The Hillsborough Florida Private Annuity Agreement with Payments to Last for Life of Annuitant is a type of annuity contract that provides secure and lifelong income to the annuitant. It is designed for individuals who are seeking a reliable source of income during retirement, offering financial stability and peace of mind. The agreement works by transferring assets, such as real estate or business interests, to a private annuity trust. In return, the annuitant receives regular payments for the rest of their life. These payments can be customized to meet the annuitant's specific financial needs and can be made monthly, quarterly, or annually. There are a few different types of Private Annuity Agreements available in Hillsborough, Florida, each tailored to specific circumstances: 1. Fixed-term Private Annuity Agreement: This type of annuity agreement guarantees payments for a predetermined duration, such as 10, 15, or 20 years. After the agreed-upon term ends, the payments cease. 2. Joint and Survivor Private Annuity Agreement: This agreement offers lifetime payments to both the annuitant and their spouse. Upon the death of either party, the surviving spouse continues to receive the annuity payments for the rest of their life. 3. Indexed Private Annuity Agreement: With this type of agreement, the annuity payments are linked to a specific index, such as the Consumer Price Index (CPI). As the index fluctuates, the annuity payments are adjusted accordingly to help offset inflation and maintain the annuitant's purchasing power over time. 4. Variable Private Annuity Agreement: This agreement allows the annuitant to invest their assets in various investment options, such as stocks, bonds, or mutual funds. The annuity payments will vary depending on the performance of the underlying investments, providing the potential for growth but also exposing the annuitant to market risks. The Hillsborough Florida Private Annuity Agreement with Payments to Last for Life of Annuitant is an attractive option for individuals who wish to transfer assets and secure a guaranteed income stream for their retirement years. It offers flexibility, financial protection, and the potential for estate planning benefits. It is advisable to consult with a financial advisor or an expert in estate planning to determine which type of Private Annuity Agreement best suits your unique situation and goals.

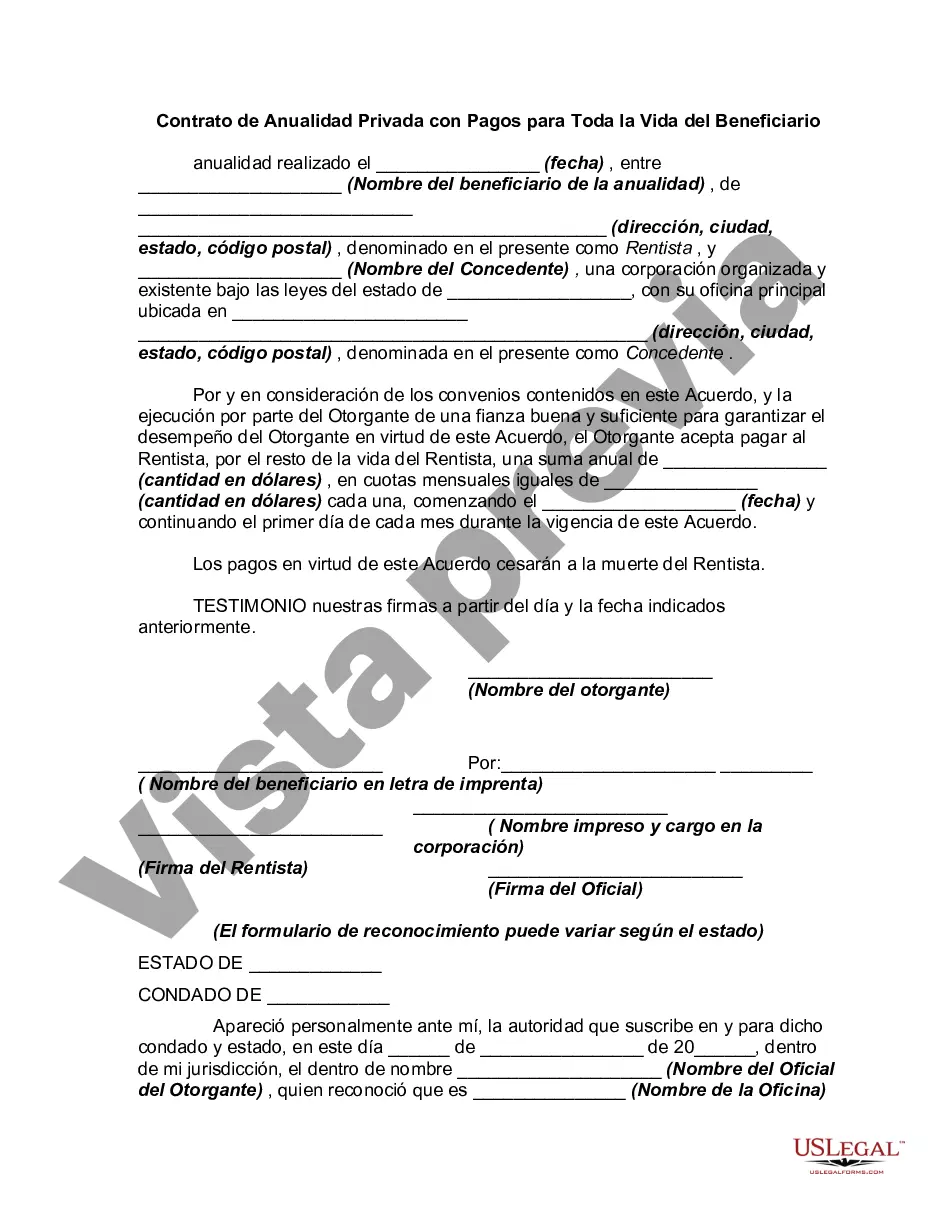

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Hillsborough Florida Contrato de Anualidad Privada con Pagos para Toda la Vida del Beneficiario - Private Annuity Agreement with Payments to Last for Life of Annuitant

Description

How to fill out Hillsborough Florida Contrato De Anualidad Privada Con Pagos Para Toda La Vida Del Beneficiario?

Are you looking to quickly create a legally-binding Hillsborough Private Annuity Agreement with Payments to Last for Life of Annuitant or probably any other document to manage your personal or business matters? You can go with two options: hire a legal advisor to draft a legal document for you or create it completely on your own. Thankfully, there's an alternative option - US Legal Forms. It will help you get professionally written legal papers without having to pay unreasonable fees for legal services.

US Legal Forms provides a rich collection of over 85,000 state-compliant document templates, including Hillsborough Private Annuity Agreement with Payments to Last for Life of Annuitant and form packages. We offer documents for an array of use cases: from divorce papers to real estate documents. We've been out there for over 25 years and got a spotless reputation among our customers. Here's how you can become one of them and obtain the necessary document without extra troubles.

- First and foremost, carefully verify if the Hillsborough Private Annuity Agreement with Payments to Last for Life of Annuitant is tailored to your state's or county's regulations.

- If the form includes a desciption, make sure to check what it's intended for.

- Start the search over if the form isn’t what you were hoping to find by using the search bar in the header.

- Select the subscription that best fits your needs and move forward to the payment.

- Choose the format you would like to get your form in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already set up an account, you can easily log in to it, find the Hillsborough Private Annuity Agreement with Payments to Last for Life of Annuitant template, and download it. To re-download the form, simply head to the My Forms tab.

It's effortless to find and download legal forms if you use our services. Moreover, the documents we provide are updated by industry experts, which gives you greater peace of mind when writing legal matters. Try US Legal Forms now and see for yourself!