Harris Texas Private Annuity Agreement with Payments to Last for Life of Annuitant is a legal and financial contract utilized in estate planning and retirement strategies. This agreement allows an individual, referred to as the annuitant, to transfer assets or property to a trust (usually known as the "annuity trust") in exchange for regular payments for the rest of their life. The Harris Texas Private Annuity Agreement offers several benefits to the annuitant, including tax advantages and the ability to secure a steady income stream throughout their lifetime. This agreement is commonly used to transfer business assets or real estate while ensuring financial security in retirement. There are various types of private annuity agreements available in Harris Texas, tailored to meet individual needs and objectives. These can include: 1. Single Life Annuity: In this type of agreement, the annuitant receives regular payments for the duration of their life. Payments cease upon the annuitant's death, and there is no provision for continued payments to beneficiaries. 2. Joint and Survivor Annuity: This agreement extends annuity payments to multiple individuals, typically a married couple. Payments continue until the death of the last surviving annuitant, ensuring financial support for both partners. 3. Installment Refund Annuity: With this option, any remaining unpaid or deferred value is refunded to the annuitant's beneficiary in case of their premature death, guaranteeing that the estate will receive the full value of the annuity. 4. Cash Refund Annuity: Similar to the installment refund annuity, this type ensures that the annuitant's beneficiary or estate will receive any remaining balance not yet paid out upon their death. However, the difference is that the remaining amount is refunded as a lump sum rather than in installments. The Harris Texas Private Annuity Agreement with Payments to Last for Life of Annuitant provides flexibility, tax advantages, and financial security to individuals seeking to preserve their wealth, retirement income, and transfer assets in a controlled manner. It is essential to consult with qualified professionals, such as estate planning attorneys and financial advisors, to navigate the complexities and ensure the appropriate contract type is selected to meet one's unique goals and circumstances.

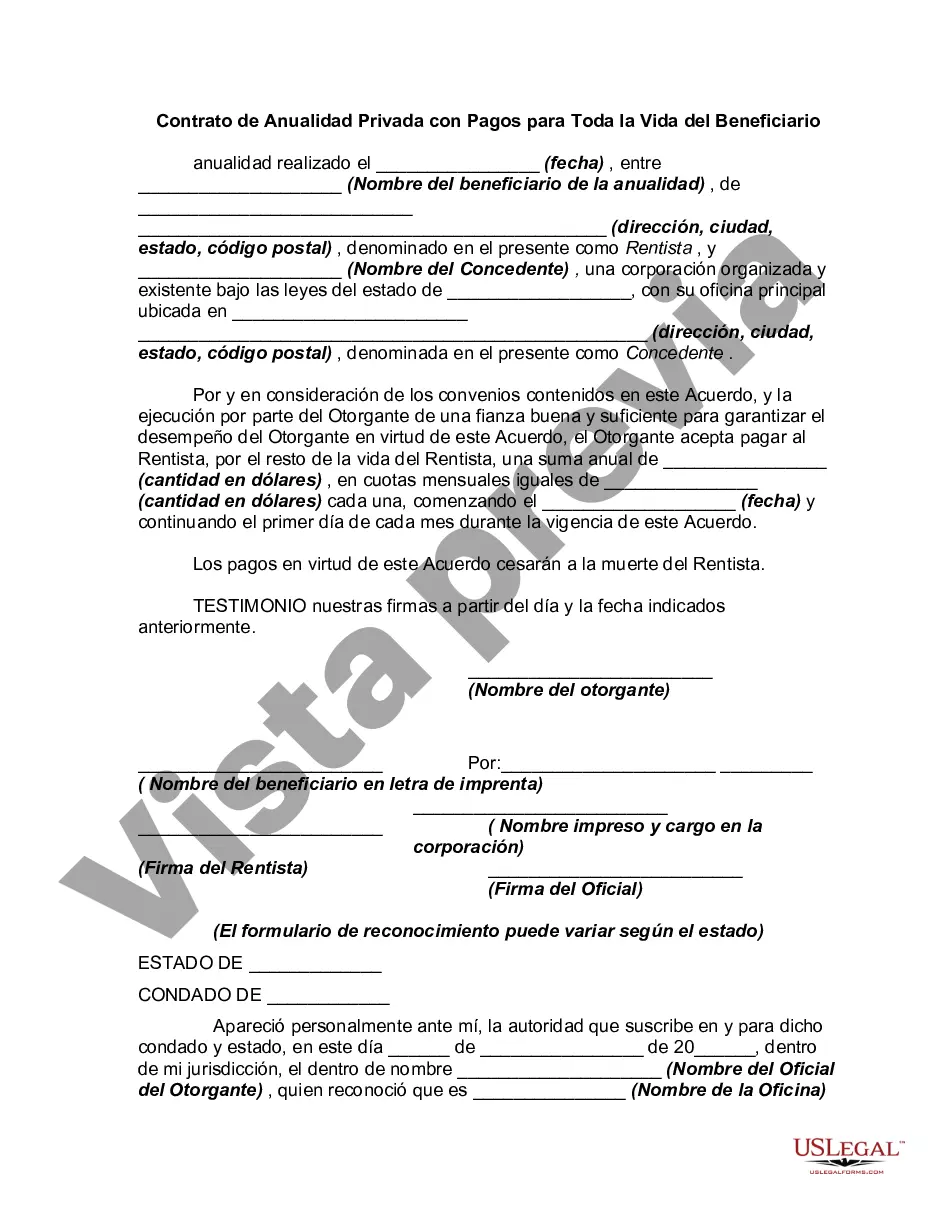

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Harris Texas Contrato de Anualidad Privada con Pagos para Toda la Vida del Beneficiario - Private Annuity Agreement with Payments to Last for Life of Annuitant

Description

How to fill out Harris Texas Contrato De Anualidad Privada Con Pagos Para Toda La Vida Del Beneficiario?

Preparing legal documentation can be cumbersome. In addition, if you decide to ask a lawyer to write a commercial contract, papers for proprietorship transfer, pre-marital agreement, divorce papers, or the Harris Private Annuity Agreement with Payments to Last for Life of Annuitant, it may cost you a lot of money. So what is the most reasonable way to save time and money and draft legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is a perfect solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is biggest online catalog of state-specific legal documents, providing users with the up-to-date and professionally checked templates for any use case gathered all in one place. Consequently, if you need the recent version of the Harris Private Annuity Agreement with Payments to Last for Life of Annuitant, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample with the Download button. If you haven't subscribed yet, here's how you can get the Harris Private Annuity Agreement with Payments to Last for Life of Annuitant:

- Look through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - search for the correct one in the header.

- Click Buy Now when you find the needed sample and pick the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a payment with a credit card or via PayPal.

- Choose the file format for your Harris Private Annuity Agreement with Payments to Last for Life of Annuitant and download it.

Once finished, you can print it out and complete it on paper or import the template to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the paperwork ever obtained many times - you can find your templates in the My Forms tab in your profile. Try it out now!