Houston, Texas, located in the southeastern part of the state, is a bustling city known for its diverse culture, vibrant economy, and rich history. It is one of the largest cities in the United States and the fourth-largest in terms of population. When it comes to the collection agency industry in Houston, the Acceptance of Claim by Collection Agency and Report of Experience with Debtor play a crucial role. These documents pertain to the processes and procedures surrounding debt collection efforts carried out by collection agencies. The Acceptance of Claim by Collection Agency is a formal acknowledgment made by the agency that they have taken on the responsibility of collecting a debt on behalf of the original creditor. This document establishes a legal relationship between the collection agency and the creditor, setting the groundwork for future interactions with the debtor. In Houston, there are different types of Acceptance of Claim by Collection Agency, including: 1. Commercial Debt Acceptance: This type of acceptance deals with the collection of business-related debts, such as unpaid invoices, outstanding loans, or overdue payments from commercial entities. 2. Consumer Debt Acceptance: Consumer debt acceptance involves the collection of debts owed by individuals, such as credit card bills, medical expenses, or personal loans. On the other hand, the Report of Experience with Debtor is a document provided by the collection agency to the original creditor. It outlines the agency's efforts taken to collect the debt, including any communications with the debtor, payment arrangements made, or any legal actions initiated. The report serves as an update for the creditor and helps them evaluate the performance of the collection agency. In Houston, different types of Report of Experience with Debtor that collection agencies may issue include: 1. Initial Report: This report is typically generated when the collection agency first takes on the debt and provides an overview of the debtor's contact information, outstanding balance, and any initial actions taken. 2. Progress Report: These reports are periodic updates that collection agencies provide to the original creditors. They outline the progress made in collecting the debt, including any attempts at negotiation, demand letters sent, or payment arrangements established. 3. Final Report: A final report is generated once the collection agency has exhausted all efforts to collect the debt. It includes a summary of the actions taken, outcomes achieved, and the agency's recommendation for further steps, such as legal action or debt write-off. In conclusion, Houston, Texas, acts as a hub for collection agency activities, with the Acceptance of Claim by Collection Agency and Report of Experience with Debtor being critical documents involved in the debt collection process. These documents help establish legal relationships, outline progress made, and evaluate the effectiveness of debt collection efforts. Different types of acceptance and report documents exist, catering to commercial and consumer debts, providing creditors with updates on debtor interactions.

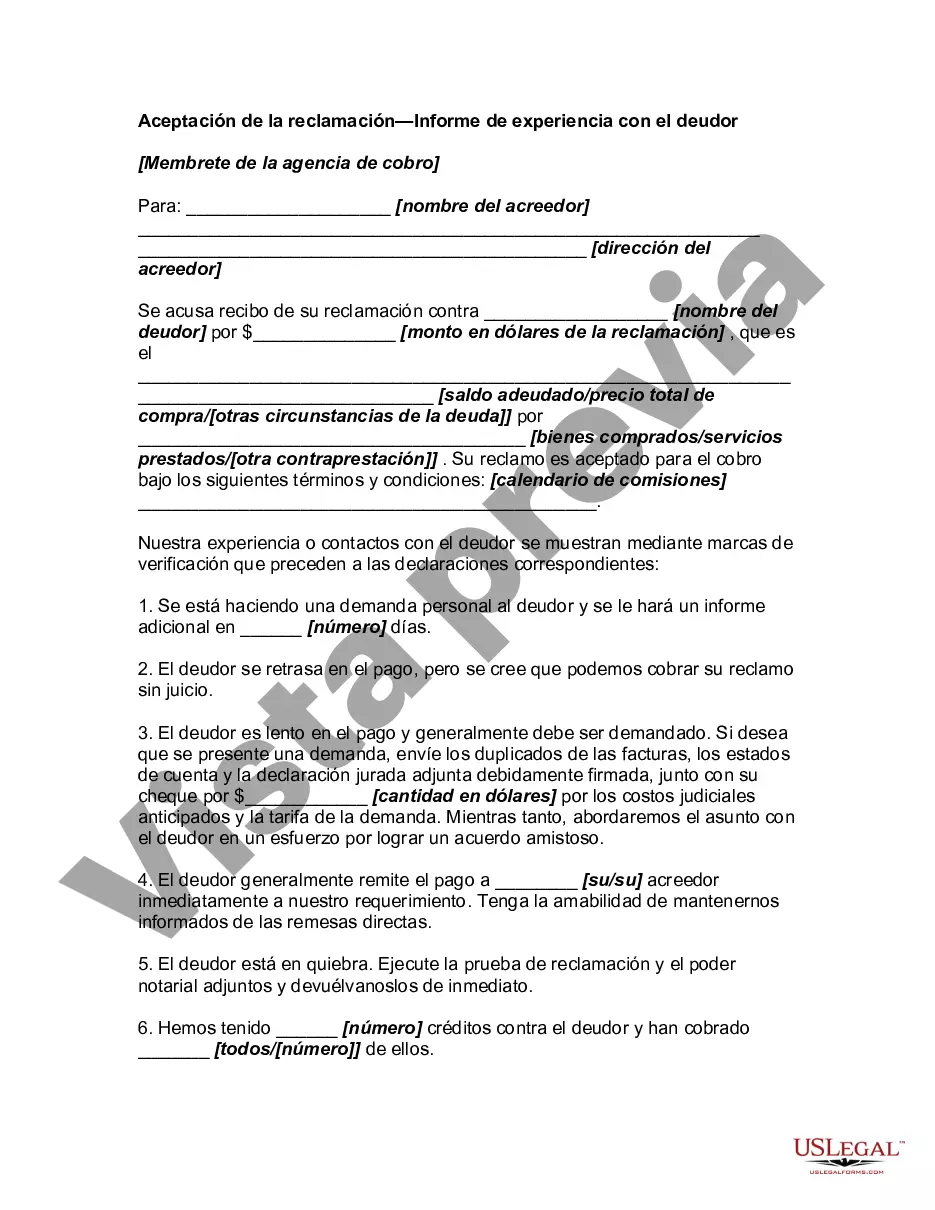

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Houston Texas Aceptación de Reclamo por Agencia de Cobranza e Informe de Experiencia con Deudor - Acceptance of Claim by Collection Agency and Report of Experience with Debtor

Description

How to fill out Houston Texas Aceptación De Reclamo Por Agencia De Cobranza E Informe De Experiencia Con Deudor?

Draftwing paperwork, like Houston Acceptance of Claim by Collection Agency and Report of Experience with Debtor, to manage your legal matters is a challenging and time-consumming process. Many situations require an attorney’s involvement, which also makes this task not really affordable. Nevertheless, you can get your legal affairs into your own hands and deal with them yourself. US Legal Forms is here to the rescue. Our website comes with more than 85,000 legal documents intended for various cases and life circumstances. We make sure each document is compliant with the laws of each state, so you don’t have to be concerned about potential legal pitfalls compliance-wise.

If you're already aware of our services and have a subscription with US, you know how easy it is to get the Houston Acceptance of Claim by Collection Agency and Report of Experience with Debtor template. Simply log in to your account, download the template, and customize it to your requirements. Have you lost your document? No worries. You can find it in the My Forms tab in your account - on desktop or mobile.

The onboarding flow of new customers is fairly simple! Here’s what you need to do before getting Houston Acceptance of Claim by Collection Agency and Report of Experience with Debtor:

- Ensure that your document is specific to your state/county since the rules for writing legal paperwork may differ from one state another.

- Learn more about the form by previewing it or reading a quick description. If the Houston Acceptance of Claim by Collection Agency and Report of Experience with Debtor isn’t something you were hoping to find, then use the header to find another one.

- Log in or create an account to begin utilizing our website and download the document.

- Everything looks good on your end? Click the Buy now button and select the subscription plan.

- Pick the payment gateway and enter your payment details.

- Your form is good to go. You can try and download it.

It’s easy to locate and buy the appropriate document with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our rich collection. Sign up for it now if you want to check what other benefits you can get with US Legal Forms!