Collin Texas Acceptance of Claim by Collection Agency and Report of Experience with Debtor Collin, Texas, a rapidly growing county located in the Dallas-Fort Worth retroflex, is home to many businesses and individuals who may find themselves dealing with the complexities of debt collection. When a creditor is unable to collect on a debt directly, they often turn to a collection agency for assistance. One important step in this process is the acceptance of the claim. The acceptance of claim by a collection agency is a formal acknowledgment from the agency that they have agreed to take on the responsibility of collecting a debt on behalf of the creditor. This agreement outlines the terms and conditions under which the agency will operate, including any associated fees or percentages of the collected amount that may be charged. It is crucial for both the creditor and the collection agency to have a clear understanding of these terms to ensure a smooth debt recovery process. In Collin, Texas, there are different types of acceptance of claim by collection agency and report of experience with debtor. Some key variations include: 1. Commercial debt acceptance of claim: This type of acceptance of claim focuses on the collection of debts between businesses. Commercial creditors, such as suppliers or service providers, often seek assistance from collection agencies when their clients fail to pay their outstanding invoices. The report of experience with debtors in this context would provide detailed information about the debtor's payment history, including any disputes, late payments, or non-payment issues. 2. Consumer debt acceptance of claim: Consumer debt acceptance of claim involves the collection of debts between individuals, such as unpaid credit card bills, medical bills, or personal loans. Collection agencies specializing in consumer debt recovery help individuals navigate the complexities of debt collection, ensuring fair treatment and adherence to applicable regulations. The report of experience with debtors in this scenario would outline the debtor's previous payment behavior, any attempts made to collect the debt, and any additional relevant documentation required for legal action. 3. Legal debt acceptance of claim: This type of acceptance of claim deals specifically with debts that require legal action to be pursued. It could include debts resulting from contract disputes, non-payment of rent, or other significant financial obligations. The report of experience with debtors in this case would detail any legal proceedings initiated, court judgments obtained, or any other pertinent information concerning the debtor's financial responsibilities. Regardless of the type of acceptance of claim by collection agency or the report of experience with debtors, it is essential for both parties to adhere to the laws and regulations governing debt collection practices. Collin, Texas, enforces strict rules to protect debtors from harassment or unfair treatment during the debt recovery process. In conclusion, Collin, Texas, acceptance of claim by collection agency and report of experience with debtor plays a vital role in facilitating effective debt collection. It is essential for creditors and collection agencies to fully understand the terms of the acceptance agreement and accurately report the debtor's experience to ensure a fair and legally compliant process.

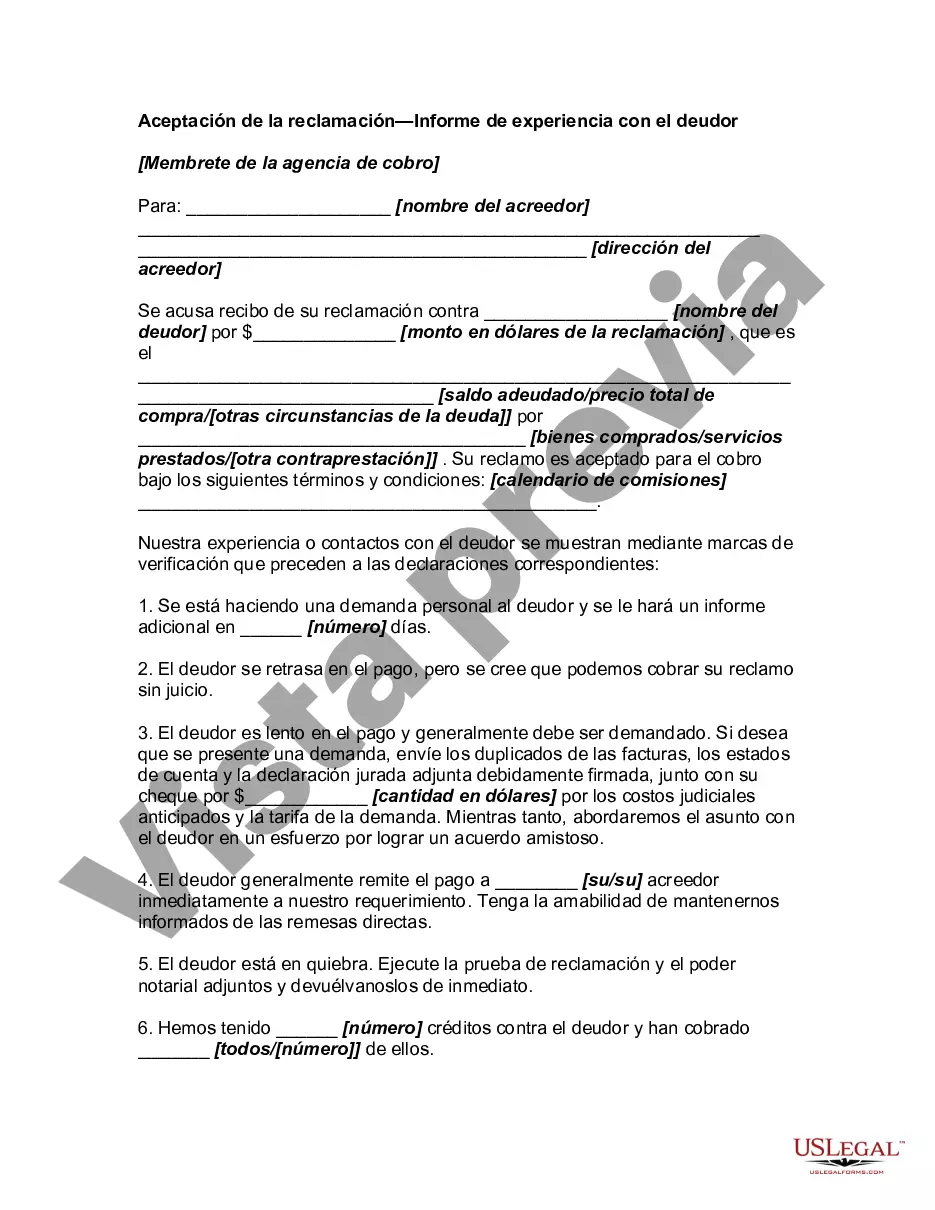

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Collin Texas Aceptación de Reclamo por Agencia de Cobranza e Informe de Experiencia con Deudor - Acceptance of Claim by Collection Agency and Report of Experience with Debtor

Description

How to fill out Collin Texas Aceptación De Reclamo Por Agencia De Cobranza E Informe De Experiencia Con Deudor?

Preparing legal paperwork can be difficult. In addition, if you decide to ask an attorney to write a commercial agreement, papers for proprietorship transfer, pre-marital agreement, divorce papers, or the Collin Acceptance of Claim by Collection Agency and Report of Experience with Debtor, it may cost you a lot of money. So what is the most reasonable way to save time and money and draft legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is an excellent solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is the most extensive online library of state-specific legal documents, providing users with the up-to-date and professionally checked templates for any scenario accumulated all in one place. Consequently, if you need the latest version of the Collin Acceptance of Claim by Collection Agency and Report of Experience with Debtor, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample with the Download button. If you haven't subscribed yet, here's how you can get the Collin Acceptance of Claim by Collection Agency and Report of Experience with Debtor:

- Look through the page and verify there is a sample for your area.

- Examine the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - search for the right one in the header.

- Click Buy Now once you find the required sample and select the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a payment with a credit card or via PayPal.

- Choose the file format for your Collin Acceptance of Claim by Collection Agency and Report of Experience with Debtor and save it.

Once finished, you can print it out and complete it on paper or import the template to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the documents ever acquired multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!