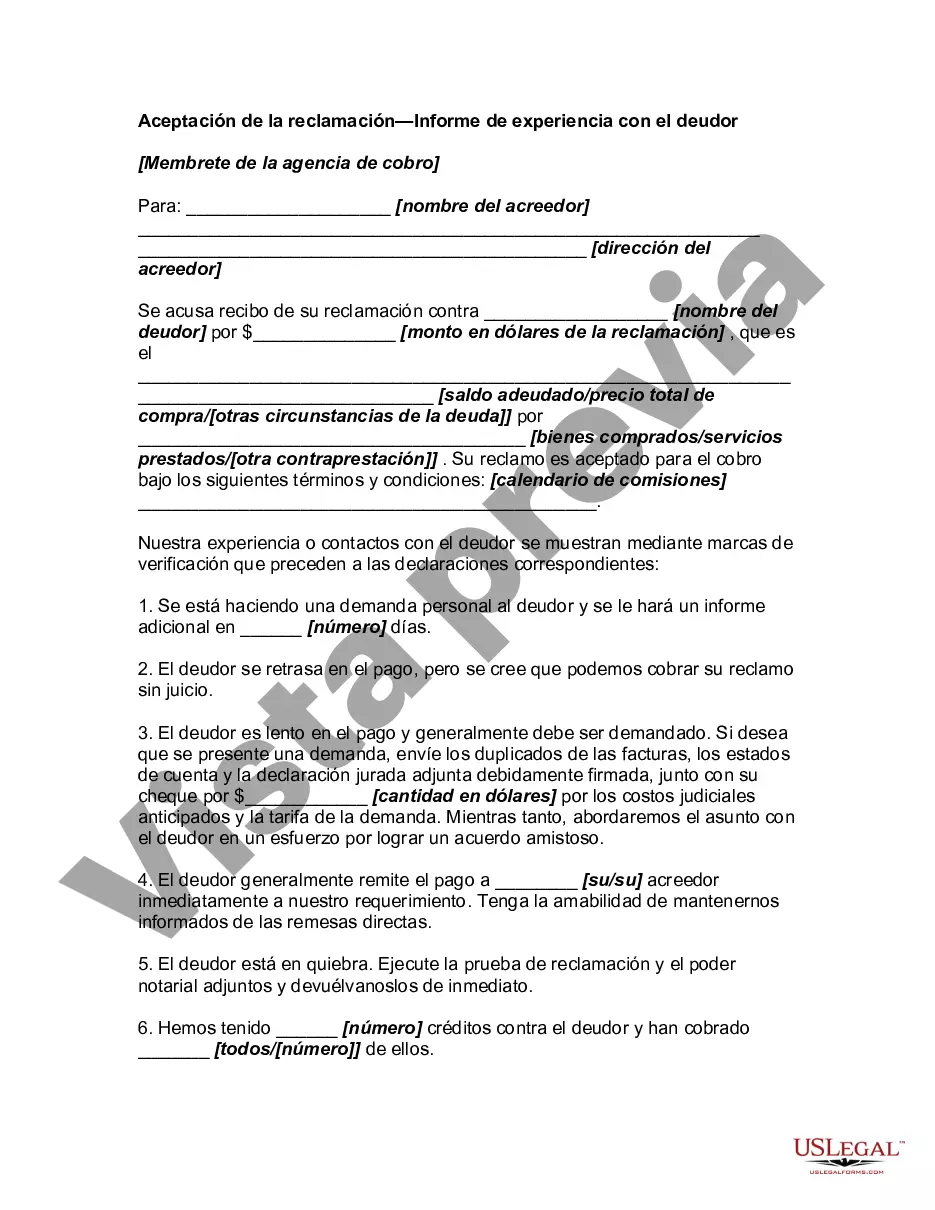

Title: Allegheny, Pennsylvania: Acceptance of Claim by Collection Agency and Report of Experience with Debtor Keywords: Allegheny, Pennsylvania, collection agency, claim acceptance, debtor report, debt collection, debt recovery, financial management agency, credit score, debt settlement, debt negotiation Introduction: In Allegheny, Pennsylvania, individuals and businesses often rely on collection agencies to assist in the recovery of unpaid debts. These agencies play a crucial role in the financial management ecosystem, aiding creditors by accepting claims and taking necessary actions to resolve outstanding debts. This article will delve into Allegheny Pennsylvania's acceptance of claims by collection agencies and delve into the process of reporting experiences with debtors. Types of Allegheny, Pennsylvania Acceptance of Claim by Collection Agency and Report of Experience with Debtor: 1. Financial Management Agency Services: Allegheny boasts various reputable collection agencies that specialize in debt recovery and financial management services. These agencies work as intermediaries between creditors and debtors, collecting overdue payments while adhering to state and federal regulations. Their teams of skilled professionals are well-versed in navigating the legal aspects of debt recovery and providing effective solutions. 2. Claim Acceptance and Processing: When a creditor submits a claim to a collection agency in Allegheny, it typically involves detailed information about the debtor, including contact details, debt amount, and background information. The collection agency then evaluates the legitimacy of the claim, verifying the provided information and assessing its potential for successful recovery. If the claim meets the agency's criteria, it is accepted for further action. 3. Debtor Report and Credit Score Impact: Collection agencies maintain comprehensive debtor records, including detailed reports on individuals or businesses with outstanding debts. These reports are vital for assessing a debtor's creditworthiness, as they reflect on their credit history, payment patterns, and any negotiations or settlements made. Lenders and financial institutions often refer to these reports when making decisions related to loans and credit offers. 4. Debt Settlement and Negotiation: In addition to accepting claims, collection agencies in Allegheny work towards achieving debt settlements with debtors. They actively engage in negotiations with debtors, aiming to establish feasible repayment plans or reach mutually agreeable settlement amounts. These negotiations, when successful, result in debtors paying off a portion of their debts, relieving financial burdens, and rebuilding their credit profiles. 5. Compliance with Legal Regulations: Allegheny's collection agencies must adhere to state and federal laws governing debt collection practices. The Fair Debt Collection Practices Act (FD CPA) sets guidelines that protect consumers from abusive, deceptive, or unfair debt collection practices. Agencies must ensure full compliance with these regulations, treating debtors fairly and promoting ethical debt collection practices. Conclusion: In Allegheny, Pennsylvania, the acceptance of claims by collection agencies plays a crucial role in debt recovery and financial management. These agencies employ qualified professionals who assist creditors in recovering outstanding debts and provide comprehensive reports on debtor experiences. By adhering to legal regulations and employing effective debt negotiation strategies, collection agencies play a vital role in balancing the interests of both creditors and debtors in Allegheny's financial landscape.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Allegheny Pennsylvania Aceptación de Reclamo por Agencia de Cobranza e Informe de Experiencia con Deudor - Acceptance of Claim by Collection Agency and Report of Experience with Debtor

Description

How to fill out Allegheny Pennsylvania Aceptación De Reclamo Por Agencia De Cobranza E Informe De Experiencia Con Deudor?

Whether you plan to open your business, enter into an agreement, apply for your ID renewal, or resolve family-related legal concerns, you must prepare certain paperwork corresponding to your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and checked legal templates for any personal or business occurrence. All files are collected by state and area of use, so picking a copy like Allegheny Acceptance of Claim by Collection Agency and Report of Experience with Debtor is quick and easy.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you a couple of additional steps to get the Allegheny Acceptance of Claim by Collection Agency and Report of Experience with Debtor. Adhere to the guidelines below:

- Make certain the sample fulfills your personal needs and state law requirements.

- Look through the form description and check the Preview if there’s one on the page.

- Use the search tab specifying your state above to find another template.

- Click Buy Now to obtain the file when you find the correct one.

- Select the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Allegheny Acceptance of Claim by Collection Agency and Report of Experience with Debtor in the file format you prefer.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our website are multi-usable. Having an active subscription, you are able to access all of your previously acquired paperwork at any time in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documentation. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!