Chicago Illinois Acceptance of Claim by Collection Agency and Report of Experience with Debtor In Chicago, Illinois, the acceptance of claim by a collection agency and the subsequent report of experience with a debtor play crucial roles in the debt collection process. These activities are of utmost significance in ensuring the smooth functioning of debt recovery and maintaining a healthy financial ecosystem. In this detailed description, we will explore the different types and aspects of Chicago Illinois acceptance of claim by collection agency and report of experience with debtor. 1. Acceptance of Claim by Collection Agency: When a creditor is unable to collect outstanding debts, they often seek the assistance of a collection agency. The acceptance of claim by a collection agency denotes the moment when a creditor entrusts their unpaid debt to a professional collection agency for recovery. This acceptance indicates that the collection agency is authorized to take appropriate measures, as per the legal requirements and debt collection guidelines, to recover the debt on behalf of the creditor. Types of Acceptance of Claim: — Legal Documentation: The acceptance of claim typically involves legal paperwork, such as a written agreement or contract between the creditor and collection agency. This document outlines the terms and conditions, fees, and responsibilities of both parties. — Verification of Debt: The collection agency validates the legitimacy of the debt, confirming details such as the debtor's identity, outstanding balance, and any associated documentation. — Transfer of Information: The creditor provides essential information regarding the debtor, including contact details, payment history, and any existing payment arrangements. 2. Report of Experience with Debtor: Once the claim has been accepted by the collection agency, they begin their pursuit of debt recovery. During this process, the agency maintains detailed records of their experience with the debtor. This report of experience serves multiple purposes, including: Types of Report of Experience: — Communication History: The collection agency documents all communication attempts made with the debtor, recording dates, times, and outcomes of conversations or interactions. — Payment Arrangements: If a debtor agrees to a payment plan, the collection agency notes the agreed-upon terms, including payment amounts, due dates, and any down payment made. — Collection Progress: The report of experience also includes updates on the progress made in terms of debt recovery. This may involve regular status updates, notifications of partial payments received, or instances where legal action has been pursued. Keywords: Chicago, Illinois, acceptance of claim, collection agency, report of experience, debtor, debt recovery, outstanding debts, legal requirements, documentation, validation of debt, transfer of information, communication history, payment arrangements, collection progress. In conclusion, the acceptance of claim by a collection agency and subsequent report of experience with a debtor are critical steps in the debt collection process in Chicago, Illinois. These procedures help streamline debt recovery efforts, maintain accurate records, and ensure effective communication between all parties involved.

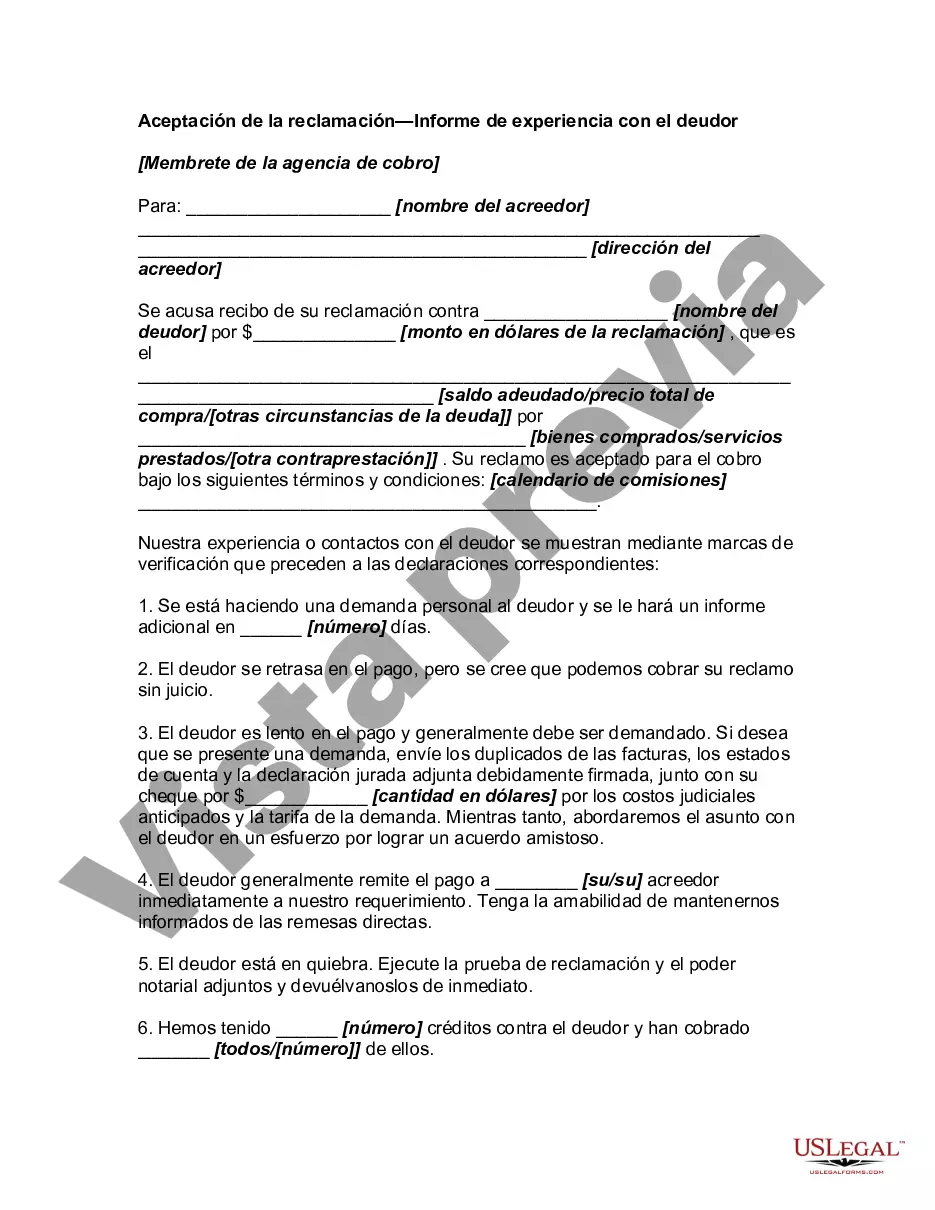

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Chicago Illinois Aceptación de Reclamo por Agencia de Cobranza e Informe de Experiencia con Deudor - Acceptance of Claim by Collection Agency and Report of Experience with Debtor

Description

How to fill out Chicago Illinois Aceptación De Reclamo Por Agencia De Cobranza E Informe De Experiencia Con Deudor?

Drafting documents for the business or personal needs is always a big responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's essential to consider all federal and state laws of the specific area. However, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it burdensome and time-consuming to create Chicago Acceptance of Claim by Collection Agency and Report of Experience with Debtor without professional help.

It's easy to avoid wasting money on attorneys drafting your documentation and create a legally valid Chicago Acceptance of Claim by Collection Agency and Report of Experience with Debtor on your own, using the US Legal Forms web library. It is the most extensive online catalog of state-specific legal documents that are professionally cheched, so you can be certain of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to save the needed form.

In case you still don't have a subscription, adhere to the step-by-step instruction below to obtain the Chicago Acceptance of Claim by Collection Agency and Report of Experience with Debtor:

- Examine the page you've opened and verify if it has the sample you require.

- To accomplish this, use the form description and preview if these options are presented.

- To find the one that satisfies your needs, utilize the search tab in the page header.

- Recheck that the template complies with juridical standards and click Buy Now.

- Select the subscription plan, then sign in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever purchased never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and quickly get verified legal forms for any scenario with just a couple of clicks!