San Diego, California, also known as America's Finest City, is a vibrant coastal metropolis renowned for its picturesque beaches, year-round mild climate, and diverse cultural scene. With its stunning natural beauty, thriving economy, and numerous tourist attractions, San Diego offers an exceptional quality of life. The acceptance of a claim by a collection agency in San Diego, California, refers to the process where a collection agency acknowledges and agrees to pursue the collection of a debt on behalf of a creditor. This acceptance signifies that the agency acknowledges the debtor's outstanding financial obligations and takes over the responsibility of recovering the owed funds. In this scenario, a report of experience with the debtor provides comprehensive information about the debtor's payment history, communication patterns, and any pertinent details that can help the collection agency strategize the most effective means of recovering the debt. This report plays a crucial role in allowing the collection agency to understand the debtor's financial behavior and devise appropriate collection strategies. Different types of San Diego, California, acceptance of claim by collection agency and report of experience with debtor may include: 1. Individual Debtor: This refers to a situation where an individual has incurred debts and the collection agency is pursuing the recovery from that person. The report of experience with the debtor would provide insights into the individual's payment habits, financial situation, and any previous attempts made to collect the debt. 2. Business Debtor: In cases where a collection agency is tasked with recovering debts from a business entity, the acceptance of claim and report of experience would focus on the company's financial health, creditworthiness, and previous patterns of payment or collection attempts. 3. Medical Debt: San Diego is known for its robust healthcare industry, and medical debts can be a common challenge. Acceptance of claim and report of experience in this context would entail understanding the debtor's medical history, insurance coverage, and any relevant details related to the incurred medical expenses. 4. Non-profit Organization Debtor: Non-profit entities may also face financial difficulties and require the assistance of a collection agency. Acceptance of claim and report of experience would involve assessing the organization's operating budget, financial obligations, and past patterns of debt repayment. In conclusion, San Diego, California, is a thriving city that experiences various types of acceptance of claim by collection agency and report of experience with debtor scenarios. It is imperative for collection agencies to tailor their approaches based on the nature of the debt and the debtor, ensuring effective debt recovery while adhering to legal and ethical standards.

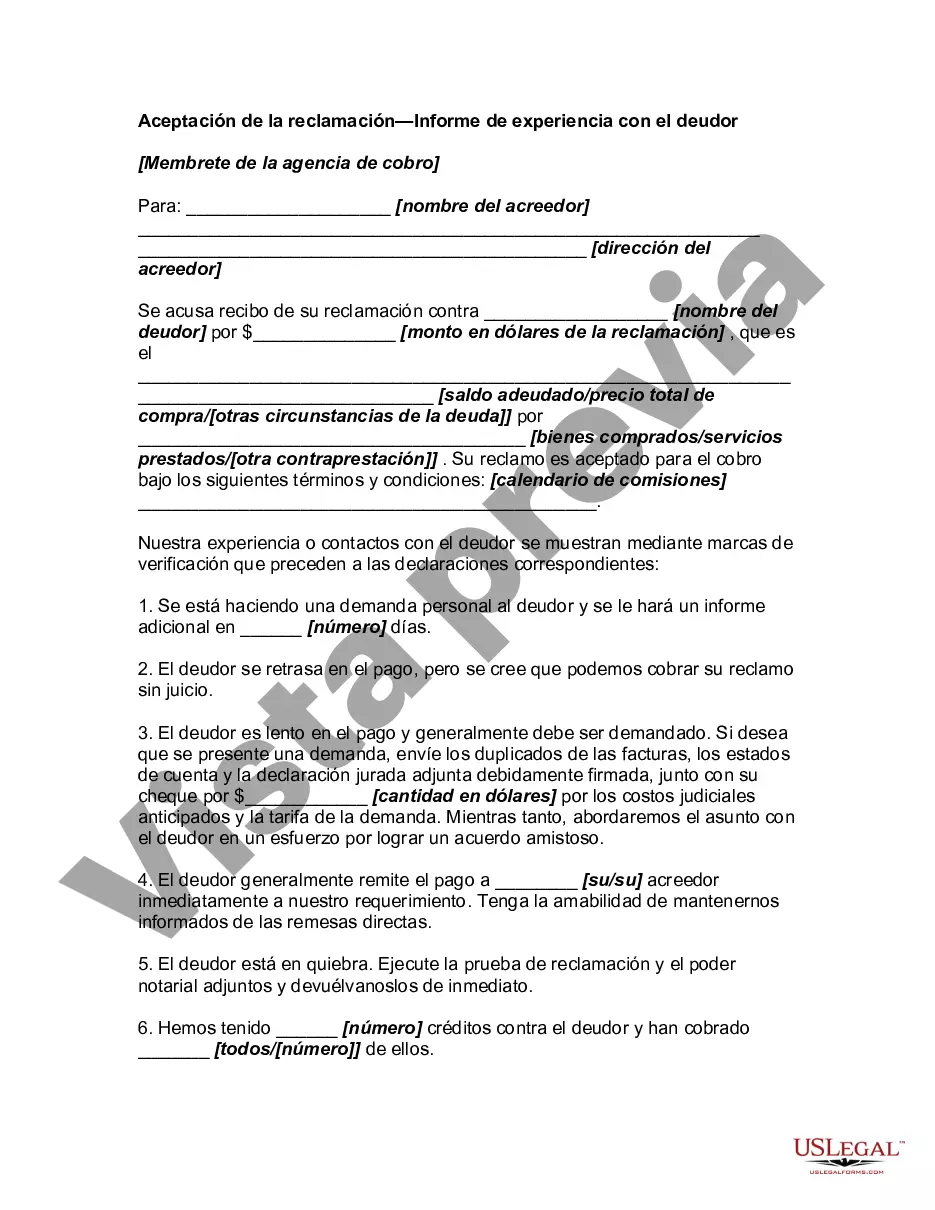

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Diego California Aceptación de Reclamo por Agencia de Cobranza e Informe de Experiencia con Deudor - Acceptance of Claim by Collection Agency and Report of Experience with Debtor

Description

How to fill out San Diego California Aceptación De Reclamo Por Agencia De Cobranza E Informe De Experiencia Con Deudor?

Do you need to quickly create a legally-binding San Diego Acceptance of Claim by Collection Agency and Report of Experience with Debtor or maybe any other form to handle your own or corporate matters? You can go with two options: hire a legal advisor to draft a legal paper for you or draft it completely on your own. Thankfully, there's a third solution - US Legal Forms. It will help you get neatly written legal papers without having to pay unreasonable fees for legal services.

US Legal Forms provides a huge catalog of over 85,000 state-compliant form templates, including San Diego Acceptance of Claim by Collection Agency and Report of Experience with Debtor and form packages. We offer documents for a myriad of use cases: from divorce papers to real estate documents. We've been out there for more than 25 years and got a rock-solid reputation among our clients. Here's how you can become one of them and obtain the needed document without extra troubles.

- To start with, double-check if the San Diego Acceptance of Claim by Collection Agency and Report of Experience with Debtor is tailored to your state's or county's laws.

- In case the form has a desciption, make sure to verify what it's suitable for.

- Start the search again if the document isn’t what you were seeking by using the search box in the header.

- Select the subscription that best fits your needs and move forward to the payment.

- Choose the format you would like to get your form in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already set up an account, you can easily log in to it, find the San Diego Acceptance of Claim by Collection Agency and Report of Experience with Debtor template, and download it. To re-download the form, just go to the My Forms tab.

It's stressless to find and download legal forms if you use our services. In addition, the paperwork we offer are updated by industry experts, which gives you greater confidence when dealing with legal matters. Try US Legal Forms now and see for yourself!

Form popularity

FAQ

Por ejemplo, si una deuda en particular prescribe a los 6 anos si durante ese periodo nadie ha reconocido esa deuda y nadie la ha reclamado podemos decir que es una deuda prescrita.

En la mayoria de los estados, la deuda en si misma no caduca o desaparece hasta que usted pague. En virtud de la Ley de Informes de Credito Justos, las deudas pueden aparecer en su informe de credito por lo general durante siete anos y, en algunos casos, durante mayor tiempo.

Si un cobrador viola la FDCPA, usted puede presentar una queja y tiene derecho a demandar ante un tribunal civil. Una vez que presente una demanda civil, puede solicitar una indemnizacion por danos y perjuicios junto con los honorarios de los abogados y las tasas judiciales en las que incurra al solicitar la sentencia.

Como responder a un cobrador de deudas Identidad del cobrador de deudas, incluyendo nombre, direccion y numero de telefono. El monto de la deuda, incluyendo los honorarios tales como intereses o costos de cobranza. Para que es la deuda y cuando se contrajo la deuda.

Las agencias de cobro estan obligadas a cumplir con la Ley Sobre Agencias de Cobro, Ley Num. 143 del 27 de junio de 1968, segun enmendada. Esta ley establece cual es el proceso que deben respetar las agencias y los derechos que tiene la persona deudora al momento del cobro.

Los despachos de cobranza no tienen permitido realizar amenazas ni dirigirse a los deudores de forma agresiva. Tampoco tienen autorizacion para presentarse a nombre de instituciones publicas ni usar nombres o papeleria que pueda insinuarlo. Una deuda civil no puede llevarte a la carcel.

¿Cuando prescribe una deuda con una financiera Espana? Cuando hablamos de prestamos personales, el codigo civil contempla que las deudas prescriben entre 3 y 15 anos, siempre a partir de que el acreedor reclame el impago a traves de la via civil.

Los despachos de cobranza no tienen permitido realizar amenazas ni dirigirse a los deudores de forma agresiva. Tampoco tienen autorizacion para presentarse a nombre de instituciones publicas ni usar nombres o papeleria que pueda insinuarlo. Una deuda civil no puede llevarte a la carcel.

¿Cuando prescribe una deuda con una financiera Espana? Cuando hablamos de prestamos personales, el codigo civil contempla que las deudas prescriben entre 3 y 15 anos, siempre a partir de que el acreedor reclame el impago a traves de la via civil.

Entonces, ¿cuales son las tareas especificas de un gestor de cobranzas? Contactar a tiempo a clientes, tutores y padres de familia. Llevar el seguimiento de las deudas de manera tal que ya en mora temprana se preste atencion a lo que ocurre con esos pagos. Comunicar asertivamente.