Orange County, located in southern California, is home to the vibrant city of Orange. A General Form of Agreement to Incorporate is a legally binding document that outlines the details and requirements for incorporating a business in Orange, California. This agreement sets the foundation for a company's legal structure and provides guidelines for its operations. Incorporating a business in Orange, California presents several benefits, including limited liability protection, tax advantages, and increased credibility. The Orange County General Form of Agreement to Incorporate ensures that all legal and procedural requirements are met during the incorporation process. This agreement covers various key aspects related to incorporating a business in Orange, California. It includes details such as the desired business name, the purpose and activities of the company, the number and types of shares to be issued, the appointment of directors and officers, and the registered office address. The Orange County General Form of Agreement to Incorporate also addresses matters like capital structure, ownership percentages, and the allocation of profits and losses within the company. Additionally, it stipulates the rights and responsibilities of shareholders, as well as guidelines for meetings, voting procedures, and the amendment of the agreement. While there may not be different types of Orange County General Form of Agreement to Incorporate, it is important to note that there are various types of corporations that can be formed in Orange, California. These include: 1. C-Corporation: This is the most common type of corporation in Orange, California, offering limited liability protection to shareholders while allowing the business to raise capital through the sale of stocks. 2. S-Corporation: This type of corporation, also known as a "small business corporation," provides the same limited liability protection as a C-Corporation but is subject to certain restrictions on the number and types of shareholders. 3. Non-Profit Corporation: For organizations aiming to operate for charitable, educational, religious, or scientific purposes, forming a non-profit corporation in Orange, California is an option. This type of corporation is exempt from federal income tax. Regardless of the type of corporation chosen, the Orange County General Form of Agreement to Incorporate is a vital document that lays the groundwork for the legal and operational aspects of the business. It ensures compliance with local laws and regulations while addressing the unique needs and goals of the company.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Orange California Formulario General de Acuerdo para Incorporar - General Form of Agreement to Incorporate

Description

How to fill out Orange California Formulario General De Acuerdo Para Incorporar?

Whether you plan to start your company, enter into an agreement, apply for your ID renewal, or resolve family-related legal issues, you need to prepare certain documentation corresponding to your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and verified legal documents for any individual or business occasion. All files are collected by state and area of use, so picking a copy like Orange General Form of Agreement to Incorporate is quick and straightforward.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you a couple of additional steps to obtain the Orange General Form of Agreement to Incorporate. Adhere to the guidelines below:

- Make certain the sample fulfills your individual needs and state law regulations.

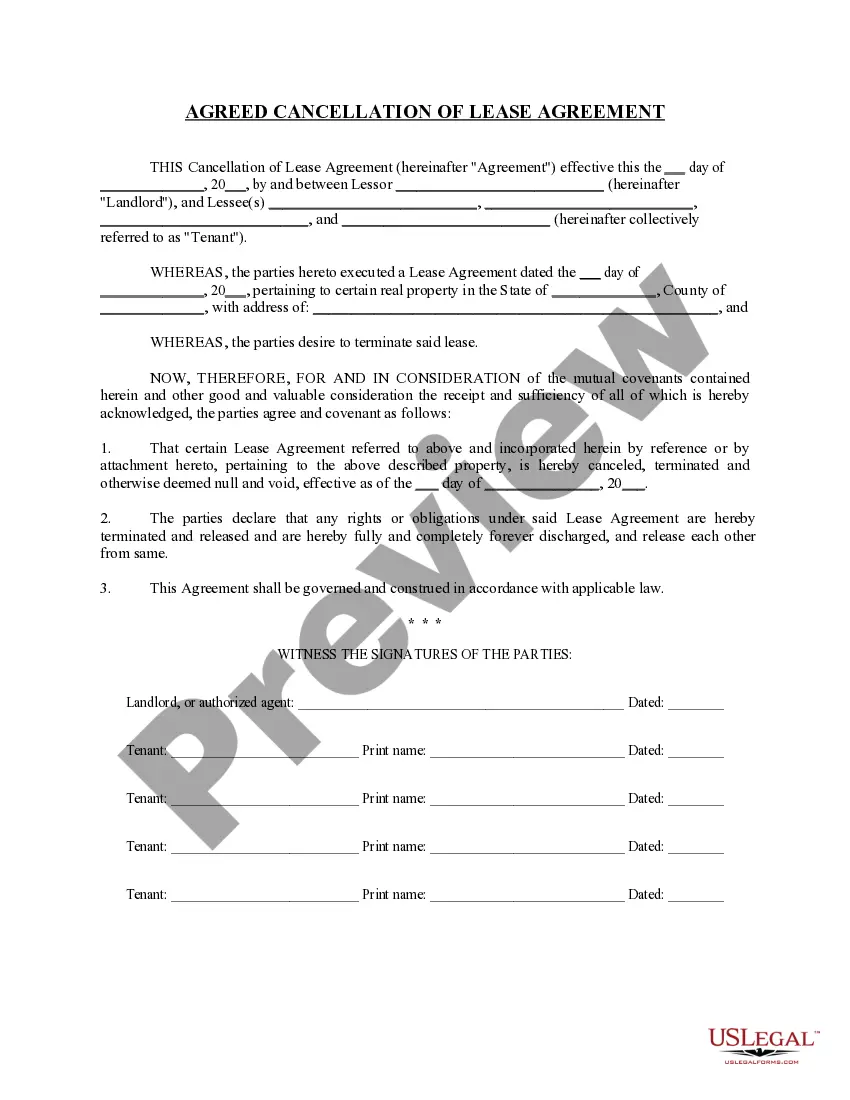

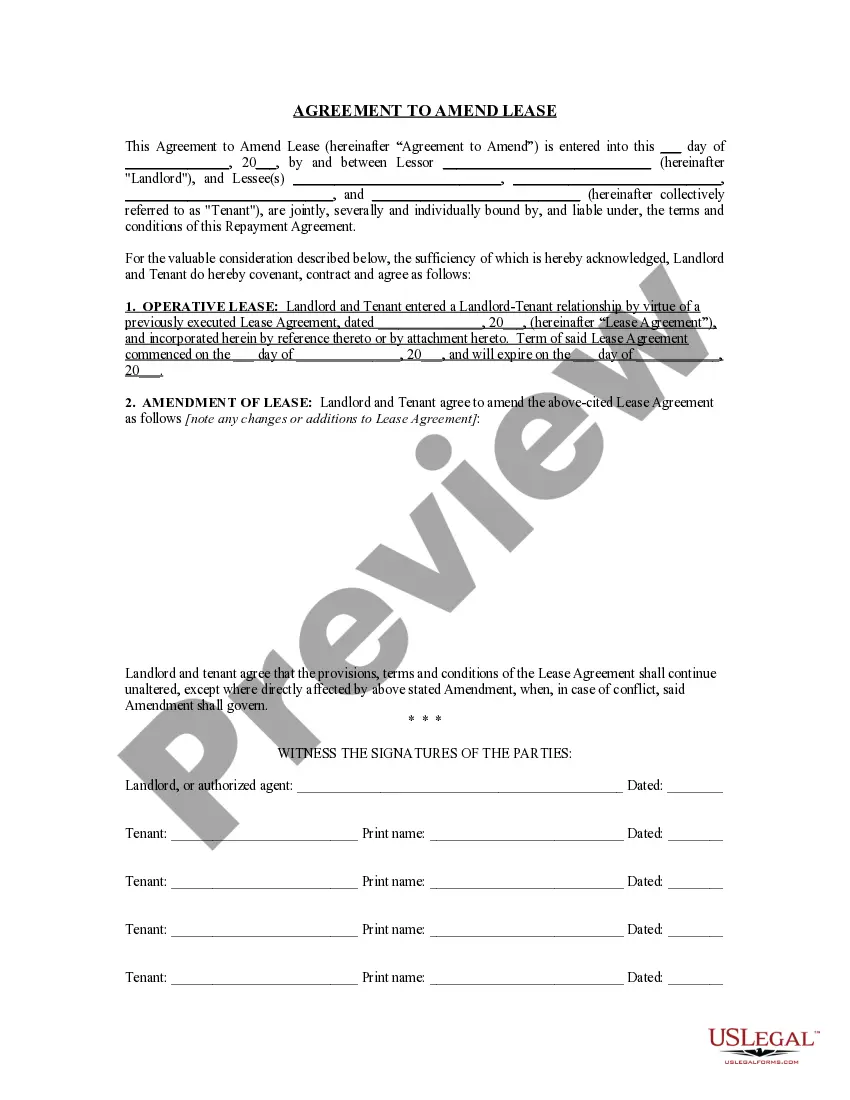

- Look through the form description and check the Preview if available on the page.

- Use the search tab specifying your state above to find another template.

- Click Buy Now to obtain the file once you find the right one.

- Choose the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Orange General Form of Agreement to Incorporate in the file format you need.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our website are multi-usable. Having an active subscription, you can access all of your previously acquired paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form collection!