In real estate, a short sale occurs when a bank or mortgage lender agrees to discount a loan balance due to an economic hardship on the part of the mortgagor (i.e., the seller). Circumstances determine whether or not banks will discount a loan balance. These circumstances are usually related to the current real estate market climate and the individual borrower's financial situation. A short sale typically is executed to prevent a home foreclosure. Often a bank will choose to allow a short sale if they believe that it will result in a smaller financial loss than foreclosing.

An arms-length or short sale affidavit is a document created by a bank in an attempt to prevent sellers from selling to relatives or friends to act as a straw buyer. Sometimes sellers make such side agreements. Then, after the transaction closes, the pretend buyers quickly transfer title back to the seller. This practice, in affect, means the sellers have repurchased their home at maybe half the cost, which greatly benefits those sellers.

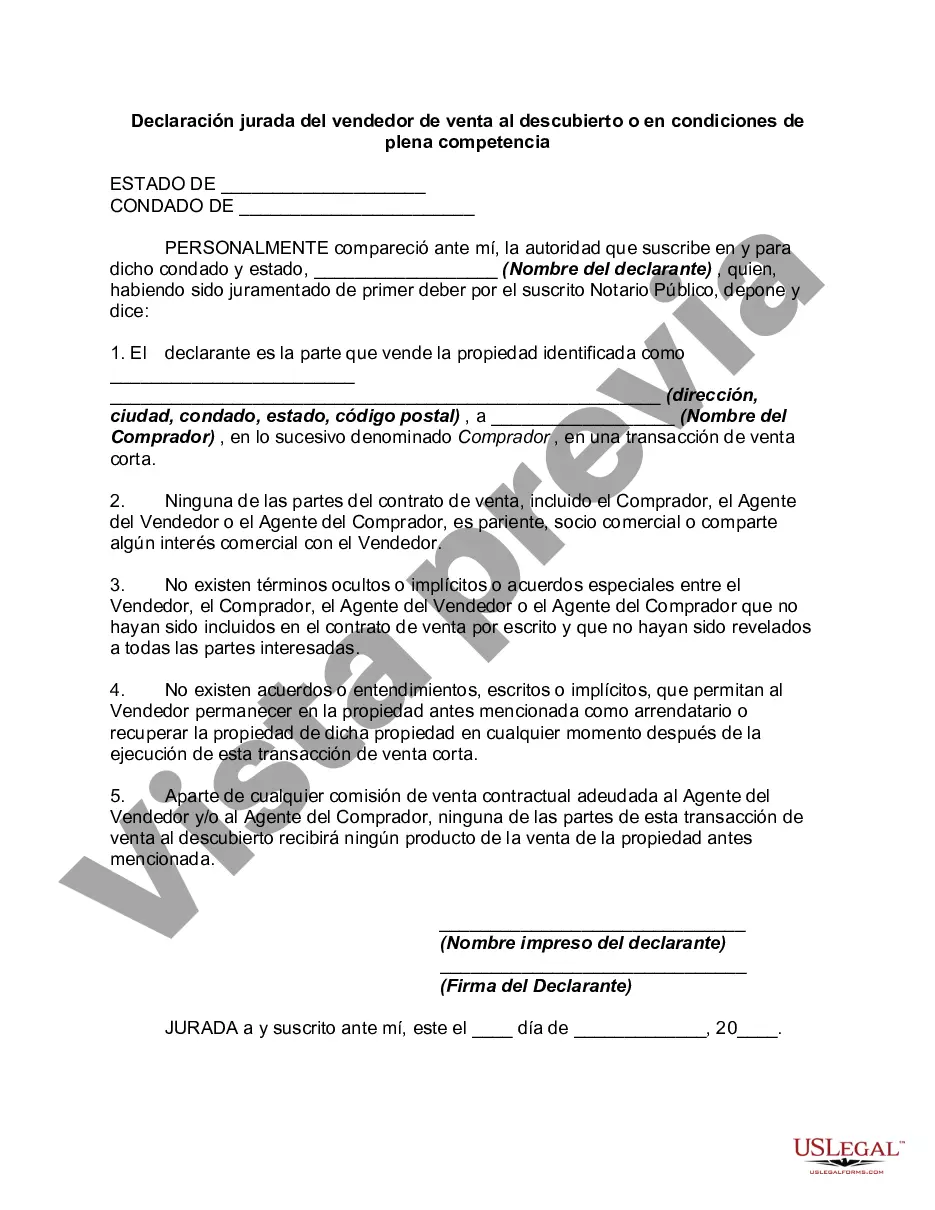

A San Bernardino California Short Sale or Arms Length Affidavit is a legal document that is used during a real estate transaction involving a short sale in the San Bernardino County area. This affidavit serves to verify that the buyer and seller have no personal or business relationship with each other, ensuring that the transaction is conducted at arm's length. The purpose of the San Bernardino California Short Sale or Arms Length Affidavit is to prevent fraudulent practices such as collusion, where the buyer and seller may conspire to manipulate the sale price to their advantage. By signing this document, both parties confirm that the transaction is being carried out in good faith, without any hidden agreements or conflicts of interest. Understandably, the San Bernardino California Short Sale or Arms Length Affidavit requires accurate and extensive information to maintain transparency and legality in the transaction. The affidavit typically includes details such as the names, addresses, and contact information of the buyer and seller, as well as their relationship status. It also requires a description of the property being sold, the agreed-upon purchase price, and the terms and conditions of the sale. While the general purpose of a San Bernardino California Short Sale or Arms Length Affidavit remains constant, there may be different types of affidavits specific to various situations or institutions. These may include but are not limited to: 1. Traditional San Bernardino California Short Sale or Arms Length Affidavit: This is the most common type of affidavit used in standard short sale transactions. It is typically required by the lender or the mortgage holder to ensure that the sale is conducted fairly. 2. San Bernardino California Short Sale or Arms Length Affidavit for Government-Backed Loans: When dealing with short sales involving loans guaranteed or insured by government entities such as the Federal Housing Administration (FHA) or the Department of Veterans Affairs (VA), additional affidavits may be necessary to meet specific requirements set by these institutions. 3. Lender-Specific San Bernardino California Short Sale or Arms Length Affidavit: Some financial institutions may have their own unique affidavit forms that borrowers and sellers need to complete during a short sale. These affidavits may include additional clauses or information specific to the lender's policies and procedures. Regardless of the specific type of San Bernardino California Short Sale or Arms Length Affidavit required, it is crucial for both parties involved in the real estate transaction to diligently fill out and sign the document accurately. Any false or misleading information can lead to severe legal consequences and may jeopardize the short sale process.A San Bernardino California Short Sale or Arms Length Affidavit is a legal document that is used during a real estate transaction involving a short sale in the San Bernardino County area. This affidavit serves to verify that the buyer and seller have no personal or business relationship with each other, ensuring that the transaction is conducted at arm's length. The purpose of the San Bernardino California Short Sale or Arms Length Affidavit is to prevent fraudulent practices such as collusion, where the buyer and seller may conspire to manipulate the sale price to their advantage. By signing this document, both parties confirm that the transaction is being carried out in good faith, without any hidden agreements or conflicts of interest. Understandably, the San Bernardino California Short Sale or Arms Length Affidavit requires accurate and extensive information to maintain transparency and legality in the transaction. The affidavit typically includes details such as the names, addresses, and contact information of the buyer and seller, as well as their relationship status. It also requires a description of the property being sold, the agreed-upon purchase price, and the terms and conditions of the sale. While the general purpose of a San Bernardino California Short Sale or Arms Length Affidavit remains constant, there may be different types of affidavits specific to various situations or institutions. These may include but are not limited to: 1. Traditional San Bernardino California Short Sale or Arms Length Affidavit: This is the most common type of affidavit used in standard short sale transactions. It is typically required by the lender or the mortgage holder to ensure that the sale is conducted fairly. 2. San Bernardino California Short Sale or Arms Length Affidavit for Government-Backed Loans: When dealing with short sales involving loans guaranteed or insured by government entities such as the Federal Housing Administration (FHA) or the Department of Veterans Affairs (VA), additional affidavits may be necessary to meet specific requirements set by these institutions. 3. Lender-Specific San Bernardino California Short Sale or Arms Length Affidavit: Some financial institutions may have their own unique affidavit forms that borrowers and sellers need to complete during a short sale. These affidavits may include additional clauses or information specific to the lender's policies and procedures. Regardless of the specific type of San Bernardino California Short Sale or Arms Length Affidavit required, it is crucial for both parties involved in the real estate transaction to diligently fill out and sign the document accurately. Any false or misleading information can lead to severe legal consequences and may jeopardize the short sale process.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.