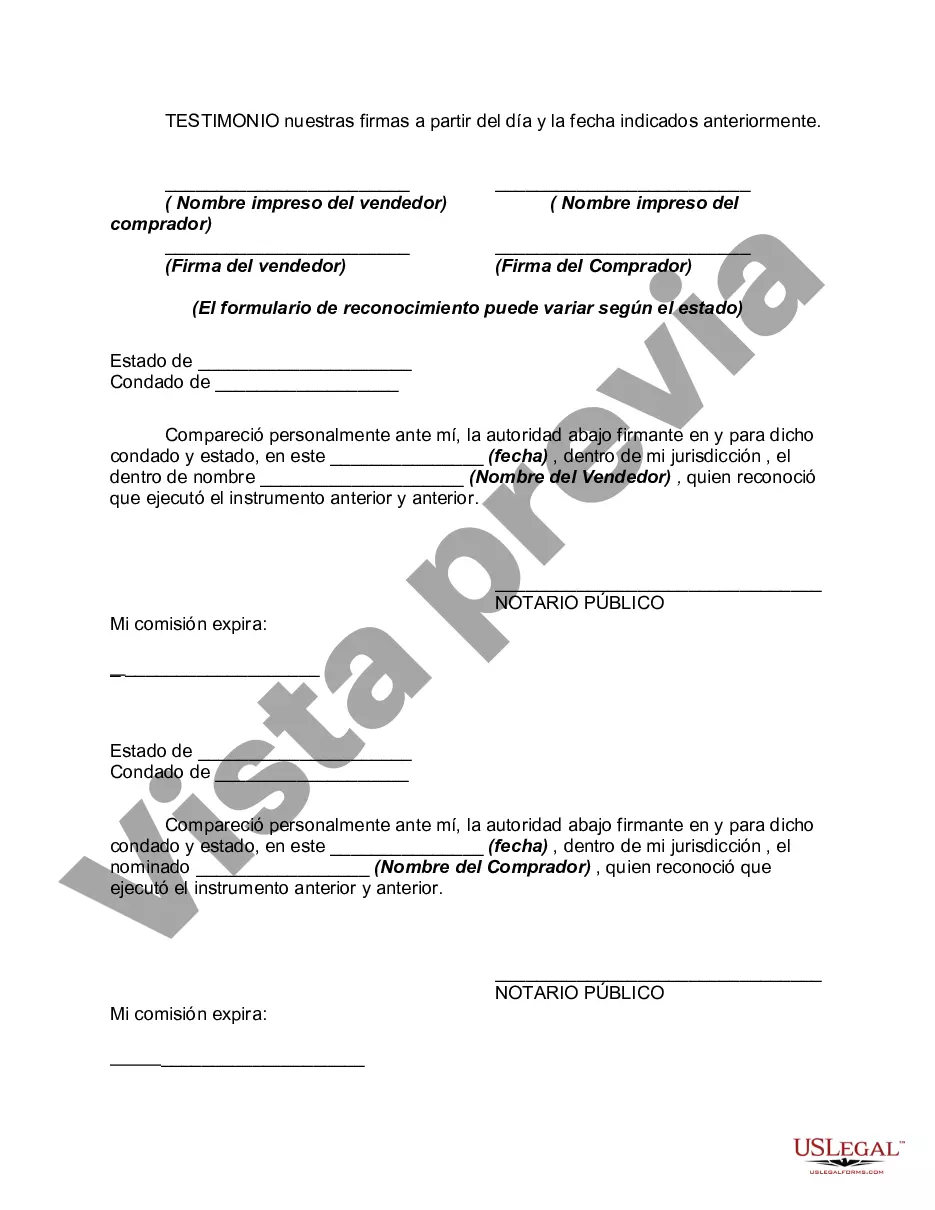

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Nassau New York Contrato de Venta de Vehículo Automotor - Dueño Financiado con Provisiones para Nota y Contrato de Garantía - Contract for the Sale of Motor Vehicle - Owner Financed with Provisions for Note and Security Agreement

Description

How to fill out Nassau New York Contrato De Venta De Vehículo Automotor - Dueño Financiado Con Provisiones Para Nota Y Contrato De Garantía?

How much time does it typically take you to draw up a legal document? Given that every state has its laws and regulations for every life situation, finding a Nassau Contract for the Sale of Motor Vehicle - Owner Financed with Provisions for Note and Security Agreement suiting all local requirements can be stressful, and ordering it from a professional attorney is often expensive. Numerous online services offer the most common state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive online collection of templates, collected by states and areas of use. Apart from the Nassau Contract for the Sale of Motor Vehicle - Owner Financed with Provisions for Note and Security Agreement, here you can get any specific document to run your business or personal deeds, complying with your county requirements. Specialists check all samples for their actuality, so you can be sure to prepare your documentation correctly.

Using the service is pretty straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the required form, and download it. You can get the document in your profile at any moment later on. Otherwise, if you are new to the platform, there will be a few more steps to complete before you get your Nassau Contract for the Sale of Motor Vehicle - Owner Financed with Provisions for Note and Security Agreement:

- Examine the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another document using the related option in the header.

- Click Buy Now once you’re certain in the chosen document.

- Choose the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Nassau Contract for the Sale of Motor Vehicle - Owner Financed with Provisions for Note and Security Agreement.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased document, you can find all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!