The Allegheny Pennsylvania Private Annuity Agreement with Payments to Last for Life of Annuitant is a legal contract designed to provide individuals with a secure and reliable source of income throughout their lifetime. This agreement is particularly relevant for those who wish to ensure financial stability and secure their future during retirement. The Allegheny Pennsylvania Private Annuity Agreement is a legally binding contract between two parties: the annuitant and the annuity provider. The annuitant, often an individual reaching retirement age or someone seeking a steady income stream, agrees to transfer assets (such as property or other valuable belongings) to the annuity provider in exchange for lifelong payments. One of the key benefits of this agreement is that it offers a guaranteed income stream for the life of the annuitant. It provides financial security by eliminating concerns about outliving one's savings or investments. The annuity payments are made on a regular basis, typically monthly or annually, ensuring a stable and consistent income. Allegheny Pennsylvania Private Annuity Agreements can be categorized into two main types: fixed private annuity agreements and variable private annuity agreements. 1. Fixed Private Annuity Agreement: In this type of agreement, the annuitant receives a predetermined fixed amount of money at regular intervals, often pre-determined at the start of the agreement. This provides the annuitant with a predictable income and allows for effective financial planning. 2. Variable Private Annuity Agreement: Unlike a fixed private annuity agreement, a variable private annuity agreement allows the annuitant to receive payments that fluctuate based on the performance of the underlying investment assets. This type of annuity agreement offers potential for higher returns, but also involves higher risk compared to a fixed annuity. It is essential to consider factors such as the annuity provider's reputation, financial stability, and the terms and conditions of the agreement when entering into an Allegheny Pennsylvania Private Annuity Agreement. Seeking professional financial advice is highly recommended understanding the implications and make informed decisions regarding this type of agreement. Disclaimer: This content is created for informational purposes only and should not be considered financial or legal advice. It is always recommended consulting with a qualified professional regarding personal financial matters.

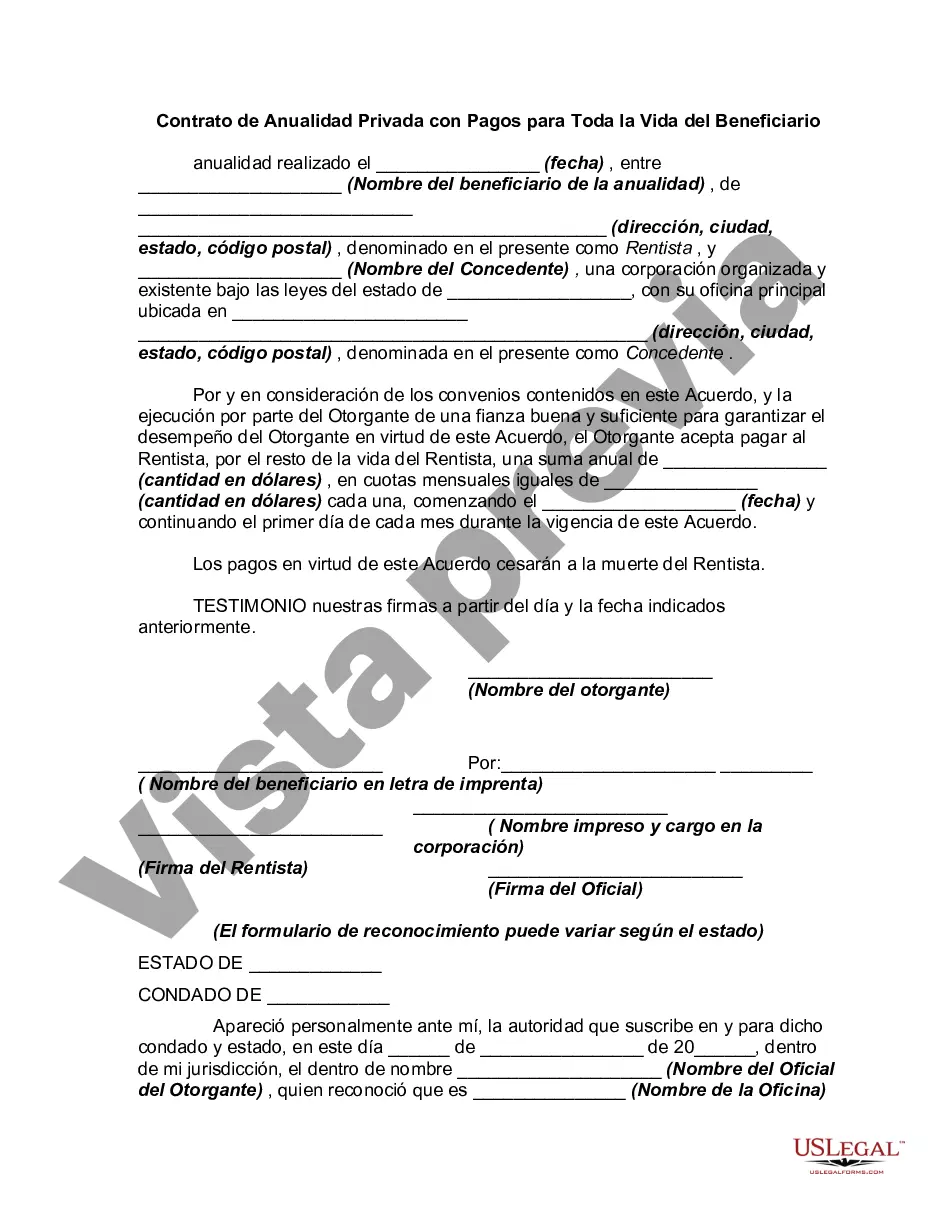

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Allegheny Pennsylvania Contrato de Anualidad Privada con Pagos para Toda la Vida del Beneficiario - Private Annuity Agreement with Payments to Last for Life of Annuitant

Description

How to fill out Allegheny Pennsylvania Contrato De Anualidad Privada Con Pagos Para Toda La Vida Del Beneficiario?

Creating legal forms is a necessity in today's world. Nevertheless, you don't always need to look for professional help to create some of them from scratch, including Allegheny Private Annuity Agreement with Payments to Last for Life of Annuitant, with a service like US Legal Forms.

US Legal Forms has over 85,000 forms to select from in various categories varying from living wills to real estate paperwork to divorce documents. All forms are arranged based on their valid state, making the searching experience less overwhelming. You can also find detailed materials and guides on the website to make any activities associated with paperwork completion simple.

Here's how you can locate and download Allegheny Private Annuity Agreement with Payments to Last for Life of Annuitant.

- Go over the document's preview and description (if available) to get a basic idea of what you’ll get after getting the document.

- Ensure that the template of your choosing is adapted to your state/county/area since state regulations can affect the legality of some documents.

- Check the related document templates or start the search over to locate the appropriate file.

- Hit Buy now and create your account. If you already have an existing one, choose to log in.

- Pick the pricing {plan, then a needed payment gateway, and buy Allegheny Private Annuity Agreement with Payments to Last for Life of Annuitant.

- Select to save the form template in any available file format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the appropriate Allegheny Private Annuity Agreement with Payments to Last for Life of Annuitant, log in to your account, and download it. Of course, our website can’t replace an attorney completely. If you need to deal with an exceptionally challenging case, we recommend getting an attorney to check your form before signing and submitting it.

With over 25 years on the market, US Legal Forms proved to be a go-to platform for many different legal forms for millions of users. Become one of them today and purchase your state-specific paperwork with ease!