The Fairfax Virginia General Form of Factoring Agreement — Assignment of Accounts Receivable is a legal document that outlines the terms and conditions of an agreement between a company (the "Assignor") and a financial institution or a factor (the "Assignee"). This agreement allows the Assignor to sell or assign its accounts receivable to the Assignee in exchange for immediate cash flow. Keywords: Fairfax Virginia, General Form of Factoring Agreement, Assignment of Accounts Receivable, legal document, terms and conditions, company, financial institution, factor, Assignor, Assignee, immediate cash flow. The Fairfax Virginia General Form of Factoring Agreement — Assignment of Accounts Receivable serves as a comprehensive framework for businesses located in Fairfax, Virginia, to engage in factoring transactions. Factoring is a financing method commonly adopted by businesses to improve their cash flow and manage working capital effectively. Different Types of Fairfax Virginia General Form of Factoring Agreement — Assignment of Accounts Receivable: 1. Recourse Factoring: This type of factoring agreement places the responsibility for collecting outstanding account balances solely on the Assignor. If a customer fails to pay, the Assignor must buy back the unpaid invoice from the Assignee. 2. Non-Recourse Factoring: In this scenario, the Assignee assumes the credit risk of the accounts receivable. If a customer fails to pay due to bankruptcy or insolvency, the Assignee absorbs the loss without recourse to the Assignor. 3. Notification Factoring: With this type of factoring agreement, the Assignor notifies its customers about the assignment of their accounts receivable to the Assignee. The customers are directed to make payments directly to the Assignee. 4. Non-Notification Factoring: In this variation, the Assignor does not notify its customers regarding the assignment. The Assignee discreetly collects payments from the customers without directly intervening in the business relationship between the Assignor and customers. 5. Maturity Factoring: Maturity factoring involves the sale of accounts receivable that have a longer payment term, such as installment payments or extended credit terms. The Assignee advances funds to the Assignor based on the net present value of the future cash flows. 6. Spot Factoring: Spot factoring allows the Assignor to select specific invoices or accounts receivable to sell to the Assignee on a one-time basis, rather than entering into a long-term agreement. This flexibility enables the Assignor to address immediate cash needs without committing to a continuous factoring arrangement. 7. Full-Service Factoring: This comprehensive form of factoring includes credit protection, collection services, and ongoing administration. The Assignee handles credit checks, collections, and account management, allowing the Assignor to focus on core business operations. The Fairfax Virginia General Form of Factoring Agreement — Assignment of Accounts Receivable provides businesses with a solid framework and a range of options to select the most suitable factoring arrangement based on their unique cash flow requirements and risk tolerance. It ensures a mutually beneficial relationship between the Assignor and Assignee, fostering financial stability and growth for businesses in Fairfax, Virginia.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Fairfax Virginia Modelo General de Contrato de Factoring - Cesión de Cuentas por Cobrar - General Form of Factoring Agreement - Assignment of Accounts Receivable

Description

How to fill out Fairfax Virginia Modelo General De Contrato De Factoring - Cesión De Cuentas Por Cobrar?

A document routine always accompanies any legal activity you make. Opening a business, applying or accepting a job offer, transferring ownership, and many other life scenarios demand you prepare formal documentation that varies throughout the country. That's why having it all collected in one place is so helpful.

US Legal Forms is the largest online library of up-to-date federal and state-specific legal forms. Here, you can easily find and get a document for any personal or business objective utilized in your county, including the Fairfax General Form of Factoring Agreement - Assignment of Accounts Receivable.

Locating templates on the platform is extremely straightforward. If you already have a subscription to our service, log in to your account, find the sample using the search bar, and click Download to save it on your device. Afterward, the Fairfax General Form of Factoring Agreement - Assignment of Accounts Receivable will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this simple guideline to get the Fairfax General Form of Factoring Agreement - Assignment of Accounts Receivable:

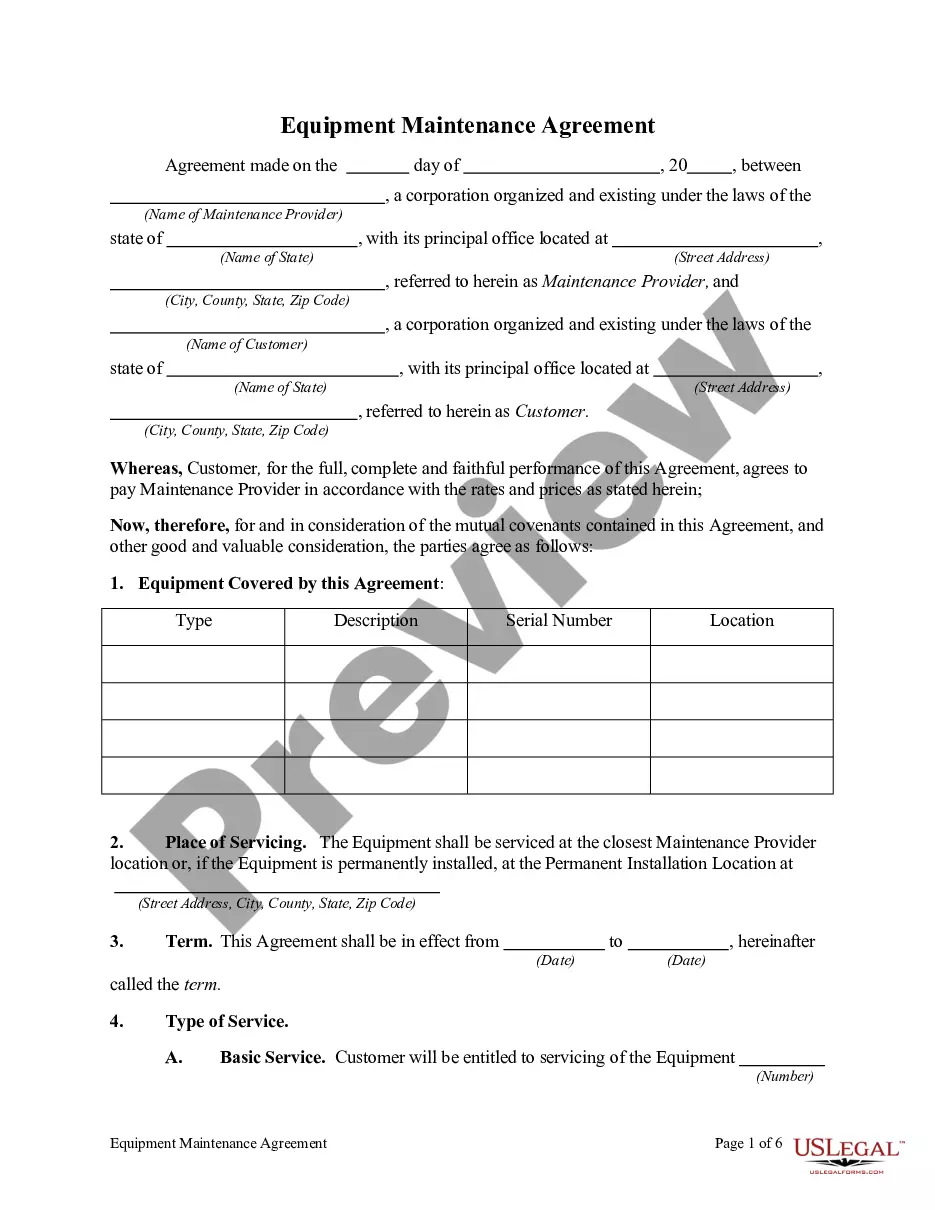

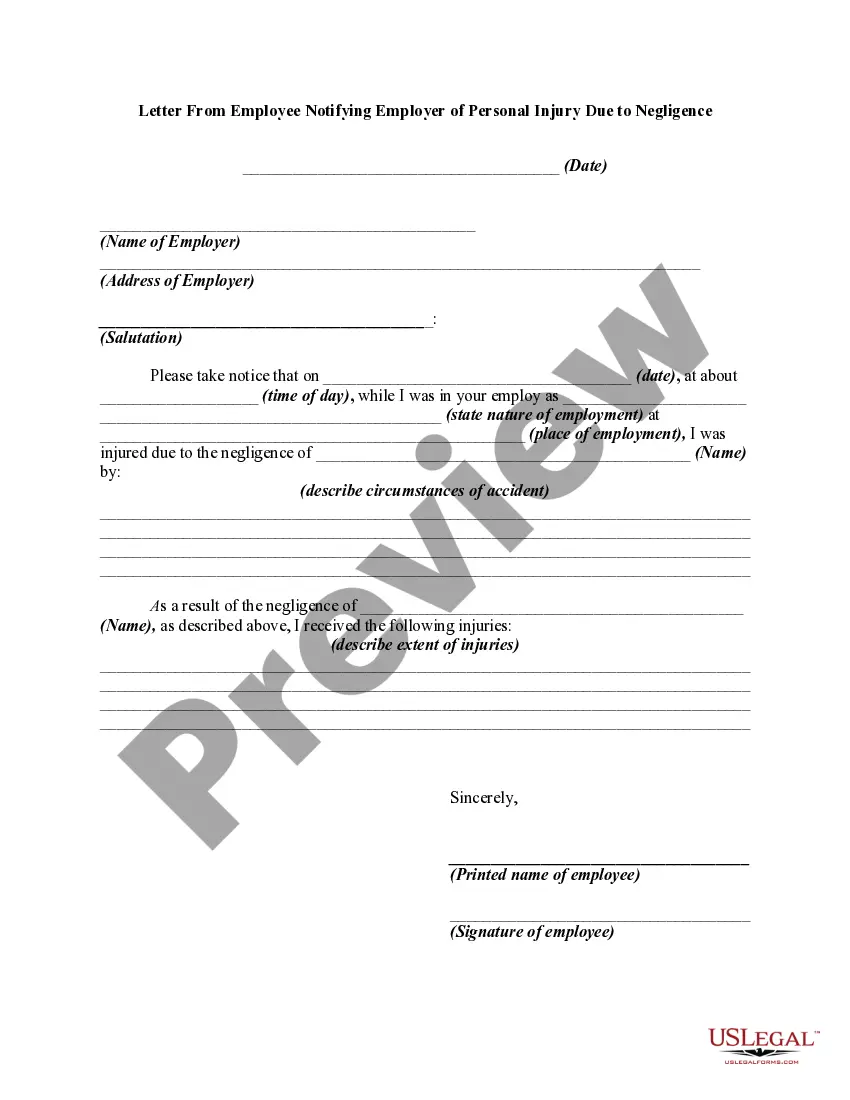

- Ensure you have opened the correct page with your regional form.

- Use the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the form meets your needs.

- Search for another document using the search tab in case the sample doesn't fit you.

- Click Buy Now when you find the required template.

- Decide on the appropriate subscription plan, then sign in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and download the Fairfax General Form of Factoring Agreement - Assignment of Accounts Receivable on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most trustworthy way to obtain legal documents. All the samples provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs properly with the US Legal Forms!