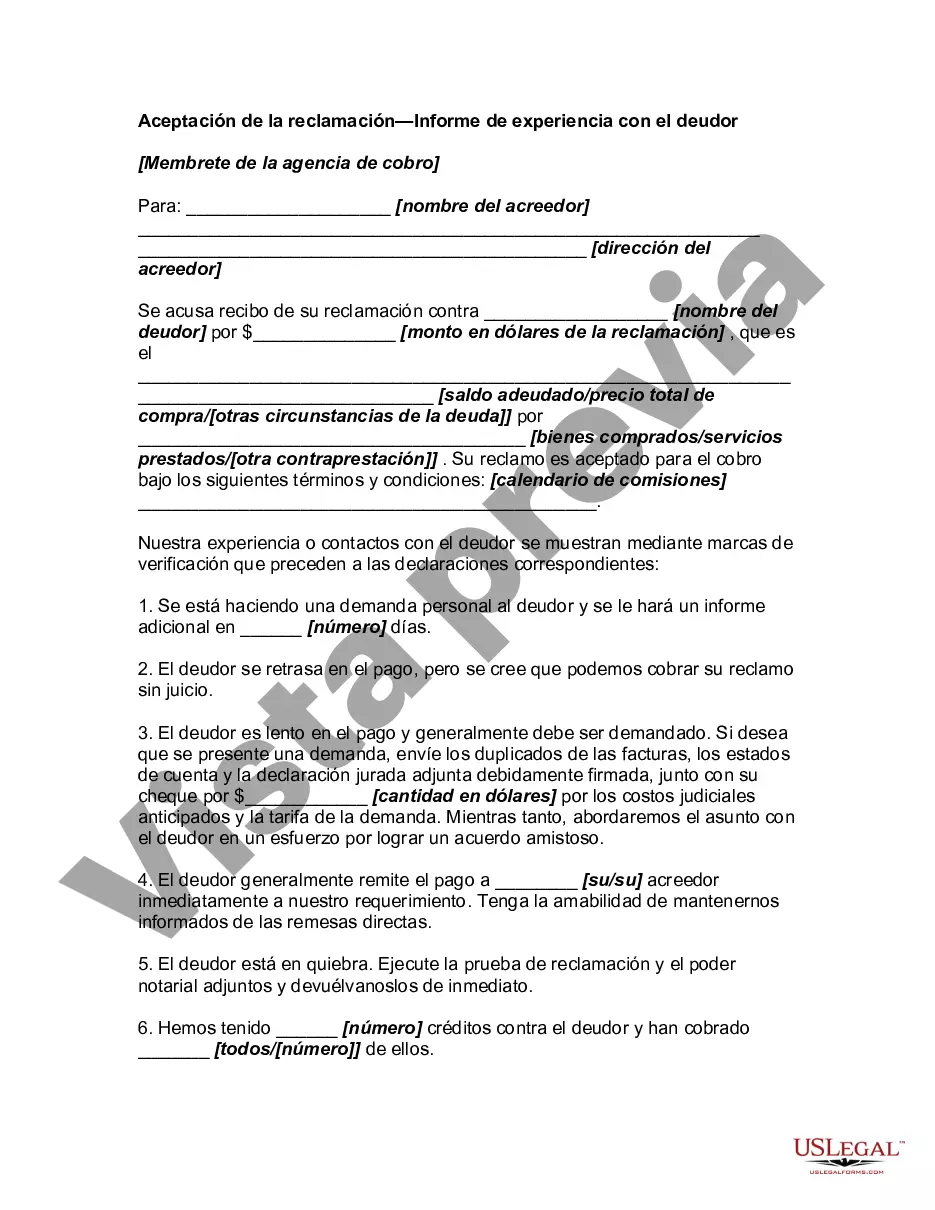

Salt Lake Utah Acceptance of Claim by Collection Agency and Report of Experience with Debtor In Salt Lake, Utah, the acceptance of claim by a collection agency is an important step in the debt collection process. When a debtor defaults on their payments, the creditor may assign or sell the debt to a collection agency to recover the outstanding amount. The collection agency then reaches out to the debtor, notifying them of the transfer of the debt and providing an opportunity for them to dispute or settle the claim. There are several types of Salt Lake Utah Acceptance of Claim by Collection Agency and Report of Experience with Debtor: 1. Initial Notice of Claim Acceptance: This is the first communication sent by the collection agency to the debtor after the claim has been assigned. It outlines the details of the debt, including the amount owed, the creditor's information, and the steps the debtor can take to address the claim. 2. Verification and Validation: Upon receiving the initial notice, the debtor has the right to request verification and validation of the debt. The collection agency must provide evidence that the debt is legitimate and belongs to the debtor. They may submit documents like account statements or copies of the original contract. 3. Dispute Resolution: If the debtor believes there is an error in the claim or disputes its validity, they can initiate a dispute resolution process. This involves providing any supporting documentation or reasons why they believe the claim is incorrect. The collection agency is responsible for investigating the matter and responding accordingly. 4. Settlement Negotiation: In some cases, the debtor may opt to negotiate a settlement with the collection agency. This involves reaching an agreement on a reduced amount or a payment plan to satisfy the debt. The collection agency will outline the terms of the settlement, and upon acceptance by both parties, a written agreement is created. 5. Record of Experience: Throughout the debt collection process, the collection agency maintains a record of their experience with the debtor. This includes documenting all communications, disputes, settlement negotiations, and any agreements reached. The record provides a history of the interactions between the collection agency and the debtor, which can be useful for legal purposes or further collection efforts if necessary. It is crucial for both the collection agency and the debtor to understand their rights and obligations during the Salt Lake Utah Acceptance of Claim process. Compliance with applicable debt collection laws, transparent communication, and fair treatment are key elements in fostering a positive experience for all parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Salt Lake Utah Aceptación de Reclamo por Agencia de Cobranza e Informe de Experiencia con Deudor - Acceptance of Claim by Collection Agency and Report of Experience with Debtor

Description

How to fill out Salt Lake Utah Aceptación De Reclamo Por Agencia De Cobranza E Informe De Experiencia Con Deudor?

How much time does it normally take you to draft a legal document? Because every state has its laws and regulations for every life situation, locating a Salt Lake Acceptance of Claim by Collection Agency and Report of Experience with Debtor meeting all regional requirements can be tiring, and ordering it from a professional lawyer is often costly. Numerous online services offer the most common state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive online catalog of templates, collected by states and areas of use. In addition to the Salt Lake Acceptance of Claim by Collection Agency and Report of Experience with Debtor, here you can get any specific document to run your business or individual affairs, complying with your regional requirements. Professionals verify all samples for their actuality, so you can be sure to prepare your documentation properly.

Using the service is fairly simple. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the required form, and download it. You can retain the document in your profile at any time in the future. Otherwise, if you are new to the platform, there will be a few more actions to complete before you get your Salt Lake Acceptance of Claim by Collection Agency and Report of Experience with Debtor:

- Examine the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Search for another document utilizing the related option in the header.

- Click Buy Now when you’re certain in the selected document.

- Select the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Salt Lake Acceptance of Claim by Collection Agency and Report of Experience with Debtor.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased document, you can find all the samples you’ve ever saved in your profile by opening the My Forms tab. Try it out!