Bronx, New York: Exploring the General Form of Factoring Agreement — Assignment of Accounts Receivable The Bronx neighborhood in New York City is a culturally vibrant borough that offers a diverse range of attractions, making it an ideal place for residents and businesses to thrive. In the realm of business transactions, the Bronx has its own specific guidelines and protocols for financial arrangements such as the General Form of Factoring Agreement — Assignment of Accounts Receivable. The General Form of Factoring Agreement — Assignment of Accounts Receivable is a legal document that outlines the terms and conditions between a business (known as the assignor) and a financial institution or factor (known as the assignee). This agreement allows the assignor to convert their accounts receivable into immediate cash by selling them to the assignee at a discount. It helps businesses manage their cash flow and mitigate the risks associated with delayed payments or bad debts. Within the Bronx, there may be different types or variations of the General Form of Factoring Agreement — Assignment of Accounts Receivable, catering to specific industries or unique business requirements. These types of agreements may include: 1. Recourse Factoring Agreement: This type of agreement holds the assignor liable for any uncollected or disputed accounts receivable. If the assignee fails to collect payment from a customer, the assignor must buy back the debt. 2. Non-Recourse Factoring Agreement: Unlike the recourse agreement, the assignor is not responsible for uncollected accounts receivable or defaults by the customers. The assignee bears the risk of non-payment. 3. Notification Factoring Agreement: In this agreement, the assignor retains control over the collection process and the customers are notified about the assignment of their accounts receivable to the assignee. The assignee does not have direct communication with the customer. 4. Non-Notification Factoring Agreement: Here, the assignor surrenders control of the collection process to the assignee, who directly contacts the customers regarding the assignment. This type of agreement is typically used for businesses that prefer to maintain confidentiality. 5. Domestic Factoring Agreement: This agreement involves the assignment of accounts receivable from domestic customers within the United States. 6. International Factoring Agreement: This type of agreement pertains to the assignment of accounts receivable from foreign customers or those involved in cross-border business transactions. It considers factors such as foreign currency exchange rates and specific legal regulations. In conclusion, the General Form of Factoring Agreement — Assignment of Accounts Receivable is an essential tool for businesses in the Bronx, New York, providing a means to optimize cash flow and minimize financial risks. It is important to understand the nuances of different types of factoring agreements available, as they cater to specific industries, risk tolerances, and legal requirements.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Bronx New York Modelo General de Contrato de Factoring - Cesión de Cuentas por Cobrar - General Form of Factoring Agreement - Assignment of Accounts Receivable

Description

How to fill out Bronx New York Modelo General De Contrato De Factoring - Cesión De Cuentas Por Cobrar?

Creating legal forms is a necessity in today's world. Nevertheless, you don't always need to seek professional help to create some of them from the ground up, including Bronx General Form of Factoring Agreement - Assignment of Accounts Receivable, with a service like US Legal Forms.

US Legal Forms has over 85,000 forms to pick from in various categories varying from living wills to real estate paperwork to divorce documents. All forms are organized according to their valid state, making the searching experience less overwhelming. You can also find information resources and guides on the website to make any activities associated with paperwork completion simple.

Here's how you can find and download Bronx General Form of Factoring Agreement - Assignment of Accounts Receivable.

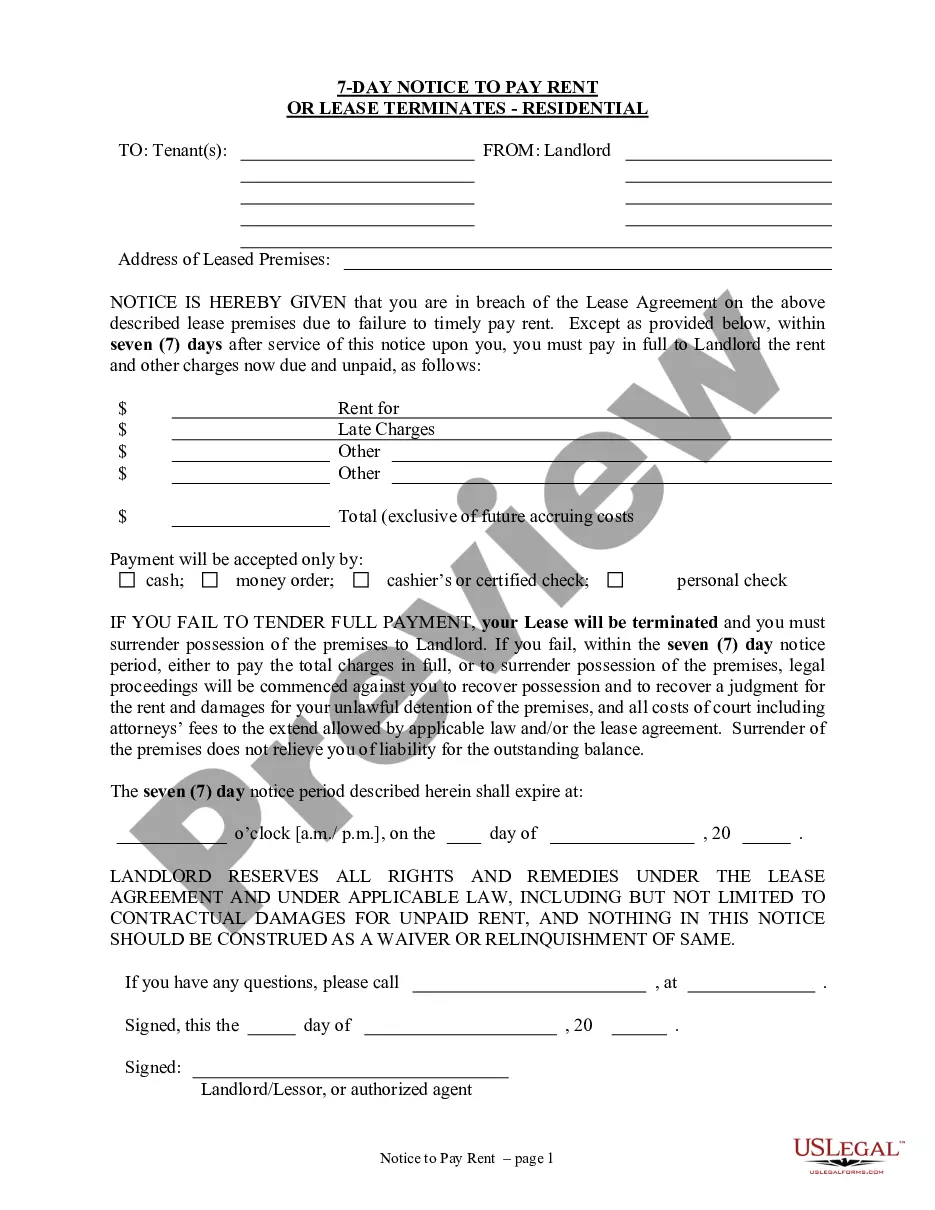

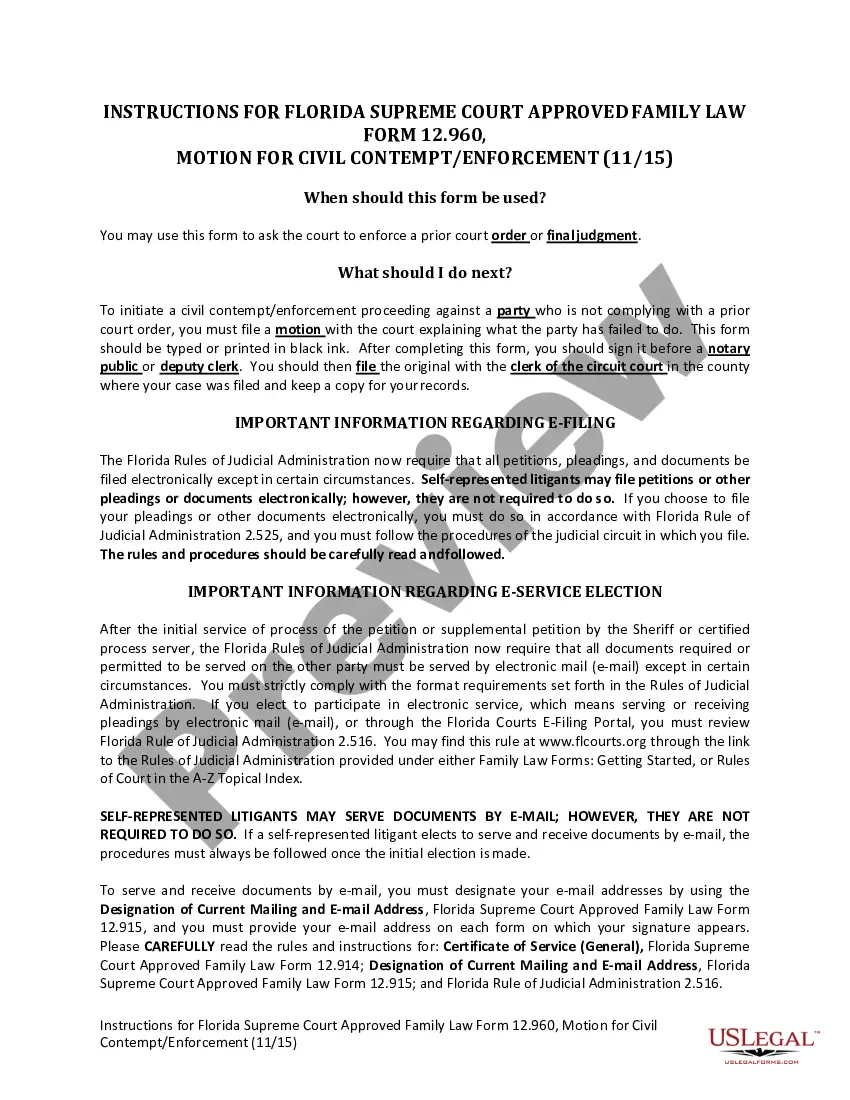

- Go over the document's preview and outline (if provided) to get a basic information on what you’ll get after downloading the form.

- Ensure that the document of your choosing is adapted to your state/county/area since state regulations can impact the legality of some records.

- Examine the similar forms or start the search over to locate the right document.

- Click Buy now and register your account. If you already have an existing one, choose to log in.

- Pick the pricing {plan, then a suitable payment gateway, and buy Bronx General Form of Factoring Agreement - Assignment of Accounts Receivable.

- Select to save the form template in any offered format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the needed Bronx General Form of Factoring Agreement - Assignment of Accounts Receivable, log in to your account, and download it. Of course, our website can’t replace a legal professional completely. If you need to deal with an exceptionally challenging situation, we recommend using the services of a lawyer to check your form before executing and submitting it.

With over 25 years on the market, US Legal Forms became a go-to platform for many different legal forms for millions of users. Join them today and purchase your state-specific paperwork effortlessly!