Cuyahoga Ohio Modelo General de Contrato de Fideicomiso Irrevocable Inter Vivos - General Form of Inter Vivos Irrevocable Trust Agreement

Description

How to fill out Modelo General De Contrato De Fideicomiso Irrevocable Inter Vivos?

Drafting legal documents can be challenging.

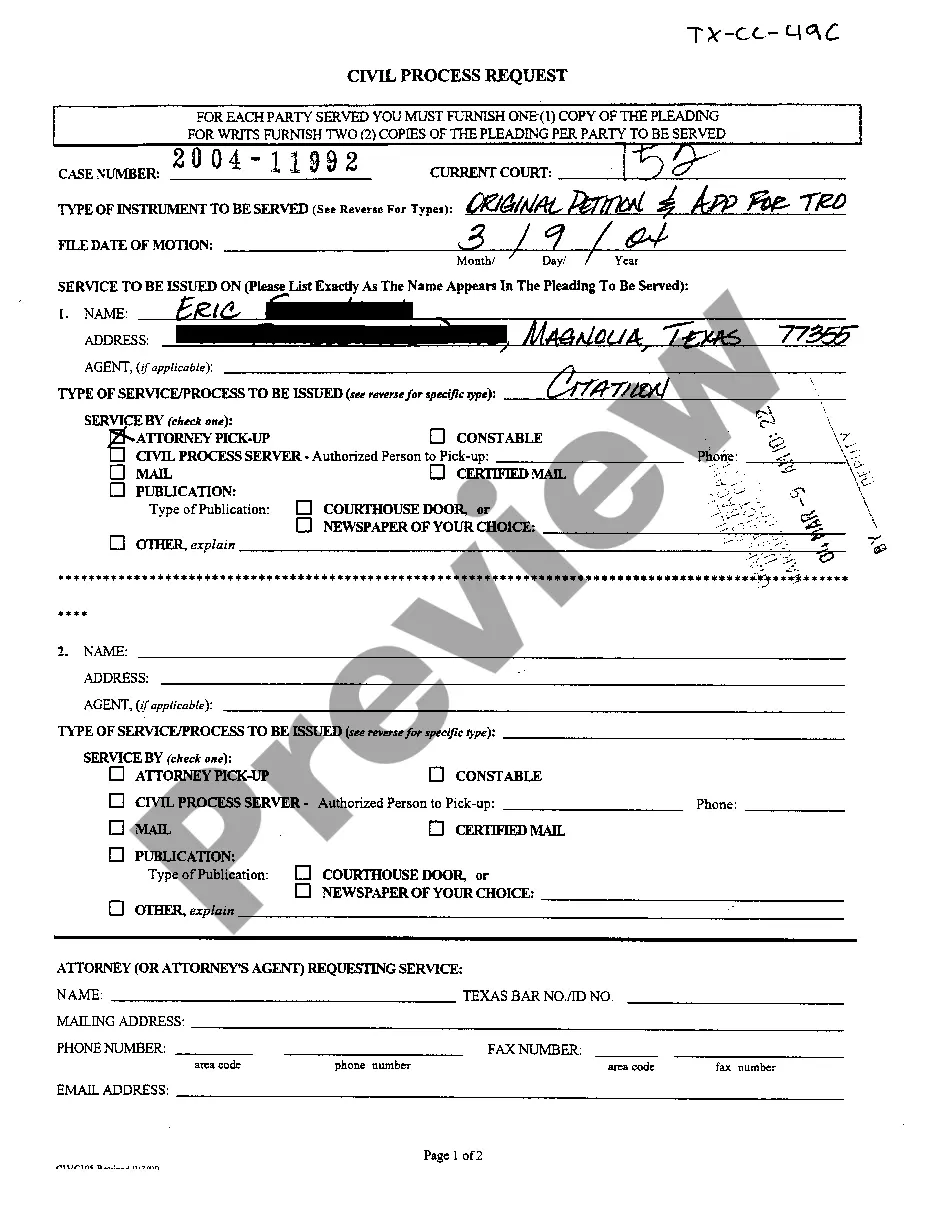

Moreover, if you choose to hire a lawyer to create a business contract, documents for ownership transfer, pre-nuptial agreement, divorce documents, or the Cuyahoga General Form of Inter Vivos Irrevocable Trust Agreement, it might be quite expensive.

Review the form description and utilize the Preview option, if available, to confirm it is the template you require.

- So what is the most effective method to conserve time and finances while creating valid documents that fully comply with your state and local laws and regulations.

- US Legal Forms is an excellent solution, whether you are looking for templates for personal or business purposes.

- US Legal Forms is the largest online repository of state-specific legal documents, offering users current and professionally verified templates for any scenario, all conveniently collected in one location.

- Therefore, if you require the latest version of the Cuyahoga General Form of Inter Vivos Irrevocable Trust Agreement, you can swiftly locate it on our platform.

- Acquiring the documents takes minimal time.

- Those who already possess an account should verify their subscription is active, Log In, and choose the template by clicking on the Download button.

- If you have not subscribed yet, here is how you can obtain the Cuyahoga General Form of Inter Vivos Irrevocable Trust Agreement.

- Browse the page and ensure there is a template for your region.

Form popularity

FAQ

Fundamentos del Fideicomiso Irrevocable Un fideicomiso irrevocable tiene un otorgante, un fideicomisario y un beneficiario o beneficiarios. Una vez que el otorgante coloca un activo en un fideicomiso irrevocable, es un regalo para el fideicomiso y el otorgante no puede revocarlo.

¿Que es un fideicomiso en Paraguay? Se trata de una herramienta juridica a traves de la cual una persona, el fiduciante, le otorga a otra, el fiduciario, la titularidad de un activo o un conjunto de ellos.

Determinar cual es la finalidad que se desea realizar y seleccionar los bienes de los que desea disponer para lograrlo. Seleccionar quien sera el beneficiario. Elegir una institucion financiera para que se encargue de la administracion y pactar con la misma las condiciones de la administracion.

Algunos de los tipos de contrato mas frecuente en el mercado actualmente son: Fideicomiso testamentario.Fideicomiso como medio de pago.Fideicomiso de planeacion patrimonial.Fideicomiso estructurado.

Un fideicomiso o fidecomiso200b (del latin fideicommissum, a su vez de fides, "fe", y commissus, "comision") es un contrato en virtud del cual una o mas personas (fideicomitente/s o fiduciante/s) transmiten bienes, cantidades de dinero o derechos, presentes o futuros, de su propiedad a otra persona (fiduciaria, que puede

¿Que debe contener el contrato de fideicomiso? Individualizacion de los bienes objeto del contrato.Forma en que se incorporaran en el futuro aquellos bienes no contemplados al inicio. Condicion o plazo al que quedan sujetos los bienes al dominio fiduciario. Destino de los bienes al final del fideicomiso.

El fideicomiso puede ser constituido sobre bienes de cualquier naturaleza de procedencia licita, presentes o futuros, teniendo el fiduciario la obligacion de verificar el origen de los activos que constituyen el patrimonio fideicometido y el valor de mercado de los mismos al momento de ser entregados al fideicomisario.

Un fideicomiso de inversion es un instrumento financiero que te ayudara con tu planeacion patrimonial, mediante el cual un tercero mantiene activos o dinero en resguardo y sera quien se encargue de las diligencias de otras dos partes que estan interesadas en que esos fondos sean bien utilizados.

UN FIDEICOMISO ES: Una operacion mercantil mediante la cual una persona -fisica o moral- llamada fideicomitente, destina ciertos bienes a la realizacion de un fin licito determinado, encomendando esta a una Institucion de Credito (Art. 381 de la Ley General de Titulos y Operaciones de Credito).

Determinar cual es la finalidad que se desea realizar y seleccionar los bienes de los que desea disponer para lograrlo. Seleccionar quien sera el beneficiario. Elegir una institucion financiera para que se encargue de la administracion y pactar con la misma las condiciones de la administracion.