Harris Texas Acceptance of Claim by Collection Agency and Report of Experience with Debtor In Harris Texas, the Acceptance of Claim by Collection Agency and Report of Experience with Debtor is a legal process undertaken by a collection agency to acknowledge a claim filed against a debtor and provide a detailed account of their experience in attempting to collect the debt. This formal procedure helps document the agency's efforts while following the applicable laws and regulations. There are various types of Acceptance of Claim by Collection Agency and Report of Experience with Debtor, such as: 1. Commercial Debt Collection: This type involves collection agencies specializing in business-to-business (B2B) transactions. Collection agencies handle outstanding debts, late payments, or defaulting accounts owed by one business to another. 2. Consumer Debt Collection: Consumer debt collection focuses on individuals who owe money to creditors. Collection agencies dealing with consumer debts may include credit card debts, medical bills, personal loans, or unpaid utilities. 3. Medical Debt Collection: This particular area of collection agency services focuses on recovering outstanding medical bills owed by patients to healthcare facilities, hospitals, doctors, or other healthcare providers. 4. Legal Collections: Some collection agencies specialize in legal collections, assisting legal firms or debt buyers in recovering debts associated with judgments, court orders, or other legal processes. When the Acceptance of Claim by Collection Agency and Report of Experience with Debtor is initiated, key keywords that might be relevant include: — Harris County, Texas: Referring to the specific jurisdiction where the claim and debt collection are taking place. This jurisdiction determines the applicable laws, rules, and procedures surrounding debt collection efforts. — Acceptance of Claim: This term signifies that the collection agency recognizes and acknowledges the claim filed against the debtor. — Collection Agency: A licensed entity authorized to pursue the collection of outstanding debts on behalf of the original creditor. — Report of Experience with Debtor: This report outlines the collection agency's activities and experiences, including communication attempts, payment negotiations, legal proceedings, and any other relevant actions undertaken during the debt collection process. — Debtor: The individual or business entity who owes money and is subject to debt collection activities. — Creditor: The original entity or person to whom the debt is owed. The creditor typically hires a collection agency to assist in recovering the owed amount. — Compliance: Referring to the collection agency's adherence to local, state, and federal regulations governing debt collection practices, ensuring fair treatment, and avoiding unlawful activities. — Fair Debt Collection PracticeActedFPAPAPA): A federal law in the United States that outlines rules and regulations governing the debt collection industry and prohibits abusive, unfair, or deceptive practices. In conclusion, the process of Harris Texas Acceptance of Claim by Collection Agency and Report of Experience with Debtor involves recognizing and documenting the outstanding debt, along with the collection agency's experiences in attempting debt recovery. Different types of debt collection specialized services are tailored to specific industries, such as commercial, consumer, medical, or legal collections. Understanding the relevant keywords assists in presenting a detailed and accurate description of this complex process while remaining compliant with applicable debt collection laws.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Harris Texas Aceptación de Reclamo por Agencia de Cobranza e Informe de Experiencia con Deudor - Acceptance of Claim by Collection Agency and Report of Experience with Debtor

Description

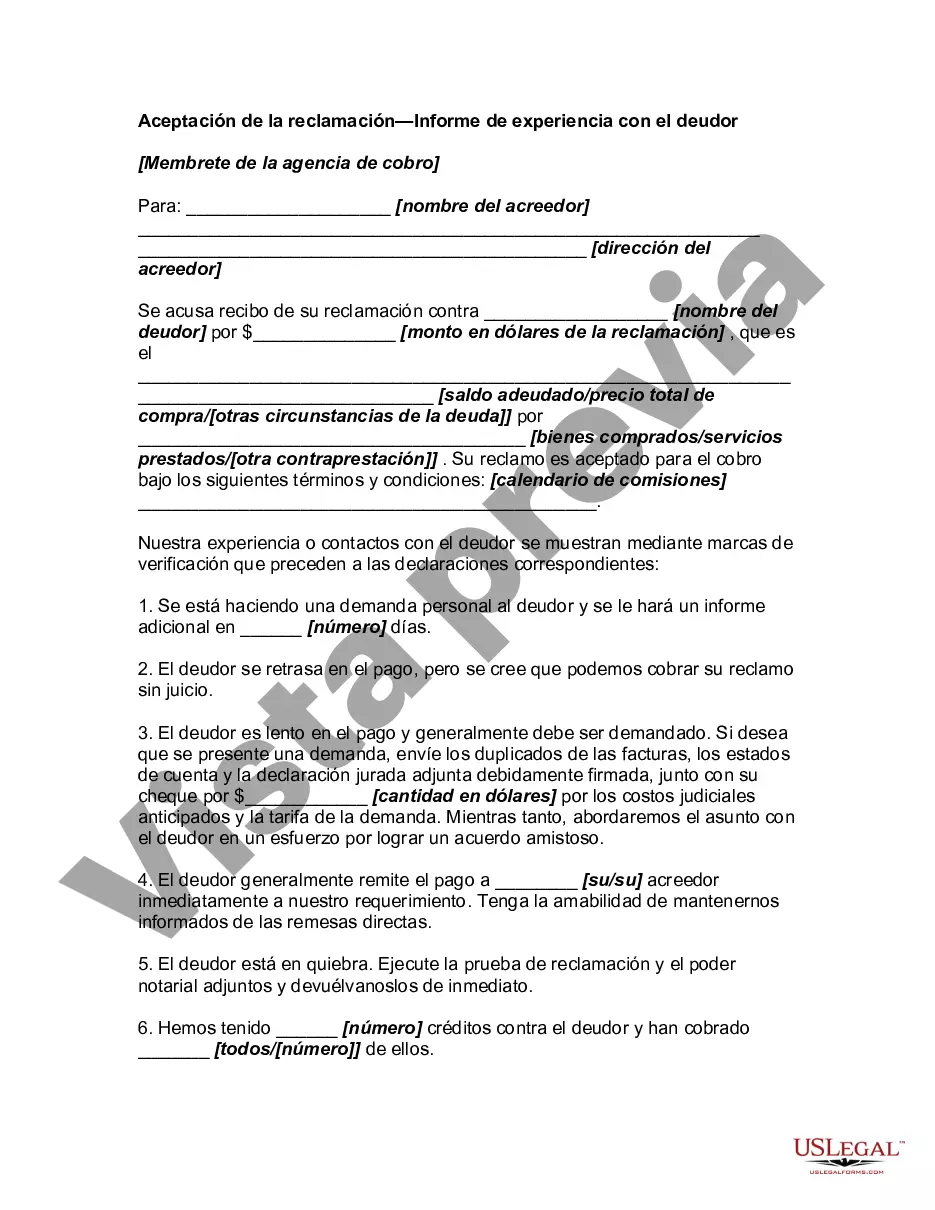

How to fill out Harris Texas Aceptación De Reclamo Por Agencia De Cobranza E Informe De Experiencia Con Deudor?

Dealing with legal forms is a must in today's world. However, you don't always need to look for qualified assistance to create some of them from the ground up, including Harris Acceptance of Claim by Collection Agency and Report of Experience with Debtor, with a platform like US Legal Forms.

US Legal Forms has over 85,000 templates to pick from in various categories ranging from living wills to real estate paperwork to divorce documents. All forms are arranged based on their valid state, making the searching experience less challenging. You can also find information resources and tutorials on the website to make any activities related to paperwork completion simple.

Here's how to purchase and download Harris Acceptance of Claim by Collection Agency and Report of Experience with Debtor.

- Go over the document's preview and outline (if provided) to get a general information on what you’ll get after getting the form.

- Ensure that the document of your choosing is specific to your state/county/area since state regulations can affect the validity of some records.

- Examine the similar document templates or start the search over to find the correct file.

- Hit Buy now and register your account. If you already have an existing one, choose to log in.

- Choose the option, then a needed payment gateway, and purchase Harris Acceptance of Claim by Collection Agency and Report of Experience with Debtor.

- Select to save the form template in any available format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the appropriate Harris Acceptance of Claim by Collection Agency and Report of Experience with Debtor, log in to your account, and download it. Of course, our website can’t take the place of a legal professional entirely. If you need to deal with an exceptionally challenging situation, we advise getting an attorney to check your document before executing and filing it.

With over 25 years on the market, US Legal Forms proved to be a go-to platform for various legal forms for millions of customers. Become one of them today and get your state-compliant paperwork effortlessly!