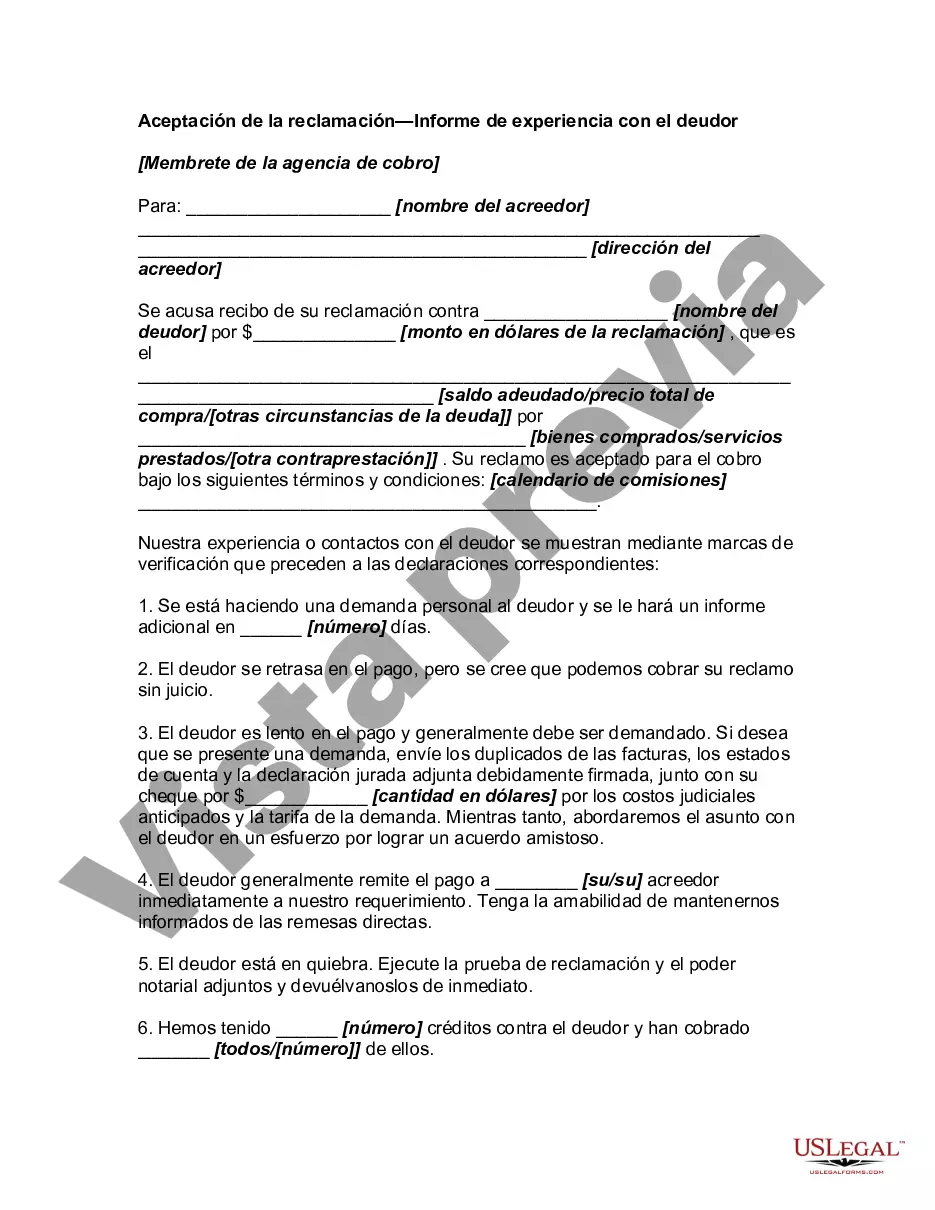

Santa Clara, California: Acceptance of Claim by Collection Agency and Report of Experience with Debtor In Santa Clara, California, the Acceptance of Claim by Collection Agency is an essential process for both creditors and debtors. This document serves as proof that a particular claim has been acknowledged and accepted by the collection agency, allowing them to pursue further actions to collect the outstanding debt. Additionally, creditors may need to submit a Report of Experience with the Debtor, detailing their experience and interactions with the debtor. Different Types of Santa Clara, California Acceptance of Claim by Collection Agency and Report of Experience with Debtor: 1. Individual Debtor Acceptance: This type of acceptance occurs when a collection agency acknowledges and accepts the claim against an individual debtor. It includes the debtor's personal details, such as name, address, social security number, and any other relevant identifying information. The acceptance may also outline the nature and amount of the debt. 2. Business Debtor Acceptance: This form of acceptance applies when the claim is against a business entity. It includes information about the company, such as its legal name, address, employer identification number, and other relevant identifying details. The acceptance document highlights the nature and amount of the debt owed by the business. 3. Joint Debtor Acceptance: Joint debtor acceptance comes into play when multiple individuals are jointly liable for a debt. In such cases, each debtor's information needs to be specified in the acceptance document. The collection agency accepts the joint claim, acknowledging the liability of all parties involved. 4. Report of Experience with the Debtor: This report is prepared by the creditor or collection agency to provide an overview of their interactions and experiences while attempting to collect the debt. It outlines essential details, such as the history of communication, payment arrangements, any legal actions taken, and the debtor's response or lack thereof. This report helps establish the debtor's financial behavior and determines the feasibility of pursuing further collection actions. The Santa Clara, California Acceptance of Claim by Collection Agency and Report of Experience with Debtor holds great significance in debt collection processes. Creditors and collection agencies must ensure accurate and comprehensive documentation to facilitate a smooth and legally compliant debt collection process. It is advisable to consult legal professionals familiar with Santa Clara's specific guidelines and regulations to ensure adherence to local laws during debt collection actions. Always remember to protect both the creditor's and debtor's rights while following ethical practices throughout the collection process.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Santa Clara California Aceptación de Reclamo por Agencia de Cobranza e Informe de Experiencia con Deudor - Acceptance of Claim by Collection Agency and Report of Experience with Debtor

Description

How to fill out Santa Clara California Aceptación De Reclamo Por Agencia De Cobranza E Informe De Experiencia Con Deudor?

Do you need to quickly create a legally-binding Santa Clara Acceptance of Claim by Collection Agency and Report of Experience with Debtor or maybe any other document to handle your personal or corporate affairs? You can go with two options: contact a professional to write a legal document for you or draft it completely on your own. The good news is, there's another solution - US Legal Forms. It will help you get neatly written legal paperwork without having to pay unreasonable fees for legal services.

US Legal Forms provides a huge catalog of over 85,000 state-specific document templates, including Santa Clara Acceptance of Claim by Collection Agency and Report of Experience with Debtor and form packages. We provide templates for an array of life circumstances: from divorce papers to real estate documents. We've been out there for over 25 years and gained a rock-solid reputation among our clients. Here's how you can become one of them and get the needed template without extra hassles.

- To start with, double-check if the Santa Clara Acceptance of Claim by Collection Agency and Report of Experience with Debtor is tailored to your state's or county's regulations.

- If the form includes a desciption, make sure to verify what it's suitable for.

- Start the searching process again if the form isn’t what you were hoping to find by using the search bar in the header.

- Choose the subscription that best suits your needs and proceed to the payment.

- Choose the file format you would like to get your form in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already set up an account, you can simply log in to it, locate the Santa Clara Acceptance of Claim by Collection Agency and Report of Experience with Debtor template, and download it. To re-download the form, simply go to the My Forms tab.

It's effortless to buy and download legal forms if you use our services. In addition, the documents we provide are updated by industry experts, which gives you greater peace of mind when writing legal affairs. Try US Legal Forms now and see for yourself!